ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Price Level (P)

Economy of Winterspring

879

Eo

ADO

4,516

estion Viewer

Real GDP (Y)

AS ASO

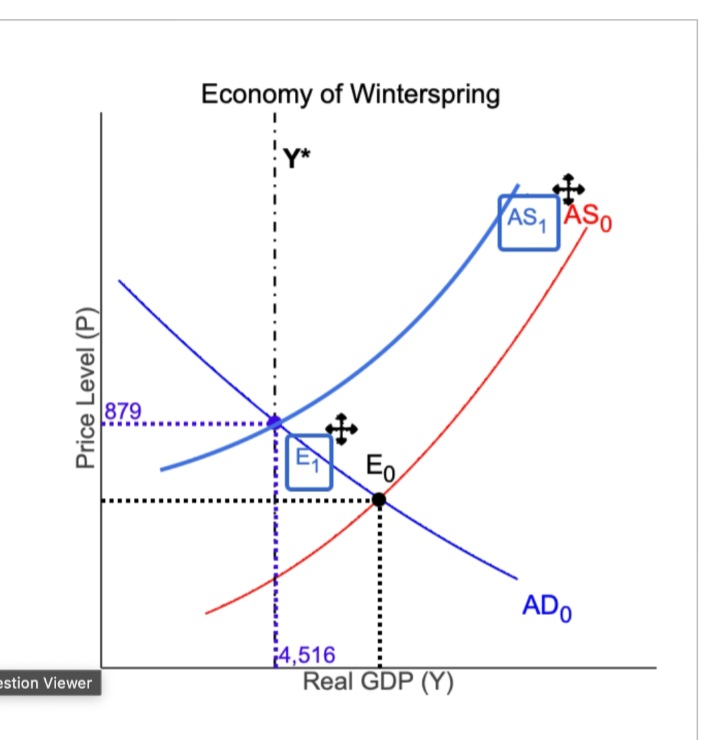

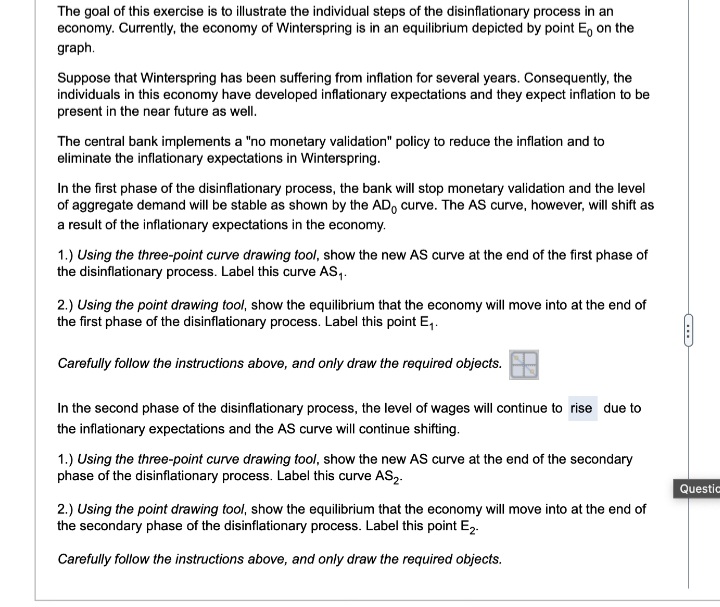

Transcribed Image Text:The goal of this exercise is to illustrate the individual steps of the disinflationary process in an

economy. Currently, the economy of Winterspring is in an equilibrium depicted by point Е on the

graph.

Suppose that Winterspring has been suffering from inflation for several years. Consequently, the

individuals in this economy have developed inflationary expectations and they expect inflation to be

present in the near future as well.

The central bank implements a "no monetary validation" policy to reduce the inflation and to

eliminate the inflationary expectations in Winterspring.

In the first phase of the disinflationary process, the bank will stop monetary validation and the level

of aggregate demand will be stable as shown by the AD curve. The AS curve, however, will shift as

a result of the inflationary expectations in the economy.

1.) Using the three-point curve drawing tool, show the new AS curve at the end of the first phase of

the disinflationary process. Label this curve AS₁.

2.) Using the point drawing tool, show the equilibrium that the economy will move into at the end of

the first phase of the disinflationary process. Label this point E₁.

Carefully follow the instructions above, and only draw the required objects.

In the second phase of the disinflationary process, the level of wages will continue to rise due to

the inflationary expectations and the AS curve will continue shifting.

1.) Using the three-point curve drawing tool, show the new AS curve at the end of the secondary

phase of the disinflationary process. Label this curve AS2.

Questio

2.) Using the point drawing tool, show the equilibrium that the economy will move into at the end of

the secondary phase of the disinflationary process. Label this point E2.

Carefully follow the instructions above, and only draw the required objects.

