College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

What is the adjusted book balance?

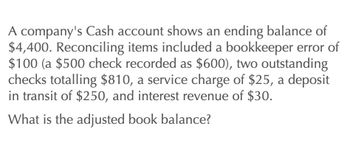

Transcribed Image Text:A company's Cash account shows an ending balance of

$4,400. Reconciling items included a bookkeeper error of

$100 (a $500 check recorded as $600), two outstanding

checks totalling $810, a service charge of $25, a deposit.

in transit of $250, and interest revenue of $30.

What is the adjusted book balance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Book Balance?arrow_forwardWhat is the adjusted book balance?arrow_forwardA company's Cash account shows an ending balance of $4,850. Reconciling items included a bookkeeper error of $125 (a $525 check recorded as $630), two outstanding checks totaling $810, a service charge of $28, a deposit in transit of $270, and interest revenue of $43. What is the adjusted book balance?arrow_forward

- CAn you please answer. General Accountarrow_forwardA company's Cash account shows an ending balance of $4,600. Reconciling items included a bookkeeper error of $105 (a $525 check recorded as $630), two outstanding checks totaling $810, a service charge of $20, a deposit in transit of $270, and interest revenue of $31. What is the adjusted book balance? A. $4,716 B. $4,060 C. $5,140 D. $ 4,484arrow_forwardWhat is the adjusted book balance???arrow_forward

- A company shows an ending balance of $790. The bank statement shows a $14 service charge and an NSF check for $150. A $280 deposit is in transit, and outstanding checks total $310. What is their adjusted cash balance?arrow_forwardThe following account balances come from the records of Ourso Company: Accounts receivable Allowance for doubtful accounts During the accounting period, Ourso recorded $11,850 of sales revenue on account. The company also wrote off a $194 account receivable. Required Beginning Balance Ending Balance $3,198 $3,549 134 203 a. Determine the amount of cash collected from receivables. b. Determine the amount of uncollectible accounts expense recognized during the period. a. Collections of accounts receivable b. Uncollectible accounts expensearrow_forwardThe following account balances come from the records of Ourso Company: Beginning Balance Ending Balance Accounts receivable Allowance for doubtful accounts $ 2,570 128 $ 3,414 187 During the accounting period, Ourso recorded $12,450 of sales revenue on account. The company also wrote off a $192 account receivable. Required: 1. Determine the amount of cash collected from receivables. 2. Determine the amount of uncollectible accounts expense recognized during the period. a. Collections of accounts receivable b. Uncollectible accounts expensearrow_forward

- The following account balances come from the records of Ourso Company. Accounts receivable Allowance for doubtful accounts Beginning Balance $ 3,141 Ending Balance $ 3,982 202 116 During the accounting period, Ourso recorded $12,300 of sales revenue on account. The company also wrote off a $123 account receivable. Required a. Determine the amount of cash collected from receivables. b. Determine the amount of uncollectible accounts expense recognized during the period. Complete this question by entering your answers in the tabs below. Required A Required B Determine the amount of cash collected from receivables. Collections of accounts receivablearrow_forwardA company received a bank statement with a balance of $6,100. Reconciling items included a bookkeeper error of $300—a $300 check recorded as $800—two outstanding checks totaling $830, a service charge of $20, a deposit in transit of $250, and interest revenue of $21. What is the adjusted bank balance? A. $5,220 B. $5,061 C. $5,520 D. $4,721arrow_forwardThe cash register tape for Oriole Industries reported sales of $27,662.00. Record the journal entry that would be necessary for each of the following situations. (a) Sales per cash register tape exceeds cash on hand by $45.00. (b) Cash on hand exceeds cash reported by cash register tape by $20.50. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, eg. 52.75.) No. Account Titles and Explanation Credit (b) Cash Cash Over and Short Sales Revenue Cash Sales Revenue Cash Over and Short Debitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,