FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:MTK to review this question

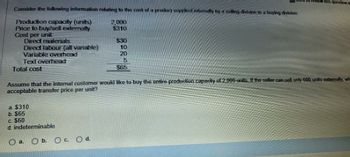

Consider the following information relating to the cost of a product supplied internally by a selling division to a buying division:

Production capacity (units)

Price to buy sell externally

Cost per unit

2,000

$310

Direct materials

$30

Direct labour (all variable)

10

Variable overhead

20

Text overhead

5

Total cost

$65

Assume that the internal customer would like to buy the entire production capacity of 2,000 units. If the seller can sell only 600 units externally, wh

acceptable transfer price per unit?

a. $310

b. $65

c. $60

d. indeterminable

a.

Ob. Oc Od

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- hello, please give more emphasis on points a,b,c, and d Spark Ltd has two divisions, assembly and electrical. The assembly division transfers partiallycompleted components to the electrical division at a predetermined transfer price. The assemblydivision’s standard variable production cost per unit is $550. This division has spare capacity, and itcould sell all its components to outside buyers at $680 per unit in a perfectly competitive market.Required:a) Determine a transfer price using the general rule.b) How would the transfer price change if the assembly division had no spare capacity? c) What transfer price would you recommend if there was no outside market for the transferredcomponent and the assembly division had spare capacity? d) Explain how negotiation between the supplying and buying units may be used to set transferprices. How does this relate to the general transfer pricing rule?arrow_forwardIvanhoe, Inc. developed the following information for its product: Sales price Variable cost Contribution margin Total fixed costs Per Unit (a) $102.00 71.40 $30.60 $1,288,260 Answer the following independent questions. Number of units to be sold How many units must be sold to break even?arrow_forwardA company is considering two alternative technologies for manufacturing a product. The cost data are shown below. Fixed Cost Variable Cost The breakeven volume is More than 400 units A $10,000 $30/unit Less than or equal to 200 units B $25,000 $5/unit More than 300 but less than or equal to 400 units O None of the options More than 200 but less than or equal to 300 unitsarrow_forward

- QRC Company is trying to decide which one of two alternatives it will accept. The costs and revenues associated with each alternative are listed below: Alternative A Alternative B Projected revenue $ 125,000 $ 150,000 Unit-level costs 25,000 36,000 Batch-level costs 12,500 24,000 Product-level costs 15,000 17,000 Facility-level costs 10,000 12,500 What is the differential revenue for this decision? Multiple Choice $50,000 $25,000 $125,000 $150,000arrow_forwardAssume that a company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Desired return on investment (ROI) What is the markup percentage on absorption cost required to achieve the desired ROI? 15,000 30 $ $81,900 $780,000 12%arrow_forwardAssume that a company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Desired return on investment (ROI) 15,000 $ 33.00 $ 63,900 $780,000 12% The selling price that the company would establish using a markup percentage on absorption cost is closest to:arrow_forward

- QRC Company is trying to decide which one of two alternatives it will accept. The costs and revenues associated with each alternative are listed below: Projected revenue Unit-level costs Batch-level costs Product-level costs Facility-level costs What is the differential revenue for this decision? Multiple Choice O $110.000 $85,000 $205,000 Alternative A $205,000 39,000 26,500 29,000 24,000 $290,000 Alternative B $290,000 50,000 38,000 31,000 26,500arrow_forwardplease answer with working with stepsarrow_forwardYasmin Co. can further process Product B to produce Product C. Product B is currently selling for $31 per pound and costs $29 per pound to produce. Product C would sell for $56 per pound and would require an additional cost of $23 per pound to produce. What is the differential cost of producing Product C? Oa. $23 per pound Ob. $29 per pound Oc. $56 per pound Od. $31 per poundarrow_forward

- Solve this problem with calculation and provide answer in text Format pleasearrow_forwardProvide Solutions about this Question please solve it with Step by steparrow_forwardDivision A makes a part with the following characteristics: **USE IMAGE ATTAHCED TO SEE** a) Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division A is currently selling 10,000 units to its outside customers. What should be the lowest acceptable transfer price from the perspective of Division A? b}Refer back to your answer in the last problem. Division B is now purchasing these parts from an outside supplier at a price of $24 each. If Division B begins to purchase the 5,000 parts from Division A rather than the outside supplier, what is the company as a whole change in net income? c} Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division A is currently selling 10,000 units to its outside customers. IF the transfer is made, variable costs will decrease by $2 per unit. What should be the lowest acceptable transfer price…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education