FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

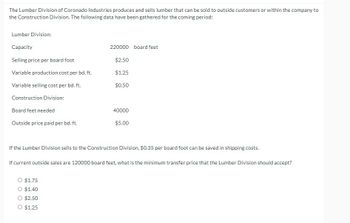

Transcribed Image Text:The Lumber Division of Coronado Industries produces and sells lumber that can be sold to outside customers or within the company to

the Construction Division. The following data have been gathered for the coming period:

Lumber Division:

Capacity

Selling price per board foot

Variable production cost per bd. ft.

Variable selling cost per bd. ft.

Construction Division:

Board feet needed

Outside price paid per bd. ft.

220000 board feet

$2.50

$1.25

$1.75

O $1.40

O $2.50

O $1.25

$0.50

40000

$5.00

If the Lumber Division sells to the Construction Division, $0.35 per board foot can be saved in shipping costs.

If current outside sales are 120000 board feet, what is the minimum transfer price that the Lumber Division should accept?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manly Beach Enterprises projects the following information for the coming year. Sales Production 1,900 units 2,000 units Selling price per sewing machine Total variable manufacturing cost Total fixed manufacturing cost Marketing and administrative cost (40% variable based on sales) $200 $160,000 $60,000 $80,000 a. Determine the projected net income using absorption costing: $ b. Determine the projected net income using variable costing: $arrow_forwardSubject: acountingarrow_forwardPresented below is data of B Ltd for next year. XYZ Selling price ($) 3.0 2.0 4.0 Unit variable cost ($) 1.0 0.8 1.2 Standard labor hours 2.5 2 3.5 Maximum sales demand (units) 300 500 400 Total labor hours available for production in a month is 1000 hours. Requirements: 1. Compute unit contribution per unit of labor hour and show the product mix to maximize profit. 2. If the labor hours can be increased by 100 hours, how many units of product should the company produce to maximize profit?arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 10,000 units? (Do not round intermediate calculations.) X Answer is complete but not entirely correct. $ 65.000 x Average Cost Per Unit $ 6.30 $ 3.80 $ 1.50 $ 4.00 $ 3.30 $ 2.00 $ 1.00 $ 0.50 Total period costarrow_forwardHello question is attached, thanks.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education