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer the given question with a proper explanation and step-by-step solution.arrow_forwardConsider the ASAD model of a closed economy with zero ongoing inflation and workers misperceptions. Firms are perfectly competitive, produce output with diminishing marginal returns to labour and have perfect foresight over the price level. Workers, instead, expect zero inflation in each period. At time zero, the economy is in the potential equilibrium. There is a negative shock on aggregate demand – for example, a permanent fall in desired autonomous consumption at time t = 1. What are the effects of the shock on the equilibrium real wage in the short and in the medium run?arrow_forwardLet’s see just how much high expected inflation can hurt incentives to save for the long run. Let’s assume the government takes about one‑third of every extra dollar of nominal interest you earn. You must pay taxes on nominal interest. However, if you are rational, you will care mostly about your real, after‑tax interest rate when deciding how much to save. ?i ??=?Eπ=π 23×?23×i (23×?)−?(23×i)−π Nominal interest rate Inflation (no surprises) Nominal after‑tax return Real after‑tax return 15% 12% 10% -2% 6% 3% 12% 9% 90% 87% 900% 897% Calculate the nominal and real after‑tax return for each case.Nominal interest rate = 6%, inflation = 3% Nominal after‑tax return: % Real after‑tax return: % Nominal interest rate = 12%, inflation = 9% Nominal after‑tax return: % Real after‑tax return: % Nominal interest rate = 90%, inflation = 87% Nominal after‑tax return: %…arrow_forward

- An economy has an unemployment rate of 11% and real GDP grows by 2.5% annually. A treasury official says next year's expected growth rate of 4% is ecpected to bring down the enemployment rate to 8% within one year. However, an economists disagrees as it is non consistent with macroeconomic research. -who is correct? the treasury official or the economist and why?arrow_forwardThe aggregate economy of India has a rate of money growth equal to 7. Initially the velocity of money is not changing. The long-run aggregate supply curve equals 2 But then there is a banking panic, causing the growth rate of the velocity of money to fall to -6 percent per year. In the absence of government intervention, the resulting recession would last for 3 years (meaning it would grow at the recession growth rate for 3 years, then return to long-run equilibrium after that). Assume that just before the recession started, India's level of GDP was equal to $100 billion. Your boss has proposed that the government should step in and use fiscal policy to end the recession immediately. But Raj Kumar, a member of the opposition, has claimed that fiscal policy is too expensive, and anyways there is no reason to end the recession because it will end on its own. To counter his argument, your boss has asked you to calculate how much lower GDP would be by the end of the recession if the…arrow_forwardConsider the following 3-equation model: Y 108-2rCB +2(G-T) (1) rCB =4+1.5(\pi-\pi)+0.5(Y-Y) (2) \pi \pie+0.5(YY) (3) wherey isoutput, \pi isinflation, \pi e =\pi = 2, andY* = 100. Expected future inflation is \pi e, and Y-Y⚫ is the output gap. The variable rCB is the interest rate set by the central bank. We may interpret \pi as the central bank's inflation target. Government ex- penditure, G, and net taxes, T, are given and set by the government. (a) Which equation is the IS curve, and which is the New Keynesian Phillips curve? Provide a brief economic explanation for the relationship between \pi and \pi e in Equation (3). (b) Find inflation, output and interest rates when G = T = 5. (c) Now suppose G = 8.5 and T = 5. How are inflation, output and interest rates affected? Is the impact of the fiscal expansion on output magnified or reduced by monetary policy? Explain.arrow_forward

- In a certain economy, the Dynamic Aggregate Supply (DAS) line is represented by the function = - π₁ = Ę ₁ = ₁ π + α ( Y₁ − Ÿ) + D and the inflation expectations formation mechanism is adaptive, that is, E₁+1 Absent a supply shock (v₁ = 0), in a figure representing period t inflation rate, π, on the vertical axis, and period t output, Y₁, on the horizontal axis, the period t DAS line will pass through the pair of points, : OA. (-1) B. (α, Y) ○ C. (Y) D. (πt, Yt)arrow_forwardGg.13.arrow_forwardSuppose gold (G) and silver (S) are substitutes for each other because both serve as hedges against inflation. Suppose also that the supplies of both are fixed in the short run and \{(:Q_{C}=300)\} and that the demands for gold and silver are given by the following equations: P_{G}=960-Q_{G}+0.50P_{S} and P_{S}=600-Q_{S}+0.50P_{G} What the the equilibrium prices of gold and silver? The equilibrium price of gold is S and the equilibrium price of silver is S Please explain and show work.arrow_forward

- 300 OA: B OB;B O C;D (1) OB:C D LM, LM₂ IS₂ IS₁ Y P3 P2 PL P Y3 Y2 (2) с AD₁ YI Y2 Y3 Refer to the figure above. If the economy is initially at point A in both panels, and the rate of inflation slows down, then the economy will be at point in panel 1 and point in panel 2. YI AD, AD₂ Yarrow_forwardtrue or false Suppose that the central bank lost credibility in the sense that people no longer believe its inflation target (that is, inflation expectations are not `anchored’). In this case, both short-run output and long-run output do not increase in response to a permanently higher inflation target.arrow_forwardYou work at the Central Bank and you are in charge of forecasting the effects of possible future shocks using the ASAD Redux model. Today, your task is to predict what will happen if the economy is subject to two consecutive shocks, namely, At time t = 1, there is a persistent positive shock on aggregate demand due to increased desired expenditures (e.g., a higher propensity to consume). At time t = 2, the Central Bank implements a permanent reduction in money supply. %3D The Central Bank wants you to forecast what will be the effects of a range of monetary contractions of different magnitude. Hence, you run six numerical simulations of the model assuming different sizes of the reduction in money supply. However, the software is faulty and some simulation results are wrong. Your computer produces six scenarios for employment (N) and price level (P), but some scenarios are clearly incorrect and inconsistent with the general predictions of the theoretical model: you need to eliminate the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education