FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

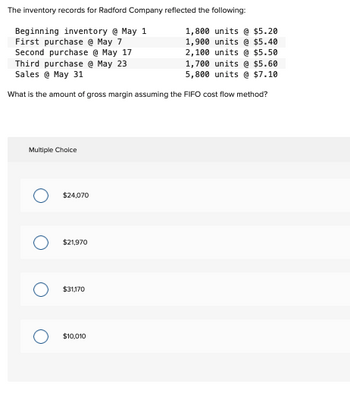

Transcribed Image Text:The inventory records for Radford Company reflected the following:

Beginning inventory @ May 1

First purchase @ May 7

Second purchase @ May 17

Third purchase @ May 23

Sales @ May 31

1,800 units @ $5.20

1,900 units @ $5.40

2,100 units @ $5.50

1,700 units @ $5.60

5,800 units @ $7.10

What is the amount of gross margin assuming the FIFO cost flow method?

Multiple Choice

$24,070

O $21,970

$31,170

$10,010

Expert Solution

arrow_forward

Step 1 Introduction

The inventory can be valued using various methods as LIFO, FIFO and weighted average method.

Using FIFO method, the old inventory is sold first and new inventory is left in the stock.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the weighted-average (AVG) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and (c) gross margin for A75 Company, considering the following transactions. Round your intermediate calculations to 2 decimal places and final answers to nearest whole dollar. Numberof Units UnitCost Beginning Inventory 125 $43 Purchased Mar. 2 155 45 Sold Mar. 31 for $75 per unit 84 (a) Sales Revenue $fill in the blank 1 (b) Cost of Goods Sold fill in the blank 2 (c) Gross Margin $fill in the blank 3arrow_forwardThe following information is taken from a company’s records. Costper Unit Market valueper Unit Inventory Item 1 (10 units) $40 $39 Inventory Item 2 (23 units) 20 20 Inventory Item 3 (12 units) 8 10 Applying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory?arrow_forwardThe following information relates to Pharoah Kitchen Ltd's inventory transactions during the month of March. \table[[,,Units,Cost/Unit,Amount],[Mar. 1,Beginning inventory,4,500,$18.00,$81,000 Calculate Pharoah Kitchen's cost of goods sold, gross margin, and ending inventory for the month of March using weighted-average.arrow_forward

- give me answerarrow_forwardCalculate the cost of goods sold dollar value for A66 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO). Number of Units Unit Cost Sales Beginning inventory 880 $50 Purchased 600 52 Sold 400 $100 Sold 350 110 Ending inventory 730 LIFO (perpetual) Inventory Cost of Goods Purchased Cost of Goods Sold Cost of Inventory Remaining Number Number Number of units Unit Cost Total Cost of units Unit Cost Total Cost of units Unit Cost Total Cost Beginning Purchase Sale Sale Total Purchases Total COGSarrow_forwardLIFO, Perpetual and Periodic Riedel Company's inventory records showed the following transactions for the fiscal period ended June 30: Units Cost/Unit June 1 Inventory 700 $6.20 June 3 Purchase 400 6.40 June 15 Sales @ $12.00 300 June 22 Sales @ $12.50 600 June 30 Purchase 600 6.70 Required: 1. Compute the ending inventory and the cost of goods sold under the LIFO cost flow assumption assuming both a perpetual and a periodic inventory system. If required, round your answers to the nearest dollar. LIFO - periodic:Ending inventory $fill in the blank 1Cost of goods sold $fill in the blank 2 LIFO - perpetual:Ending inventory $fill in the blank 3Cost of goods sold $fill in the blank 4 2. Under which of the following assumptions may the cost of goods sold include the costs of the most latest purchases of the period, even though those purchases were made after the sales took place? Under which of the following…arrow_forward

- How do I solve this?arrow_forwardThe inventory records for Radford Company reflected the following: Beginning inventory @ May 1 First purchase @ May 7 Second purchase @ May 17 Third purchase @ May 23 Sales @ May 31 700 units @ $3.60 2,700 units @ $5.10 What is the amount of cost of goods sold assuming the LIFO cost flow method? Multiple Choice $9,720 $9,430 $8,640 $9,180 800 units @ $3.20 900 units @ $3.40 1,100 units @ $3.50arrow_forwardThe inventory records for Radford Company reflected the following: Beginning inventory @ May 1900 units @ $3.40 First purchase @ May 7 1,000 units @ $3.60 Second purchase @ May 17 1,200 units @ $3.70 Third purchase @ May 23 800 units @ $3.80 Sales @ May 31 3,000 units @ $5.30 What is the amount of gross margin assuming the FIFO cost flow method? Multiple Choice $10,730 $ 5,700 $5,170 $4,820arrow_forward

- What is unsecured borrowing?arrow_forwardPark Company’s perpetual inventory records indicate the following transactions in the month of June: 1. Compute the cost of goods sold for June and the inventory at the end of June using each of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places and other amounts to the nearest dollar.) 2. Next Level Why are the cost of goods sold and ending inventory amounts different for each of the three methods?what do these amounts tell us about the purchase price of inventory during the year? 3. Next Level Which method produces…arrow_forwardThere are such data of the ABC Company’s activity. The company uses perpetual inventory updating. Number of Units Unit Cost, $ Sales prise, $ Beginning inventory 900 60 Purchased 700 65 Sold 1 900 100 Sold 2 200 120 Ending inventory Find ending inventory and its cost Calculate the cost of goods sold in units and in dollar value for Company ABC for the month. Provide calculations for first-in, first-out (FIFO) method. Find Gross margin for the 1-st and 2-d sellsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education