Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:eBook

Video

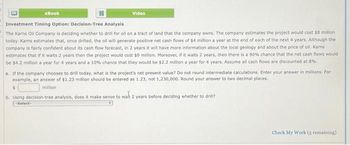

Investment Timing Option: Decision-Tree Analysis

The Karns Oil Company is deciding whether to drill for oil on a tract of land that the company owns. The company estimates the project would cost $8 million

today. Kams estimates that, once drilled, the oil will generate positive net cash flows of $4 million a year at the end of each of the next 4 years. Although the

company is fairly confident about its cash flow forecast, in 2 years it will have more information about the local geology and about the price of oill. Karms

estimates that if it waits 2 years then the project would cost $9 million. Moreover, if it waits 2 years, then there is a 90 % chance that the net cash flows would

be $4.2 million a year for 4 years and a 10% chance that they would be $2.2 million a year for 4 years. Assume all cash flows are discounted at 8%.

a. If the company chooses to drill today, what is the project's net present value? Do not round intermediate calculations. Enter your answer in millions. For

example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places.

million

$

b. Using decision-tree analysis, does it make sense to walt 2 years before deciding whether to drill?

-Select-

Check My Work (5 remaining)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- Athena Investment Company is considering the purchase of an office property. After a careful review of the market and the leases that are in place, Athena believes that next year’s cash flow will be $100,000. It also believes that the cash flow will rise in the amount of $5,000 each year for the foreseeable future. It plans to own the property for at least 10 years. Athena believes that it should earn a return (r) of at least 11 percent. Athena estimates the value of the property today to be $1,224,808. What is the current, or going-in, cap rate for this property? A. 11.05% B. 10.49% C. 8.57% D. 8.16%arrow_forwardBrett Collins is reviewing his company's investment in a cement plant. The company paid $16,000,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original expectations before he decides its fate. The company's desired rate of return for present value computations is 10 percent. Expected and actual cash flows follow: (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Expected Actual Year 1 $3,310,000 2,600,000 Required Year 2 $5,090,000 2,980,000 Year 3 $4,560,000 4,860,000 Year 4 $5,090,000 3,810,000 Year 5 $4,290,000 3,540,000 a.&b. Compute the net present value of the expected and actual cash flows as of the beginning of the investment. Note: Negative amounts should be indicated by a minus sign. Round your intermediate calculations and final answers to the nearest whole dollar.arrow_forwardBrett Collins is reviewing his company's investment in a cement plant. The company paid $15.500,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original expectations before he decides its fate. The company's desired rate of return for present value computations is 10 percent. Expected and actual cash flows follow: (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Expected Actual Year 1 $3,380,000 2,700,000 Year 2 $4,950,000 3,060,000 Net present value (expected) Net present value (actual) Year 3 $4,580,000 4,900,000 Year 4 $5,040,000 Year 5 $4,250,000 3,860,000 3,530,000 Required a.&b. Compute the net present value of the expected and actual cash flows as of the beginning of the investment. Note: Negative amounts should be Indicated by a minus sign. Round your Intermediate calculations and final answers to the nearest whole dollar.arrow_forward

- someone solve this but not use excelarrow_forwardXYZ, which currently sells art products, is considering project Q, which would involve teaching art lessons For most of its existence, XYZ sold art products, taught art lessons, and painted murals Project Q Would require an initial investment of $87,300 today and is expected to produce annual cash flows of $10,200 each year forever with the first annual cash flow expected in 1 year What is the NPV of project Q. based on the information in this paragraph and the following table and applying the pure play approach to detemining a project's cost of capital? Firm XYZ Frisco Frescos NorCal Art Art Factory Line of business Sells art products Paints murals at residential and commercial sights Teaches art lessons Sells art products, teaches art lessons, & paints murals WACC 144 percent 82 percent 95 percent 77 percent O a. $20,068 (plus or minus $10) Ob. $144,518 (plus or minus $10) OC. $37,090 (plus or minus $10) O d. $45,168 (plus or minus $10) O e. None of the above is within $10 of the…arrow_forwardOTR Trucking Company runs a fleet of long-haul trucks and has recently expanded into the Midwest, where it has decided to build a maintenance facility. This project will require an initial cash outlay of 20 million and will generate annual cash inflows of $ 4.5 million per year for Years 1 through 3. In Year 4, the project will provide a net negative cash flow of $5 million due to anticipated expansion of and repairs to the facility. During Years 5 through 10, the project will provide cash inflows of 2 million per year. a. Calculate the project's NPV and IRR where the discount rate is 12 percent. Is the project a worthwhile investment based on these two measures? Why or why not?b. Calculate the project's MIRR. Is the project a worthwhile investment based on this measure? Why or why not?arrow_forward

- The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with this project are as follows: Year. Project cash flow 0 ? 1 $810,000 2 $390,000 3 $260,000 4 $460,000 If you know that the project has a regular payback of 2.4 years, what is the projects IRR?arrow_forwardF2.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education