Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

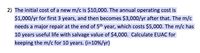

Transcribed Image Text:2) The initial cost of a new m/c is $10,000. The annual operating cost is

$1,000/yr for first 3 years, and then becomes $3,000/yr after that. The m/c

needs a major repair at the end of 5th year, which costs $5,000. The m/c has

10 years useful life with salvage value of $4,000. Calculate EUAC for

keeping the m/c for 10 years. (i=10%/yr)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A project that cost $72000 has a useful life of 5 years and a salvage value of $3000. The internal rate of return is 12% and the annual rate of return is 18%. The annual net income isarrow_forwardA construction company is evaluating two options for an elevator, each of which has a useful life in 10 years. Option 1 costs $45, 000 to install and $2700 annually, with a salvage value of $ 3000 in year 10. Option 1 also requires a significant overhaul in year 6 with a cost of $8, 000. Option 2 costs $54, 000, costs $2, 800 annually, and has a salvage value of $5000 in year 10. Annual interest is 4%, compounded monthly. Which option would you choose? Show your work.arrow_forwardA new project will cost $40,000 to fund today, and an additional $40,000 next year. The device built will generate revenues of $17,000 starting in year 2 which increases by 4% each year until the device is sold at the end of year 12. The device’s salvage value is $10,000. $2,000 of maintenance is required every year. What is the NPV of building this device, if the interest to borrow the funds is 15%? (Round to nearest dollar)arrow_forward

- An elective project is currently under review. It requires an initial investment of $116,000 for equipment. The profit is expected to be $28,000 each year, over the 6-year project period. The salvage value of the equipment at the end of the project period is projected to be $22,000. Assume a MARR of 10%. Find an IRR for this project.arrow_forwardA newly constructed water treatment facility costs $2 million. It is estimated that the facility will need revamping to maintain the original design specification every 30 years at a cost of $1 million. Annual repairs and maintenance costs are estimated to be $100,000. At an interest rate of 8%, determine the capitalized cost of the facility, assuming that it will be used for an indefinite period.arrow_forwardonsider the following financial informationabout a retooling project at a computer manufacturing company:• The project costs $2.5 million and has a five-yearservice life.• The retooling project can be classified as sevenyear property under the MACRS rule.• At the end of the fifth year, any assets held for theproject will be sold. The expected salvage valuewill be about 10% of the initial project cost.• The firm will finance 40% of the project moneyfrom an outside financial institution at an interestrate of 10%. The firm is required to repay the loanwith five equal annual payments.• The firm’s incremental (marginal) tax rate on theinvestment is 35%.• The firm’s MARR is 18%.With the preceding financial information,(a) Determine the after-tax cash flows.(b) Compute the annual equivalent worth for thisproject.arrow_forward

- A "standard" model of a dozer costs $20,000 and has an annual operating expense of $450. The dozer will be replaced in 6 years when the salvage value is expected to be $2,000. A "super" model can be purchased for $25,000, but will have a salvage value of $7,000 when retired in 6 years. Its operating expenses are also $450 a year. The purchaser's other investment opportunities are 5%. Compare these alternatives by using the annual equivalent method.arrow_forwardRussell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $194,000 and will require $29,400 in installation costs. It will be depreciated under MACRS using a 5-year recovery period Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% A $30,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a…arrow_forwardMargaret has a project with a $30560 first cost that returns $4320 per year over its 10-year life. It has a salvage value of $3000 at the end of 10 years. If the MARR is 5 percent, what is the payback period of this project if cash flow is continuous?arrow_forward

- Please show all your workarrow_forwardexpense of $500. Consider a yearly Two machines are evaluated for a new project, consider a yearly interest rate of 6% and the information described in the following table. Determine EUAC for both alternatives and determine the best option. Purchase cost Salvage value Duration Machine A Machine B $10,000 $15,000 $1,250 $1,950 5 years 10 years 11 13 Larrow_forwardCentral Mass Ambulance Service can purchase a new ambulance for $200,000 that will provide an annual net cash flow of $50,000 per year for five years. The salvage value of the ambulance will be $25,000. Assume the ambulance is sold at the end of year 5. Calculate the NPV of the ambulance if the required rate of return is 9%. (Round your answer to the nearest $1.) A) $(10,731) B) $10,731 C) $(5,517) D) $5,517arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education