Concept explainers

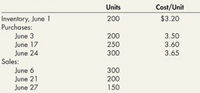

Park Company’s perpetual inventory records indicate the following transactions in the month of June: 1. Compute the cost of goods sold for June and the inventory at the end of June using each of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places and other amounts to the nearest dollar.) 2. Next Level Why are the cost of goods sold and ending inventory amounts different for each of the three methods?what do these amounts tell us about the purchase price of inventory during the year? 3. Next Level Which method produces the most realistic amount for net income? For inventory? Explain your answer. 4. Next Level If Park uses IFRS, which of the previous alternatives would be acceptable and why?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- FLCL Company had the following transactions for the month: Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. first-in, first-out (FIFO) last-in, first-out (LIFO) weighted averagearrow_forwardhere are 17 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the difference in gross profit between the FO and FIFO inventory cost systems. Enter the answer as a positive number.arrow_forwardThe Luann Company uses the periodic inventory system. The following July data are for an item in Luann's inventory: July 1 Beginning inventory 30 units @ 10 Purchased $9 per unit 50 units @ $11 per unit 15 Sold 60 units 26 Purchased 25 units @ $13 per unit Calculate the cost of goods sold for July and ending inventory at July 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) the weighted-average cost methods. Note: Round your cost per unit to three decimal places, if needed. Then round your final answers to the nearest dollar. A. First-in, First-out: Ending Inventory Cost of Goods Sold: B. Last-in, first-out: Ending Inventory Cost of Goods Sold: C. Weighted-average cost: Ending Inventory Cost of Goods Soldarrow_forward

- In chronological order, the inventory, purchases, and sales of a single product for a recent month are as follows (see attached). 1.Using the periodic inventory system, compute the cost of ending inventory, cost of goods sold, and gross margin. Use the average-cost, FIFO, and LIFO inventory costing methods. (Round unit costs to cents and totals to dollar.) 2.Explain the differences in gross margin produced by the three methods.arrow_forwardWhat is the Weighted average cost per unit?arrow_forwardAircard Corporation tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a perpetual inventory system. The following are the transactions for the month of July. July 1 July 5 Units Unit Cost Beginning Inventory 2,700 $ 47 Sold 1,350 July 13 Purchased 6,700 51 July 17 Sold 3,700 July 25 July 27 Purchased Sold 8,700 57 5,700 Calculate the cost of ending inventory and cost of goods sold assuming a perpetual inventory system is used in combination with (a) FIFO and (b) LIFO. Complete this question by entering your answers in the tabs below. Required A Required B Calculate the cost of ending inventory and cost of goods sold assuming a perpetual inventory system is used in combination with FIFO. Beginning Inventory Purchases July 13 FIFO (Perpetual) Units Cost per Unit Total $ 0 July 25 Total Purchases Goods Available for Sale Cost of Goods Sold Units from Beginning Inventory Units…arrow_forward

- Akira Company had the following transactions for the month. Number Cost of Units per Unit Beginning Inventory 150 $10 Purchased Mar. 31 180 13 Purchased Oct. 15 150 16 Ending Inventory 70 ? Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Round your intermediate calculations to 2 decimal places and final answers to the nearest dollar amount. Ending Inventory A. First-in, First-out (FIFO) B. Last-in, First-out (LIFO) C. Weighted Average (AVG) $ %24 %24arrow_forwardAkira Company had the following transactions for the month. Number Total of Units Cost Beginning inventory 130 $1,300 Purchased Mar. 31 180 2,160 Purchased Oct. 15 150 2,250 Total goods available for sale 460 5,710 Ending inventory 50 Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that all units were sold for $30 each. Round your intermediate calculations to 2 decimal places and final answers to the nearest dollar amount. Gross Margin A. First-in, First-out (FIFO) B. Last-in, First-out (LIFO) C. Weighted Average (AVG) %24 %24arrow_forwardAircard Corporation tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a periodic inventory system. The following are the transactions for the month of July. July 1 July 5 July 13 July 17 July 25 July 27 Beginning Inventory Sold Purchased Sold Purchased Sold Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold Units 2,000 1,000 6,000 S 3,000 8,000 5,000 $ Calculate the cost of goods available for sale, ending inventory, and cost of goods sold if Aircard uses (a) FIFO, (b) LIFO, or (c) weighted average cost. (Round "Cost per Unit" to 2 decimal places.) Unit Cost $ 45 47 Answer is complete but not entirely correct. LIFO Weighted Average Cost 764,000 194,250 147,000 FIFO 764,000 $ 343,000 421,000 $ 49 764,000 343,000 147,000arrow_forward

- Inventory Costing Methods and the Periodic MethodKay & Company experienced the following events in March: Date Event Units Unit Cost Total Cost Mar. 1 Purchased inventory 100 @ $16 $1,600 Mar. 3 Sold inventory 60 Mar. 15 Purchased inventory 100 @ 18 $1,800 Mar. 20 Sold inventory 40 If Kay & Company uses the weighted-average cost method, calculate the company’s cost of goods sold and ending inventory as of March 31 assuming the periodic method.(Round answer to two decimal places, if needed.) Weighted-average cost per unit Answer Cost of goods sold Answer Ending inventory Answerarrow_forwardMaxell Company uses the FIFO method to assign costs to inventory and cost of goods sold. The company uses a periodic inventory system. Consider the following information: Date Description # of units Cost per unit January 1 Beginning inventory 290 $ 4 June 2 Purchase 80 $ 3 November 5 Sales 310 What amounts would be reported as the cost of goods sold and ending inventory balances for the year? Multiple Choice Cost of goods sold $1,220; Ending inventory $180 Cost of goods sold $1,240; Ending inventory $140 Cost of goods sold $1,160; Ending inventory $240 Cost of goods sold $1,300; Ending inventory $210arrow_forwardRefer to the data in attached image. 1.Using the perpetual inventory system, compute the cost of ending inventory, cost of goods sold, and gross margin. Use the average-cost, FIFO, and LIFO inventory costing methods. (Round unit costs to the nearest cent.) 2.Explain the reasons for the differences in gross mar-gin produced by the three methods.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education