FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

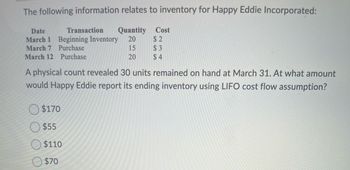

Transcribed Image Text:**Inventory Information for Happy Eddie Incorporated**

The following data relates to inventory management for Happy Eddie Incorporated:

| Date | Transaction | Quantity | Cost |

|----------|----------------------|----------|------|

| March 1 | Beginning Inventory | 20 | $2 |

| March 7 | Purchase | 15 | $3 |

| March 12 | Purchase | 20 | $4 |

A physical count revealed that 30 units remained on hand as of March 31.

**Question:** At what amount would Happy Eddie report its ending inventory using the LIFO (Last-In, First-Out) cost flow assumption?

**Options:**

- $170

- $55

- $110

- $70

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- aaarrow_forwardThe inventory data for an item for November are: Nov. 1 Inventory 24 units at $21 4 Sold 11 units 10 Purchased 27 units at $20 17 Sold 23 units 30 Purchased 25 units at $23 Using a perpetual system, what is the cost of the goods sold for November if the company uses LIFO? a.$691 b.$704 c.$915 d.$964arrow_forwardBeginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 24 units @ $10 5 Sale 17 units 17 Purchase 10 units @ $15 30 Sale 8 units Assuming a perpetual inventory system and the last-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale.$fill in the blank 1arrow_forward

- Current Attempt in Progress Blue Limited uses a perpetual inventory system. The inventory records show the following data for its first month of operations: Date Explanation Units Unit Cost Total Cost Balance in Units Aug. 2 Purchases 249 $69 $17,181 249 3 Purchases 506 96 48.576 755 10 Sales (275 ) 480 15 Purchases 926 121 112,046 1,406 25 Sales (311 ) 1,095 (a) Calculate the cost of goods sold and ending inventory using the FIFO cost method. Cost of goods sold $ Ending inventory $ eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answerarrow_forwardCalculate dollar value of ending inventory assuming company follows perpetual LIFO inventory system, from the following information: July 01 Beginning inventory 75 units @ $25 each July 04 Purchase July 09 Sale July 16 Purchase July 24 Sale 348 units @ $27 each 300 units 257 units @ $28 each 275 units a. $2,705 b. $2,852 c. $2,940 d. $2,685 с.arrow_forwardQuestion attached in photoarrow_forward

- Calculate the average unit cost for the inventory table shown below. Units Cost per Total purchased 43 22 18 26 Date of purchase Beginning inventory February 5 February 19 March 3 Goods available for sale Units sold Ending inventory 109 81 28 unit $840 $1,750 cost $36,120 $38,500 (Round to the nearest cent as needed.) Retail price per unit $975 $2,105 $975 $17,550 $1,996 $470 $12,220 $590 $104,390 Total retail value $41,925 $46,310 $35,928 $15,340 $139,503 ***arrow_forwardHess Company's inventory records show the following data for the month of September: Units Unit Cost Inventory, September 1 100 $3.00 Purchases: September 8 450 3.50 September 18 300 3.70 A physical inventory on September 30 shows 150 units on hand.Calculate the value of ending inventory and cost of goods sold if the company uses LIFO inventory costing and a periodic inventory system. Ending inventory $enter a value of ending inventory in dollars Cost of goods sold $enter a cost of goods sold in dollarsarrow_forwardpre.22arrow_forward

- Below is the Inventory purchases of Carrigan Corrugated Company. Beginning balance January 1st purchase January 8th purchase January 17th purchase January 27th purchase January 31st purchase Units Cost per Unit 173 $ 1.25 257 $ 1.15 300 $ 0.95 287 $ 1.10 164 $ 1.30 139 $ 1.35 At the end of January, a physical inventory revealed that 1,205 units were sold and the remainder were left as ending inventory. Calculate the Cost of Goods Sold and the ending Inventory balance using the FIFO method. (round all answers using two (2) decimal places)arrow_forwardplease help mearrow_forwardInventory data for Bramble Company are reported as follows. Date June 1 12 23 30 Explanation Units Inventory Purchase Purchase Inventory 200 600 350 130 Unit Cost Calculate cost of goods available for sale. $7 8 9 Total Cost $1,400 4,800 3,150 Assume a sale of 650 units occurred on June 15 for a selling price of $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education