FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

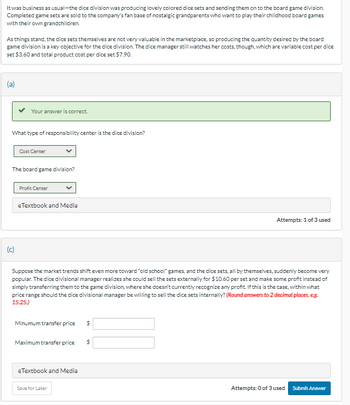

Transcribed Image Text:It was business as usual-the dice division was producing lovely colored dice sets and sending them on to the board game division.

Completed game sets are sold to the company's fan base of nostalgic grandparents who want to play their childhood board games

with their own grandchildren.

As things stand, the dice sets themselves are not very valuable in the marketplace, so producing the quantity desired by the board

game division is a key objective for the dice division. The dice manager still watches her costs, though, which are variable cost per dice

set $3.60 and total product cost per dice set $7.90.

Your answer is correct.

What type of responsibility center is the dice division?

(c)

Cost Center

The board game division?

Profit Center

eTextbook and Media

Suppose the market trends shift even more toward "old school" games, and the dice sets, all by themselves, suddenly become very

popular. The dice divisional manager realizes she could sell the sets externally for $10.60 per set and make some profit instead of

simply transferring them to the game division, where she doesn't currently recognize any profit. If this is the case, within what

price range should the dice divisional manager be willing to sell the dice sets internally? (Round answers to 2 decimal places, e.g.

15.25.)

Minumum transfer price $

Maximum transfer price

eTextbook and Media

Save for Later

Attempts: 1 of 3 used

$

Attempts: 0 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- TS Electronics is a manufacturer with two departments: computer chips and cell phones. The computer chip that is produced in the Chips Department can be sold to customers at $6.25 per chip. The costs associated with the computer chips are as follows: (Click the icon to view the computer chip costs.) The Cell Phone Department has been purchasing the chips that it needs for $4.00 per chip from Chip Universe, but the manager was thinking that if the Chips Department could supply the chips for less than what Chip Universe is asking, then it would arrange a transfer between departments instead of giving the business to an external company. If the Cell Phone Department needs 240,000 computer chips and current production in the Chips Department is 480,000 chips, should a transfer take place? If so, at what price? (Note: For internal transfers, the selling and administrative costs are reduced to $0.45 per unit.) What other qualitative factors might need to be considered? First, let's determine…arrow_forwardThe company president does not believe that the formula should be altered for fear it will tarnish the company’s brand. She prefers that the company become more efficient in manufacturing the product. If fixed manufacturing costs can be reduced by $250,000 and variable direct manufacturing labor costs are reduced by $1 per unit, will Westerly achieve its target cost?arrow_forwardVishanuarrow_forward

- Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing. Management has asked you to investigate the cost allocation problem. You find that manufacturing overhead is currently assigned to products based on their direct labor costs. For your investigation, you have data from last year. Manufacturing overhead was $1,237,000 based on production of 290,000 handheld consoles and 100,000 home consoles. Direct labor and direct materials costs were as follows. Handheld Home Total Direct labor $ 1,135,250 $ 411,000 $ 1,546,250 Materials 700,000 671,000 1,371,000…arrow_forwardBaird Chairs, Incorporated makes two types of chairs. Model Diamond is a high-end product designed for professional offices. Model Gold is an economical product designed for family use. Jane Silva, the president, is worried about cut-throat price competition in the chairs market. Her company suffered a loss last quarter, an unprecedented event in its history. The company's accountant prepared the following cost data for Ms. Silva: Direct Cost per Unit Direct materials Direct labor Category Unit level Batch level Product level Facility level Total Model Diamond (D) $19.50 per unit $ 19.10/hour x 2.00 hours production time Type of Product Estimated Cost $ 247,500 825,000 704,000 572,000 $ 2,348,500 a. Model Diamond a. Model Gold b. Model Diamond b. Model Gold Cost Driver Number of units. Number of setups Number of TV commercials Number of machine hours The market price for office chairs comparable to Model Diamond is $118 and to Model Gold is $75. Cost per Unit Model Gold (G) $9.90 per…arrow_forwardLamothe Solutions is a management consulting firm. Its Business Division advises firms on the adoption and use of financial systems. Civic Division consults with state and local governments. Civic Division has a client that is interested in implementing a new costing system in its public works department. The division's head approached the head of Business Division about using one of its associates. Corporate Division charges clients $815 per hour for associate services, the same rate other consulting companies charge. The Civic Division head complained that it could hire its own associate at an estimated variable cost of $415 per hour, which is what Business pays its associates. Required: a. What is the maximum price that Civic Division should pay? b. What is the maximum transfer price that Business Division should obtain for its services, assuming that it is operating at capacity? c-1. Is there any change in maximum price as indicated in part (a), if Business Division had idle…arrow_forward

- Speed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames…arrow_forwardEllie now had two offers to think about. Her initial reaction was to turn down the special request for 25,000 brochures at $10 per 100. Especially as she did not believe Tyco would realize any repeat or future business from the customer. She also needed to understand her costs versus the cost offered by the small shop to increase Tyco's printing capacity by outsourcing. Should she tell the small shop about the special order request and let them work it out themselves? They might both get what they needed.arrow_forwardRace Cars, Inc., produces model cars made from aluminum. It operates two production departments, Molding and Painting, and has three service departments, Administration, Accounting, and Maintenance. The accumulated costs in the three service departments were $250,000, $400,000 and $200,000, respectively. Management is concerned that the costs of its service departments are getting too high. In particular, managers would like to keep the costs of service departments under $3.50 per unit on average. You have been asked to allocate service department costs to the two production departments and compute the unit costs. The company decided that Administration costs should be allocated on the basis of square footage used by each production and service department. Accounting costs are allocated on the basis of number of employees. Maintenance cost are allocated on the basis of the dollar value of the equipment in each department. The use of each base by all departments during the current…arrow_forward

- Mary Jones and Jack Smart have joined forces to start M&J Food Products, a processor of packaged shredded lettuce for institutional use. Jack has years of food processing experience, and Mary has extensive commercial food preparation experience. The process will consist of opening crates of lettuce and then sorting, washing, slicing, preserving, and finally packaging the prepared lettuce. Together, with help from vendors, they think they can adequately estimate demand, fixed costs, revenues, and variable cost per 5-pound bag of lettuce. They think a largely manual process will have monthly fixed cost of $50,000 and a variable cost of $2.50 per bag. They expect to sell 75,000 bags of lettuce per month. They expect to sell the shredded lettuce for $3.25 per 5-pound bag. Jack and Mary has been contacted by a vendor to consider a more mechanized process. This new process will have monthly fixed cost of $125,000 per month with a variable cost of $1.75 per bag. Based on the above…arrow_forwardCHS is a large multidivision firm. One division, Health Services, is well known Inside CHS for its efficient Information technology (IT). A smaller division, Optics, has approached Health Services with a proposal that it provide IT support in the form of machine time for some of Optics's billing and administrative work. After an analysis of the demands that Optics would place on the system, the IT manager of Health Services notes that Health Services would have to lease a new server because of the additional load. The lease rates for the current server are a fixed annual lease of $3,280 and it averages machine time of 2,900 hours annually. The new server leases for an annual rate of $5,040. Because the new server is a faster machine, Health Services can complete its current requirements In only 2,040 hours. The work for Optics is estimated to be 1,110 hours. In addition to leasing a new server, there are two other changes Health Services would have to make in IT. First, it will have to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education