ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

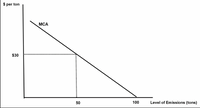

The local environmental authority levied an emissions fee of $30 per ton of waste on a firm that has the marginal cost of abatement (MCA) curve displayed in the figure below. What level of emissions will the firm release? How much will it pay in emissions fees?

Transcribed Image Text:$ per ton

МСА

$30

50

100

Level of Emissions (tons)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Imagine a firm’s marginal abatement cost function with existing technologies is: MAC = 10 – E. If the firm adopts new pollution abatement technologies, its marginal abatement cost function will be: MAC = 5 – 0.5E. If the government raises the tax on emissions from $2 to $4, the benefits of adopting the new technologies increase by $____.Select one:a. $4.b. $8.c. $6.d. $10.arrow_forwardIf a regulator underestimates the aggregate marginal abatement cost of an industry when determining the “efficient” level of emissions, the true efficient level of emissions will be? (higher, lower or same). Hint: construct a graph with AMAC and MD.arrow_forwardSuppose that a firm's marginal abatement cost function with existing technologies is MAC = 12 - E. If the firm adopts new pollution abatement technologies, then its marginal abatement cost function will become MAC = 6 - 0.5E. With an emissions tax of $3, the benefits of adopting the new technologies equal $__. Please round your final answer to two decimal places if necessary. Answer:arrow_forward

- The table below shows current carbon emissions and the cost of reducing carbon emissions for three industrial firms. The government introduces a cap-and-trade policy to regulate carbon emissions. The total cap on emissions is 180 tonnes of carbon, and each firm receives an initial allocation of tradable permits for 60 tonnes of carbon emissions. Current carbon emissions Firm A B C (tonnes) 80 100 70 a. Firm A will buy 40 emission ✓ Firm C. Cost of reducing emissions by 1 ton ($) 150 200 50 Firm B will sell 20 emissior Firm C. Instructions: Round your answer to the nearest whole number. b. To break even, the selling firm must receive $ 150arrow_forwardThe marginal benefit of reducing pollution and the marginal cost of reducing pollution are given by the following equations: MB = -2U2 + 18, and MC = 2U2 + 2, where U is the number of units of pollution abatement. What is the optimal number of units of pollution abatement? A) o B) 1 C) 2 D) 3 E) 4arrow_forwardImagine a firm’s marginal abatement cost function with existing technologies is: MAC = 8 – E. If the firm adopts new pollution abatement technologies, its marginal abatement cost function will be: MAC = 4 – 0.5E. With a tax on emissions of $2, the benefits of adopting the new technologies equal:Select one:a. $4.b. $10.c. $2.d. $8.arrow_forward

- Consider two firms with the following marginal abatement costs (MAC) as a function of emissions (E): MAC 1 10 - .5E_1 = MAC 2 20 E_2, = - and assume marginal external damages (MED) from the aggregate emissions of both firms (E_Agg = E_1 + E_2) is: MED = .5E_Agg. To achieve the socially efficient level of aggregate emissions (E*_Agg), the government institutes a cap and trade policy and sets the permit cap equal to Farrow_forwardImagine a firm’s marginal abatement cost function with existing technologies is: MAC = 100 – 2E. If the firm adopts new pollution abatement technologies, its marginal abatement cost function will be: MAC = 50 – E. If the government raises the tax on emissions from $4 to $12, the benefits of adopting the new technologies increase by $____arrow_forwardDemonstrate graphically the impact of a rise in electricity prices on the production of ice cream.arrow_forward

- A utility company is closely monitoring a new set of federal guidelines recently passed by the EPA (Environmental Protection Agency) regarding allowable green house (CO2) emission levels. In this example, the primary external factor of concern for the utility company in question. environment is the A Technological Regulatory (also political and legal) C Competitive D Economicarrow_forwardConsider an industry with two firms that emit a uniformly mixed air pollutant (e.g., carbon dioxide). The marginal abatement cost functions for Firm 1 and Firm 2 are: MAC1 = 100 - e1 MAC2 = 100 - 4e2 Aggregate emissions for the industry are denoted as E = e1 + e2. 1. In an unregulated environment how many units of emissions does each firm emit? Firm 1’s unregulated level of emissions ____________ Firm 2’s unregulated level of emissions ____________ Total unregulated level of emissions ______________ Suppose a regulator has a goal of reducing the total level of emissions from the amount from the amount you answered in [1] to 25 units. The regulator would like to achieve the goal of 25 units of total emissions in a cost-effective way. To do so it issues 25 permits, 10 are given to Firm 1 and 15 are given to Firm 2. A firm can only emit a unit of pollution if they have a permit for that unit, otherwise they must abate. After the permits are allocated,…arrow_forwardExample: Question 4a.) Arthur’s demand to reduce electric and magnetic fields (EMFs) is P = 20 – 2 Q, whileRonald’s demand is P = 15 – 3 Q. If the marginal cost of reducing emissions is equal to$15 and is constant, what is the optimal amount of EMF reduction? b.) What Lindahl prices would you charge Arthur and Ronald? What might prevent you fromcollecting these prices?c.) How would your answers change if the marginal cost of reducing emissions was equal to$10 and is constant?d.) What are the consumer surpluses of Arthur and Ronald in c.)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education