FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

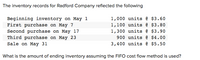

Transcribed Image Text:The inventory records for Radford Company reflected the following

1,000 units @ $3.60

1,100 units @ $3.80

Beginning inventory on May 1

First purchase on May 7

Second purchase on May 17

Third purchase on May 23

1,300 units @ $3.90

900 units @ $4.00

Sale on May 31

3,400 units @ $5.50

What is the amount of ending inventory assuming the FIFO cost flow method is used?

Expert Solution

arrow_forward

Step 1 Introduction

First In First Out Method: The FIFO Method is a method of valuation of inventory remaining at the period whether at the end of the month, quarter, or year.

In this method, we sell the stock first which is purchase first and then sell stock that is purchased after this.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the correct ending balance of Inventory under the LIFO method given the following information? Beginning Inventory: 35 units @€17, Purchase 1: 10 units @€22, Purchase 2: 15 units @€35, Ending Inventory: 40 units. Assume that the sale occurs after all inventory purchases. Answer: Xarrow_forwardThe beginning inventory and the purchases and sales of inventory for March for the Carolina Company are as presented below. Complete the inventory schedule assuming the FIFO Inventory valuation method is used. Date Transaction Number of Units Per Unit Total Mar 1 Inventory 10,500 1.5 $15,750 Mar 8 Purchase 12,000 1.6 $19,200 Mar 11 Sold 11,000 2.5 $27,500 Mar 12 Sold 9,500 2.5 $23,750 Mar 14 Purchase 8,000 1.65 $13,200 Mar 15 Sold 5,000 2.6 $13,000 Mar 19 Sold 4,000 2.6 $10,400 Mar 22 Purchase 7,000 1.7 $11,900 Mar 24 Sold 4,000 2.6 $10,400 Mar 25 Sold 2,500 2.6 $6,500 Mar 26 Purchase 10,000 1.72 $17,200 Mar 28 Sold 5,000 2.6 $13,000 FIFO Purchases Cost of Goods Sold Inventory Quantity UnitCost TotalCost…arrow_forwardABC co. has the following data for the month ended January 31, 2021. ABC uses periodic inventory system: Date 1/1 Beginning Inventory 110 $ 78 1/8 Purchase 190 81 1/12 Sale 140 110 1/18 Purchase 75 81 1/20 Sale 80 120 1/24 Purchase 210 83 1/29 Sale 190 120 Which inventory method will allow company to present the highest ending inventory on the January 31, 2021 Balance Sheet? O LIFO Specific Identification Units Unit cost or selling price O FIFO O Average Costarrow_forward

- The inventory records for Radford Company reflected the following Beginning inventory on May 1 First purchase on May 7 second purchase on May 17 Third purchase on May 23 1,800 units @ $5.20 1,900 units @ $5.40 2,100 units @ $5.50 1,700 units @ $5.60 Sales on May 31 5,700 units @ $7.10 What is the weighted average cost per unit for May? Multiple Choice $5.37 $5.43arrow_forwardUsing the FIFO method, complete the steps below to calculate the ending inventory units, inventory account balance, and cost of goods sold account balance at the end of the period.Date Activity Units Purchase Price (per unit)Sale Price(per unit)1-Feb Beginning Inventory 100 $ 4515-Feb Purchase 700 $ 529-Apr Sale 1 600 $ 9029-May Purchase 500 $ 5610-Jul Sale 2 600 $ 9010-Sep Purchase 400 $ 5815-Oct Sale 3 400 $ 905-Nov Purchase 900 $ 6218-Dec Sale 4 200 $ 901. Compute the Cost of Goods Sold and ending inventory (units and value) after Sale 1.Cost of Goods Sold (units) Total COGS after Sale 1 Inventory Remaining (units) Total Inventory Balance after Sale 1Totals:2. Compute the Cost of Goods Sold and ending inventory (units and value) after Sale 2.Cost of Goods Sold (units) Total COGS after Sale 2 Inventory Remaining (units) Total Balance after Sale 2Totals:3. Compute the Cost of Goods Sold and ending inventory (units and value) after Sale 3. Cost of Goods Sold (units) Total COGS after…arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forward

- Inventory Costing Methods and the Perpetual MethodKay & Company experienced the following events in March: Date Event Units Unit Cost Total Cost Mar. 1 Purchased inventory 100 @ $16 $1,600 Mar. 3 Sold inventory 60 Mar. 15 Purchased inventory 100 @ 18 $1,800 Mar. 20 Sold inventory 40 Assume the perpetual inventory system is used. Use the weighted-average inventory costing method to calculate the company’s cost of goods sold and ending inventory as of March 31. Round weighted-average cost per unit to two decimal places. Use rounded answer for subsequent calculations. Round all other answers to the nearest dollar. March 3 Cost of goods sold Answer March 20 Weighted-average cost per unit Answer Cost of goods sold Answer March 31 Total cost of goods sold Answer Ending inventory Answerarrow_forwardThe Company uses a periodic inventory system. For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.)arrow_forwardThe inventory records for Radford Company reflected the following Beginning inventory on May 1 First purchase on May 7 Second purchase on May 17 Third purchase on May 23 1,200 units @ $4.00 1,300 units @ $4.20 1,500 units @ $4.30 1,100 units@ $4.40 Sale on May 31 3,900 units @ $5.90 What is the amount of gross margin assuming the weighted average cost flow method is used? (Round your intermediate calculations to 2 dec Multiple Choice $10.920 $17160 $6,513 O $5.850arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education