FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

If you were the manager of Kardash Cosmetics, would you continue to process the petal residue into Romance perfume? Explain your answer.

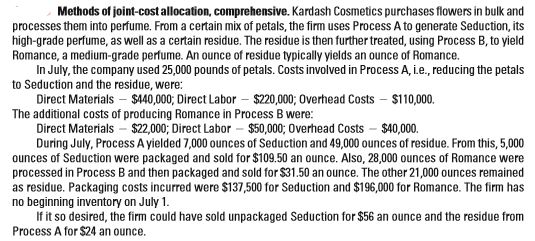

Transcribed Image Text:Methods of joint-cost allocation, comprehensive. Kardash Cosmetics purchases flowers in bulk and

processes them into perfume. From a certain mix of petals, the firm uses Process A to generate Seduction, its

high-grade perfume, as well as a certain residue. The residue is then further treated, using Process B, to yield

Romance, a medium-grade perfume. An ounce of residue typically yields an ounce of Romance.

In July, the company used 25,000 pounds of petals. Costs involved in Process A, i.e., reducing the petals

to Seduction and the residue, were:

Direct Materials – $440,000; Direct Labor – $220,000; Overhead Costs – $110,000.

The additional costs of producing Romance in Process B were:

Direct Materials - $22,000; Direct Labor – $50,000; Overhead Costs - $40,000.

During July, Process A yielded 7,000 ounces of Seduction and 49,000 ounces of residue. From this, 5,000

ounces of Seduction were packaged and sold for $109.50 an ounce. Also, 28,000 ounces of Romance were

processed in Process B and then packaged and sold for $31.50 an ounce. The other 21,000 ounces remained

as residue. Packaging costs incurred were $137,500 for Seduction and $196,000 for Romance. The firm has

no beginning inventory on July 1.

If it so desired, the firm could have sold unpackaged Seduction for $56 an ounce and the residue from

Process A for $24 an ounce.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ten items that may or may not be involved in the bank reconciliation process for April are listed in the table shown below:Complete the table shown below, identifying where each item should be included on a bank reconciliation prepared for the month of April. Indicate whether the item should be added to, or deducted from, the bank or the books. If the item should not be included in the bank reconciliation, indicate “Not Applicable” in each of the bank and books column. In addition, if an item only affects the bank, insert Not Applicable in the books column. Likewise, if it only affects the books, insert Not Applicable in the bank column. Finally, indicate whether the item will require a journal entry on the company books by indicating “yes” or “no” in the last column. Item Bank Books AdjustingEntry Required 1. Deposits in transit at the end of April select an option Deduct from BankNot ApplicableAdd to…arrow_forwardAdvertising a new health beverage is an example of a product-level activity. Select one: O True O Falsearrow_forwardHello, can you please help me with this question? Only part of the question fits in the screen snip I took so I have copied and pasted the data from the question and what it is asking for. Thanks! Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting Department, where carpet backing is added at the beginning of the process and the process is completed. On January 1, Port Ormond Carpet Company had the following inventories: Finished Goods $62,000 Work in Process-Spinning Department 35,000 Work in Process-Tufting Department 28,500 Materials 17,000 Departmental accounts are maintained for factory overhead, and both have zero balances on January 1. Manufacturing operations for January are summarized as follows: Jan. 1 Materials purchased on account, $500,000 2 Materials requisitioned for use: Fiber—Spinning…arrow_forward

- Aaron is a cost accountant for Majik Systems Inc. Martin the VP of marketing has asked Aaron to meet with the represenatives of Majik Systems major competitor to discuss product cost data. Martin indicates that the sharing of data will enable Majik Systems to determin a fair and equitable price for its products. Would it be ethical for Aaron to attend the meeting and share the relevant cost data? Why or Why not?arrow_forwardHow can you provide recommendations to improve efficiency in a parts store?arrow_forwardkkk. 2arrow_forward

- decide if task costing or process costing would be a more suitable method of accounting It's a nursing home, obviously. Landscaping services are provided byarrow_forwarddetermine whether job costing or process costing would be more appropriate. *.A custom furniture manufacturer *.A tire manufacturerarrow_forwardWhich of the following activities would be classified as a batch -level activity a. Training employees . b . Designing a new product . c. None of the given answer . d . Setting up equipment .arrow_forward

- Describe a merchandising company, and give an example.arrow_forwardWhat are the major differences between job-order costing and process costing systems? Give an example of a well-known company that might use job costing, and an example of a well-known company that might use process costing. Explain why you have chosen the companies that you did, and do not choose companies upon which your classmates have already commented. Participate in follow-up discussion by commenting on your classmates’ choices of companies.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education