FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

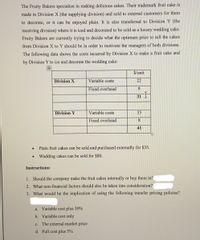

Transcribed Image Text:The Fruity Bakers specialize in making delicious cakes. Their trademark fruit cake is

made in Division X (the supplying division) and sold to external customers for them

to decorate, or it can be enjoyed plain. It is also transferred to Division Y (the

receiving division) where it is iced and decorated to be sold as a luxury wedding cake.

Fruity Bakers are currently trying to decide what the optimum price to sell the cakes

from Division X to Y should be in order to motivate the managers of both divisions.

The following data shows the costs incurred by Division X to make a fruit cake and

by Division Y to ice and decorate the wedding cake:

$/unit

Division X

Variable costs

22

Fixed overhead

9

31

Division Y

Variable costs

33

Fixed overhead

8.

41

Plain fruit cakes can be sold and purchased externally for $35.

Wedding cakes can be sold for $80.

Instructions:

1. Should the company make the fruit cakes internally or buy them in?

2. What non-financial factors should also be taken into consideration?

3. What would be the implication of using the following transfer pricing policies?

a. Variable cost plus 30%

b. Variable cost only

c. The external market price

d. Full cost plus 5%

Transcribed Image Text:Question 1: True / false

(A1)

1. Internal transfers should be preferred when there is an external market for the

transferred item because there will be more control over quality and delivery.

2. The transfer price will determine how profits will be shared between the two

divisions.

3. Residual income as a measure of performance enables fair comparisons to be

made between the performances of different divisions in the company.

4. When a transfer price is based on cost because there is no eternal market for the

transferred item, at least one of the divisional managers is likely to consider the

transfer price as 'unfair.

5. ROI is usually measured as divisional operating profit before deducting

depreciation as a percentage of the division's capital employed.

6. Residual income is calculated after deducting both depreciation on non-current

assets and notional interest on the division's capital employed.

7. Performance reports allow comparisons between actual performance and budget

expectations.

8. Residual income is the amount of profit left after subtracting expenses of a

particular investment center.

9. Like ROI, residual income is a performance measure displayed as a ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Cheyenne Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Cheyenne has decided to locate a new factory in the Panama City area. Cheyenne will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $615,000, useful life 28 years. Building B: Lease for 28 years with annual lease payments of $71,570 being made at the beginning of the year. Building C: Purchase for $659,900 cash. This building is larger than needed; however, the excess space can be sublet for 28 years at a net annual rental of $6,870. Rental payments will be received at the end of each year. The Cheyenne Inc. has no aversion to being a landlord. Show Transcribed Text In which building would you recommend that The Cheyenne Inc.…arrow_forwardUrarrow_forwardVishanuarrow_forward

- The cost of introducing the products in selected geographic areas for gauging consumer response is $150K. If the company decides to introduce the product this way, it would need to see the responses to the products before they decide to launch the product line nationally. The probability of a favorable response in the selected geographical areas is estimated at O.60. La Comida can also decide not to go for the launching in the product in selected geographical areas and go ahead with the nationwide launch or not. If La Comida Foods decides to go full-blast in launching the products nationally and are a success, the company estimates that they will gain an annual income of $1.6 million. If the products are not a hit, the company will realize losses to the tune of $700K. La Comida estimates the probability of success for the sauces and marinades to be 0.50, if these are introduced without gauging consumer response.arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Coat Pool Supporting direct labor Order processing Custom design processing Customer service Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-houra per glider Activity Rate $ 20 per direct labor-hour $ 198 per order $267 per custom design $ 420 per customer Selling price per glider Direct materials cost per glider The company's direct labor rate is $20 per hour. Customer margin Standard Model 14 2 0 27.50 $1,875 $ 472 Custom Design 2 2 2 34.00 $ 2,490 $586 Required: Using the company's…arrow_forwardLamothe Kitchen and Bath makes products for the home, which it sells through major retailers and remodeling (do-it-yourself, or DIY) outlets. One product that has had varying success is a ceiling fan for the kitchen. The fan comes in three sizes (36-Inch, 44-Inch, and 54-Inch), which are designed for various kitchen sizes and cooling requirements. The chief financial officer (CFO) at Lamothe has been looking at the segmented income statement for the fan and is concerned about the results for the 36-inch model. Revenues Variable costs Fixed costs allocated to products Operating profit (loss) 36 Inch $ 372,200 231,600 147,230 $ (6,630) If the 36-Inch model is dropped, the revenue associated with it would be lost and the related variable costs saved. In addition, the company's total fixed costs would be reduced by 25 percent. Required A Required B Required: a. Prepare a differential cost schedule to support your recommendation. b. Should Lamothe Kitchen and Bath should drop the 36-Inch…arrow_forward

