Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:What is the firm's net profit margin?

O 16.67%

Ⓒ 15.53%

O 6.29%

O 7.72%

Ⓒ 14.98%

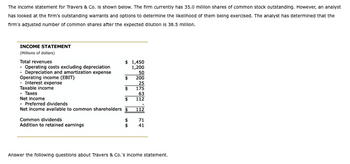

Transcribed Image Text:The Income statement for Travers & Co. is shown below. The firm currently has 35.0 million shares of common stock outstanding. However, an analyst

has looked at the firm's outstanding warrants and options to determine the likelihood of them being exercised. The analyst has determined that the

firm's adjusted number of common shares after the expected dilution is 38.5 million.

INCOME STATEMENT

(Millions of dollars)

Total revenues

- Operating costs excluding depreciation

- Depreciation and amortization expense

Operating income (EBIT)

- Interest expense

Taxable income

- Taxes

Net income

- Preferred dividends

Net income available to common shareholders

Common dividends

Addition to retained earnings

$

$

$

$

1,450

1,200

50

200

25

175

63

112

112

71

41

Answer the following questions about Travers & Co.'s Income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Based on the corporate valuation model, SG Telecom's total corporate value is $750 million. Its balance sheet shows $100 million notes payable, $200 million of long-term debt, $40 million of common stock, and $160 million of retained earnings, with a WACC of 10%. If the company has 24 million shares of stock outstanding, what is its price per share? Your answer should be between 5.03 and 58.72, rounded to 2 decimal places, with no special characters.arrow_forwardWhat is the net asset value of an investment company with $10,400,000 in assets, $590,000 in current liabilities, and 1,110,000 shares outstanding? Round your answer to the nearest cent. $ ..... per sharearrow_forwardA firm had the following financials last year: Sales Revenue = $3,060Accounts receivable = $500Interest expense = $126Total operating expenses = $600Accounts payable = $240Cost of goods sold = $1,800Dividend on preferred stock = $18Tax rate = 40% Number of outstanding number of common shares = 1,000 The E.P.S of the firm, rounded to four decimal places isarrow_forward

- #10!arrow_forwardEdelman engines has $18 million in total assets. It’s balance sheet shows $2 million in current liabilities $10 million in long term debt and $6 million in common equity. It has 300000 common shares outstanding and it’s stock price is $28.20 per share. What is edelmans market / book ratioarrow_forwardEnterprise Storage Company has 420,000 shares of cumulative preferred stock outstanding, which has a stated dividend of $5.75. It is six years in arrears in its dividend payments. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. How much in total dollars is the company behind in its payments? (Do not round intermediate calculations. Input your answer in dollars, not millions (e.g., $1,234,000).) Dividend in arrears b. The firm proposes to offer new common stock to the preferred stockholders to wipe out the deficit. The common stock will pay the following dividends over the next four years: D1 D2 D3 D4 $1.05 1.15 1.25 1.35 The company anticipates earnings per share after four years will be $4.07 with a P/E ratio of 14. The common stock will be valued as the present value of future dividends plus the present value of the future stock price after four years. The discount rate used by the investment banker is 11…arrow_forward

- McDonnell-Myer Corporation reported net income of $1,450 million. The company had 469 million common shares outstanding at January 1 and sold 42 million shares on February 28. As part of an annual share repurchase plan, 6 million shares were retired on April 30 for $32 per share. Calculate McDonnell-Myer's earnings per share for the year. (Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardEnterprise Storage Company has 450,000 shares of cumulative preferred stock outstanding, which has a stated dividend of $8.75. It is six years in arrears in its dividend payments. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.a. How much in total dollars is the company behind in its payments? (Do not round intermediate calculations. Input your answer in dollars, not millions (e.g., $1,234,000).) Dividend in arrears b. The firm proposes to offer new common stock to the preferred stockholders to wipe out the deficit. The common stock will pay the following dividends over the next four years: D1 $ 1.20 D2 1.30 D3 1.40 D4 1.50 The company anticipates earnings per share after four years will be $4.10 with a P/E ratio of 11.The common stock will be valued as the present value of future dividends plus the present value of the future stock price…arrow_forwardMarjorie Manufacturing's balance sheets report $250 million in total debt, $100 million in short-term investments, and $8 9 million in preferred stock. Marjorie has 13 million shares of common stock outstanding. A financial analyst estimated that Marjorie's value of operations is $900 million. What is the analyst's estimate of the intrinsic stock price per share?arrow_forward

- Lemmon Incorporated lists fixed assets of $100 on its balance sheet. The firm's fixed assets have recently been appraised at $140. The firm's balance sheet also lists current assets at $15. Current assets were appraised at $16.50. Current liabilities book and market values stand at $12 and the firm's long-term debt is $40. Calculate the market value of the firm's stockholders' equityarrow_forwardBased on the corporate valuation model, the value of Virtual Homes Co.'s operations is $1.15 billion. The company's balance sheet shows $50 million in accounts receivable, $77 million in inventory, and $215 million in cash and marketable securities. The balance sheet also shows $95 million in accounts payable, $165 million in notes payable, $470 million in long-term debt, $85 million in preferred stock, $281 million in retained earnings, and $705 million in total common equity. If Virtual Homes has 50 million shares of common stock and 10 million shares of preferred stock outstanding, what is the best estimate of the common stock's price per share? $12.90 O $64.50 $7.28 $15.44 $13.54arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education