FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

I need all please including the first graph & A & B of the second problem please!

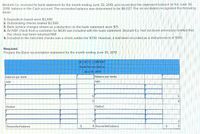

Transcribed Image Text:**Beckett Co. Bank Reconciliation Process Overview**

**Scenario:**

Beckett Co. received its bank statement for the month ending June 30, 2019, and reconciled the statement balance to the June 30, 2019, balance in the Cash account. The reconciled balance was determined to be $6,027. The reconciliation recognized the following items:

1. Deposits in transit were $3,449.

2. Outstanding checks totaled $2,595.

3. Bank service charges shown as a deduction on the bank statement were $71.

4. An NSF check from a customer for $630 was included with the bank statement. Beckett Co. had not been previously notified that the check had been returned NSF.

5. Included in the canceled checks was a check written for $730. However, it had been recorded as a disbursement of $910.

**Required:**

Prepare the Bank reconciliation statement for the month ending June 30, 2019.

**Bank Reconciliation Statement:**

- **Balance per bank**

- Add:

- Deposits in transit: $3,449

- Deduct:

- Outstanding checks: $2,595

- **Balance per books**

- Add:

- None indicated

- Deduct:

- Bank service charges: $71

- NSF check: $630

- Correction of check recorded incorrectly: ($910 - $730 = $180)

- **Reconciled balance:** $6,027

This diagram is a standard bank reconciliation template outlining items to be adjusted on both the bank and book sides to determine the reconciled balance of $6,027.

Transcribed Image Text:# Inventory Cost Flow Assumptions: FIFO, LIFO, and Weighted Average

## Inventory Data for Sellco: Fiscal Year Ending January 31, 2020

### Sales and Inventory Information:

- **Sales:** 770 units

- **Beginning inventory:** 200 units at $4 each

- **Purchases (chronological order):**

- 290 units at $4 each

- 430 units at $6 each

- 190 units at $8 each

### Requirements

#### a. Calculation of Cost of Goods Sold (COGS) and Ending Inventory

Calculate COGS and ending inventory using the following cost flow assumptions. Ensure to round unit costs to two decimal places.

- **First-In, First-Out (FIFO)**

- **Last-In, First-Out (LIFO)**

- **Weighted Average**

**Table: COGS and Ending Inventory**

| Assumption | Cost of Goods Sold | Ending Inventory |

|-------------------|--------------------|------------------|

| FIFO | | |

| LIFO | | |

| Weighted Average | | |

#### b. Calculation of Net Income Under FIFO and LIFO

Assume the net income using the weighted-average cost flow assumption is $12,300. Calculate the net income under FIFO and LIFO. Round unit costs to two decimal places.

**Table: Net Income**

| Assumption | Net Income |

|------------|------------|

| FIFO | |

| LIFO | |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For Part 2, can that be calculated using excel?arrow_forwardWhat is The NPV for Machine B=arrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forward

- How do you make a two-dimensional columnar chart in excel?arrow_forwardCreate a SQL table using your name with the following features: the columns of your table must include, at least the data types (in this order) and one more of your choice NOTE: You need to specify a 2 column (i.e 2 attribute 1. varchar (n), // where n covers the string length you want to enter 2. Int, 3. decimal, (precision = 8, scale = 3 4. date. 5. ??? your choice here ??? Table constraints: 1. It has a two column primary key 2. a check constraint on 2 columns, on the decimal and the date field 3. Use '2024-02-18' date as the default on the date field 5. write down your relational schema 5. Create the table, insert at least 4 rows, and do a Select * to show them example don't just copy these, change the constraint namesarrow_forwardcan you please show me how to calculate this without using excel? Thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education