FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

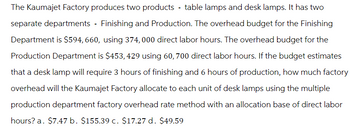

Transcribed Image Text:The Kaumajet Factory produces two products - table lamps and desk lamps. It has two

separate departments - Finishing and Production. The overhead budget for the Finishing

Department is $594,660, using 374,000 direct labor hours. The overhead budget for the

Production Department is $453,429 using 60, 700 direct labor hours. If the budget estimates

that a desk lamp will require 3 hours of finishing and 6 hours of production, how much factory

overhead will the Kaumajet Factory allocate to each unit of desk lamps using the multiple

production department factory overhead rate method with an allocation base of direct labor

hours? a. $7.47 b. $155.39 c. $17.27 d. $49.59

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marvel Parts, Incorporated, manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company uses a standard cost system for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,055 hours each month to produce 2,110 sets of covers. The standard costs associated with this level of production are: Direct materials Total $ 51,273 Per Set of Covers $ 24.30 Direct labor $ 10,550 5.00 Variable manufacturing overhead (based on direct labor-hours) $ 4,853 2.30 $ 31.60 During August, the factory worked only 1,000 direct labor-hours and produced 2,100 sets of covers. The following actual costs were recorded during the month: Per Set of Direct materials (6,800 yards) Direct labor Total $ 49,980. Covers $ 23.80 $ 10,920 5.20 Variable manufacturing overhead $ 5,460 2.60 $ 31.60 At standard, each set of covers should require 3.0 yards of material. All of the…arrow_forwardCrane Inc. manufactures two products, sweaters and jackets. The company has estimated its overhead in the order-processing department to be $193000. The company produces 54000 sweaters and 75000 jackets each year. Sweater production requires 27000 machine hours, jacket production requires 52000 machine hours. The company places raw materials orders 10 times per month, 4 times for raw materials for sweaters and the remainder for raw materials for jackets. How much of the order-processing overhead should be allocated to jackets? O $48250 O $115800 $69250 O $158200arrow_forwardSifton Electronics Corporation manufactures and assembles electronic motor drives for video cameras. The company assembles the motor drives for several accounts. The process consists of a lean cell for each customer. The following information relates to only one customer's lean cell for the coming year. For the year, projected labor and overhead was $5,154,500 and materials costs were $34 per unit. Planned production included 5,408 hours to produce 16,900 motor drives. Actual production for August was 1,820 units, and motor drives shipped amounted to 1,400 units. Conversion costs are applied based on units of production From the foregoing information, determine the amount of the conversion costs charged to Raw and In Process Inventory during August. Oa. $555,100 Ob. $556,954 Oc. $235,349 Od. $128,100arrow_forward

- Cozy, Inc., manufactures small and large blankets. It estimates $303,263 in overhead during the manufacturing of 80,487 small blankets and 85,543 large blankets. What is the predetermined overhead rate per machine hour if a small blanket takes 4 machine hour and a large blanket takes 1 machine hours? Round to the nearest penny, two decimal places.arrow_forwardGood Eats Inc. manufactures flatware sets. The budgeted production is for 80,000 sets this year. Each set requires 2.5 hours to polish the material. If polishing labor costs $15.00 per hour, determine the direct labor cost budget for polishing for the year.$____arrow_forwardThe Pizza Company makes two types of frozen pizzas: pepperoni and cheese. The Pizza Company allocates overhead to these two products based on the number of direct labor hours. The direct labor hours per unit for making a pepperoni pizza is 5 minutes or 1/12 of an hour. The direct labor hours per unit for making a cheese pizza is 4 minutes or 1/15 of an hour. At the start of the year The Pizza Company expected to make 12,000 pepperoni pizzas and 6,000 cheese pizzas. During the year, The Pizza Company actually made 9,000 pepperoni pizzas and 7,500 cheese pizzas. The time cards indicate that direct laborers worked for 1,300 hours. What are the total expected direct labor hours, standard direct labor hours, and actual direct labor hours?arrow_forward

- Sunland Inc. manufactures two products, sweaters and jackets. The company has estimated its overhead in the order-processing department to be $177000. The company produces 53000 sweaters and 78000 jackets each year. Sweater production requires 23000 machine hours, jacket production requires 49000 machine hours. The company places raw materials orders 12 times per month, 4 times for raw materials for sweaters and the remainder for raw materials for jackets. How much of the order-processing overhead should be allocated to jackets? O $44250 O $69250 O $135000 O $118000arrow_forwardHarbour Company makes two models of electronic tablets, the Home and the Work. Basic production information follows: Direct materials cost per unit Direct labor cost per unit Sales price per unit Expected production per month Harbour has monthly overhead of $168,340, which is divided into the following activity pools: Setup costs Quality control Maintenance Total Number of setups Number of inspections Number of machine hours $86,400 54,940 27,000 $ 168,340 The company also has compiled the following information about the chosen cost drivers: Home 37 340 1,600 Required 1 Home Required 2 Required 3 $ 41 16 360 770 units Work 71 330 1,100 Home Model Work Model Total Overhead Cost Required: 1. Suppose Harbour uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Calculate the production cost per unit for each of Harbour's products under a traditional costing system. 3. Calculate Harbour's gross margin per…arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $30 per unit and $45 is used in direct labor, while the direct material for the double is $45 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 10,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: Activity CostPools Driver EstimatedOverhead Use perTwin Use perDouble Framing Square Feet of Pine $270,000 6,000 3,000 Padding Square Feet of Quilting 230,000 130,000 100,000 Filling Square Feet of Filling 240,000 450,000 350,000 Labeling Number of Boxes 250,000 850,000 400,000 Inspection Number of Inspections 165,000 11,000 4,000 After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Purchasing (per order) $56 Utilities (per square foot) 2 Machine Setups (per machine hour) 7 Supervision (per direct labor hour)…arrow_forward

- Bonita Music Company makes custom marimbas and xylophones. Since much of the work on these musical instruments is done by hand, the company uses direct labor hours as its manufacturing overhead application base. The company's annual budgeted overhead costs for 40,000 direct labor hours totaled $560,000.arrow_forwardKaumajet Factory produces two products: table lamps and desk lamps. It has two separate departments: Fabrication and Assembly. The factory overhead budget for the Fabrication Department is $644,490, using 325,500 direct labor hours. The factory overhead budget for the Assembly Department is $596,624, using 76,100 direct labor hours. If a table lamp requires 4 hours of fabrication and 7 hour of assembly, the total amount of factory overhead that Kaumajet Factory will allocate to table lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours if 9,200 units are produced is a.$72,128 b.$312,751 c.$150,035 d.$577,760arrow_forwardIsaacson's Fine Furnishings manufactures upscale custom furniture. Isaacson's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,170,000 of manufacturing overhead to individual jobs. However, Delores Johnson, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $735,000 of manufacturing overhead while the Finishing Department incurs $435,000 of manufacturing overhead. Johnson has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department The Isaacson's plant completed Jobs 450 and 455 on May 15. Both jobs incurred a total of 7 DL hours throughout the entire production process. Job 450 incurred 1 MH in the Machining Department and 6 DL hours in the Finishing Department (the other DL hour occurred in the Machining…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education