- Wheels, Inc. manufactures bicycles sold through retail bicycle shops in the southeastern United States. The company has two salespeople that do more than just sell the products - they manage relationships with the bicycle shops to enable them to better meet consumers' needs. The company's sales reps visit the shops several times per year, often for hours at a time. The owner of Wheels is considering expanding to the rest of the country and would like to have distribution through 450 bicycle shops. To do so, however, the company would have to hire more salespeople. Each salesperson earns $30,000 plus 3 percent commission on all sales annually. Another alternative is to use the services of sales agents instead of its own sales force. Sales agents would be paid 6 percent of sales. Each sales call lasts approximately 3 hours, and each sales rep has approximately 675 hours per year to devote to customers. Wheels needs 6 salespeople if it has 450 bicycle shop accounts that need to be called…arrow_forwardCarmel Company has a frequent buyer program for its customers, where the customers can attain an "elite" level based on the number of orders and the total revenue of the orders. There are twoelite levels: Platinum and Titanium. The benefits of elite membership include discounts and access to special customer service representatives who can resolve problems. The company has one full time customer representative per 200 Titanium customers and one full-time customer representa tive per 2,000 Platinum customers. Customer representatives receive salaries plus bonuses of 2 percent of customer gross margin. Carmel spends 70 percent of its promotion costs on Titanium customers to encourage their loyaltyarrow_forwardBlue Corporation makes backpacks, with a specialty line for baseball players. This backpack has a spot for everything-helmet, spikes. glove, and bats-and it comes with a hook at the top that makes it easy to hang from a chain link fence in the dugout. The backpack division buys the hooks from-you guessed it-the hook division, which has enough capacity to meet both internal and external demand. At present, the hook and backpack divisions have agreed on a transfer price of $0.75 per hook. Current volumes, costs, and prices are listed below for each division for one month. The casts for the backpack division reflect all unit backpack costs, except for the hook. Variable cost per unit Absorption cost per unit Market price per unit Quantity produced Quantity sold externally Quantity sold internally (a) Hook Division * Your answer is incorrect. Gross margin $0,50 $0.75 $0.90 2,100 1,300 800 According to the information given, how much gross margin would each division report for one month?…arrow_forward

- McBurger, Inc., wants to redesign its kitchens to improve productivity and quality. Three designs, called designs K1, K2, and K3, are under consideration. No matter which design is used, daily production of sandwiches at a typical McBurger restaurant is for 500 sandwiches. A sandwich costs $1.50 to produce. Non-defective sandwiches sell, on the average, for $2.50 per sandwich. Defective sandwiches cannot be sold and are scrapped.The goal is to choose a design that maximizes the expected profit at a typical restaurant over a 300-day period. Designs K1, K2, and K3 cost $130,000 $150,000, and $170,000, respectively. Under design K1, there is a .80 chance that 90 out of each 100 sandwiches are non-defective and a .20 chance that 70 out of each 100 sandwiches are non-defective. Under design K2, there is a .85 chance that 90 out of each 100 sandwiches are non-defective and a .15 chance that 75 out of each 100 sandwiches are non-defective. Under design K3, there is a .90…arrow_forwardMilano Pizza is a small neighborhood pizzeria that has a small area for in-store dining as well as offering take-out and free home delivery services. The pizzeria's owner has determined that the shop has two major cost drivers-the number of pizzas sold and the number of deliveries made. The pizzeria's cost formulas appear below: Fixed Cost per Month Pizza ingredients Kitchen staff Utilities Delivery person Delivery vehicle Equipment depreciation Rent Miscellaneous Pizzas Deliveries Revenue Pizza ingredients Kitchen staff Utilities Delivery person Delivery vehicle Equipment depreciation Rent $ 5,910 $ 610 Miscellaneous $ 630 $ 400 $ 1,870 $ 730 In November, the pizzeria budgeted for 1,560 pizzas at an average selling price of $15 per pizza and for 220 deliveries. Data concerning the pizzeria's actual results in November appear below: Actual Results. 1,660 200 $ 25,450 $ 7,210 $ 5,850 $ 885 $ 620 $ 986 $ 400 Cost per Pizza $ 4.40 $ 1,870 $ 790 $ 0.30 Cost per Delivery $ 0.15 $ 3.10 $…arrow_forwardCompany XYZis specialized in producing and selling smart watches. The company currently has two products and is planning to improve it profits in the coming years. The company is thinking of introducing a sales commission to encourage its sales people to make more sales and improve company's profitability. When designing the sales commission the company should base the sales commission on The color of the product a O The contribution margin b O The number of employees.cO The selling price d O None of the given answers .e Oarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education