Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

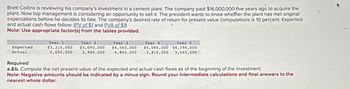

Transcribed Image Text:Brett Collins is reviewing his company's investment in a cement plant. The company paid $16,000,000 five years ago to acquire the

plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original

expectations before he decides its fate. The company's desired rate of return for present value computations is 10 percent. Expected

and actual cash flows follow: (PV of $1 and PVA of $1)

Note: Use appropriate factor(s) from the tables provided.

Expected

Actual

Year 1

$3,310,000

2,600,000

Required

Year 2

$5,090,000

2,980,000

Year 3

$4,560,000

4,860,000

Year 4

$5,090,000

3,810,000

Year 5

$4,290,000

3,540,000

a.&b. Compute the net present value of the expected and actual cash flows as of the beginning of the investment.

Note: Negative amounts should be indicated by a minus sign. Round your intermediate calculations and final answers to the

nearest whole dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) Calculate the incremental earnings of this project below: (Round to one decimal place.) Incremental Earnings Forecast (millions) Sales Operating Expenses Depreciation EBIT Income tax at 21% Unlevered Net Income Year 1 Year 2 $ $ SA $ 69 $ GA 67 69 $ $ $ 6969 $ $ SAarrow_forwardsarrow_forwardHook Industries is considering the replacement of one of its old metal stamping machines. Three alternative replacement machines are under consideration. The cash flows associated with each are shown in the following table attached: . The firm's cost of capital is 10%. a. Calculate the net present value (NPV) of each press. b. Using NPV, evaluate the acceptability of each press. c. Rank the presses from best to worst using NPV.arrow_forward

- Birkenstock is considering an investment in a nylon-knitting machine. The machine requires an initial investment of $27,300, has a five-year life, and has no residual value after five years. The company's cost of capital is 10.41%. The company has estimated expected cash inflows for three scenarios: pessimistic, most likely, and optimistic. These expected cash inflows are listed in the following table. Calculate the range for the NPV across the three scenarios. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year 1 2 3 4 5 Pessimistic $6,720 7,180 8,680 7,770 5.800 Expected cash inflows Most likely $9,240 10,150 11,790 10,740 7.840 Optimistic $11,830 13,260 15,800 12,790 8.780arrow_forwardThornton Company is considering investing in two new vans that are expected to generate combined cash inflows of $26,000 per year. The vans' combined purchase price is $95,500. The expected life and salvage value of each are four years and $20,000, respectively. Thornton has an average cost of capital of 16 percent. (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required a. Calculate the net present value of the investment opportunity. Note: Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to 2 decimal places. b. Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted. a. Net present value b. Will the return be above or below the cost of capital? b. Should the investment opportunity be accepted? Above Acceptedarrow_forwardChaquille's K-House, Inc. made an investment in a project with an initial cost of $11,064,450. This investment was for 8 years and had no residual value. The company expects to receive yearly net cash inflows of $2,603,400. Management is requiring a return of 12% on the investment. (Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forward

- Brett Collins is reviewing his company's investment in a cement plant. The company paid $15.500,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original expectations before he decides its fate. The company's desired rate of return for present value computations is 10 percent. Expected and actual cash flows follow: (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Expected Actual Year 1 $3,380,000 2,700,000 Year 2 $4,950,000 3,060,000 Net present value (expected) Net present value (actual) Year 3 $4,580,000 4,900,000 Year 4 $5,040,000 Year 5 $4,250,000 3,860,000 3,530,000 Required a.&b. Compute the net present value of the expected and actual cash flows as of the beginning of the investment. Note: Negative amounts should be Indicated by a minus sign. Round your Intermediate calculations and final answers to the nearest whole dollar.arrow_forwardThe management of Nixon Corporation is investigating purchasing equipment that would cost $550,000 and have a 7 year life with no salvage value. The equipment would allow an expansion of capacity that would increase sales revenues by $380,000 per year and cash operating expenses by $219,000 per year. (Ignore income taxes.) Required: Determine the simple rate of return on the investment. (Round your answer to 1 decimal place.)arrow_forwardYour company is evaluating an investment project. The project would require buying a piece of machinery that costs $23.43 million dollars. As part of the effort to raise money for the project, your company will also sell an old piece of machinery right away which will generate an estimated after-tax salvage of $11.39 million dollars. Assuming the above are all the investment-related activities for your company. What're the project's initial cash flows from investing activities? Note: your answer should be in millions of dollars.arrow_forward

- Management thinks that, while all of the assumptions about cash flows are the same, but rather than a four-year life, the product will have a six-year life (the salvage of the equipment will also remain the same at end of 6 years as what was estimated for 4 years); there is another overhaul needed at the end of year 2 and 4 as well). Using a 19% required rate of return, compute the NPV.arrow_forwardColsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $20 million Operating costs 16 million Interest expense 2 million The company has a 25% tax rate, and its WACC is 13%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar.$ If this project would cannibalize other projects by $1.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar.The firm's OCF would now be $ .arrow_forwardAa 27.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education