Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General aCCOUNT

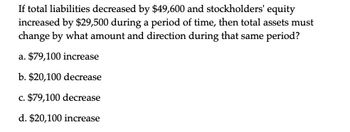

Transcribed Image Text:If total liabilities decreased by $49,600 and stockholders' equity

increased by $29,500 during a period of time, then total assets must

change by what amount and direction during that same period?

a. $79,100 increase

b. $20,100 decrease

c. $79,100 decrease

d. $20,100 increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial accountingarrow_forwardAssuming that total assets were $8,037,000 at the beginning of the current fiscal year, determine the following: When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity c. Asset turnover d. Return on total assets e. Return on stockholders' equity f. Return on common stockholders' equity % % %arrow_forwardConsider the following data....accounting questionsarrow_forward

- Compute the amount of liabilities for Company E at the beginning of the year. End of Year $ Assets Equity, beginning of year Add: Stock issuances Add: Net income 115,920 Less: Cash dividends Equity, end of year Beginning of Year Assets $ = = = 101,010 = $ $ $ Liabilities + 91,576 + 6,500 8,642 15,142 11,000 24,344 Liabilities 101,010 + + GA $ Equity 24,344 Equityarrow_forwardFind the following using the data bellow a. Accounts receivable B. Current assets C. Total assets D. Return on assets E. Common equity F. Quick ratioarrow_forwardCash and accounts receivable for Adams Company are as follows: Current Prior Year Year Cash $70,000 $50,000 Accounts receivable (net) 70,400 80,000 What is the amount and percentage of increase or decrease that would be shown with horizontal analysis? Enter a decrease using a minus sign before the amount and the percentage. Account Dollar Change Percent Change X % Cash Accounts Receivable $ X X X % increase decrease ✓ ✓arrow_forward

- Compute the annual dollar changes and percent changes for each of the following accounts. (Decreases should be indicated with a minus sign. Round percent change to one decimal place.) Current Year Prior Year Short-term investments $374,634 $234,000 101,e00 88,000 Accounts receivable 97,364 Notes payable Horizontal Analysis - Calculation of Percent Change Choose Numerator: Choose Denominator: Percent change = Current Year Prior Year Dollar Change Percent Change Short-term investments 24 374,634 $ 234,000 Accounts receivable 97,364 101,000 Notes payable 88,000arrow_forwardRATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem 24-8A. REQUIRED Calculate the following ratios and amounts for 20-1 and 20-2 (round all calculations to two decimal places): (a) Return on assets (Total assets on January 1, 20-1, were 175,750.) (b) Return on common stockholders equity (Total common stockholders equity on January 1, 20-1, was 106,944.) (c) Earnings per share of common stock (The average numbers of shares outstanding were 8,400 shares in 20-1 and 9,200 in 20-2.) (d) Book value per share of common stock (e) Quick ratio (f) Current ratio (g) Working capital (h) Receivables turnover and average collection period (Net receivables on January 1, 20-1, were 39,800.) (i) Merchandise inventory turnover and average number of days to sell inventory (Merchandise inventory on January 1, 20-1, was 48,970.) (j) Debt-to-equity ratio (k) Asset turnover (Assets on January 1, 20-1, were 175,750.) (l) Times interest earned ratio (m) Profit margin ratio (n) Assets-to-equity ratio (o) Price-earnings ratio (The market price of the common stock was 100.00 and 85.00 on December 31, 20-2 and 20-1, respectively.)arrow_forwardCategory Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,139.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,349.00 Interest expense 40,500 41,741.00 Inventories 279,000 288,000 Long-term debt 337,728.00 398,725.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,280.00 Retained earnings 306,000 342,000 Sales 639,000 847,106.00 Taxes 24,750 48,618.00 What is the current year's return on assets (ROA)? (Round to 4 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,