Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

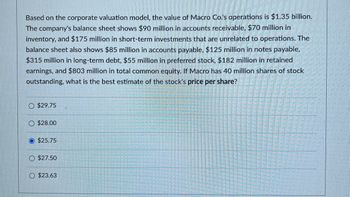

Transcribed Image Text:Based on the corporate valuation model, the value of Macro Co.'s operations is $1.35 billion.

The company's balance sheet shows $90 million in accounts receivable, $70 million in

inventory, and $175 million in short-term investments that are unrelated to operations. The

balance sheet also shows $85 million in accounts payable, $125 million in notes payable,

$315 million in long-term debt, $55 million in preferred stock, $182 million in retained

earnings, and $803 million in total common equity. If Macro has 40 million shares of stock

outstanding, what is the best estimate of the stock's price per share?

O $29.75

O $28.00

O $25.75

O $27.50

$23.63

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Based on the corporate valuation model, SG Telecom's total corporate value is $750 million. Its balance sheet shows $100 million notes payable, $200 million of long-term debt, $40 million of common stock, and $160 million of retained earnings, with a WACC of 10%. If the company has 24 million shares of stock outstanding, what is its price per share? Your answer should be between 5.03 and 58.72, rounded to 2 decimal places, with no special characters.arrow_forwardCell Enterprise Corporation reported $55 million of net income and $320 million of retained earnings in its financial statements. The previous retained earnings were $525 million. Determine the amount of dividend payments to shareholders.arrow_forwardEdelman engines has $18 million in total assets. It’s balance sheet shows $2 million in current liabilities $10 million in long term debt and $6 million in common equity. It has 300000 common shares outstanding and it’s stock price is $28.20 per share. What is edelmans market / book ratioarrow_forward

- The Jordan Company has net income of $73, 500, with sales of $3, 159, 155. Total assets are $560,000, total receivable are $84,000, and the debt - equity ratio is 0.65. What is Jordan's ROEarrow_forwardMarjorie Manufacturing's balance sheets report $250 million in total debt, $100 million in short-term investments, and $8 9 million in preferred stock. Marjorie has 13 million shares of common stock outstanding. A financial analyst estimated that Marjorie's value of operations is $900 million. What is the analyst's estimate of the intrinsic stock price per share?arrow_forwardEdelman Engines has $13 billion in total assets- of which cash and equivalents total $100 million. Its balance sheet shows $2.6 billion in current liabilities- of which the notes payable balance totals $1.03 billion. The firm also has $6.5 billion in long-term debt and $3.9 billion in common equity. It has 300 million shares of common stock outstanding, and its stock price is $25 per share. The firm's EBITDA totals $1.05 billion. Assume the firm's debt is priced at par, so the market value of its debt equals its book value. What are Edelman's market/book and its EV/EBITDA ratios? Do not round intermediate calculations. Round your answers to two decimal places. M/B: EV/EBITDA:arrow_forward

- Lemmon Incorporated lists fixed assets of $100 on its balance sheet. The firm's fixed assets have recently been appraised at $140. The firm's balance sheet also lists current assets at $15. Current assets were appraised at $16.50. Current liabilities book and market values stand at $12 and the firm's long-term debt is $40. Calculate the market value of the firm's stockholders' equityarrow_forwardThe balance sheet of Timken Inventory Ltd. has cash of $125 million, accounts receivable of $245 million, inventory of $160 million, and equipment worth $450 million. The company also has accounts payable of $ 120 million, notes payable of $280 million, and corporate bonds of $365 million. What is Timken's quick ratio?arrow_forwardBased on the corporate valuation model, the value of Virtual Homes Co.'s operations is $1.15 billion. The company's balance sheet shows $50 million in accounts receivable, $77 million in inventory, and $215 million in cash and marketable securities. The balance sheet also shows $95 million in accounts payable, $165 million in notes payable, $470 million in long-term debt, $85 million in preferred stock, $281 million in retained earnings, and $705 million in total common equity. If Virtual Homes has 50 million shares of common stock and 10 million shares of preferred stock outstanding, what is the best estimate of the common stock's price per share? $12.90 O $64.50 $7.28 $15.44 $13.54arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education