Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 5CE

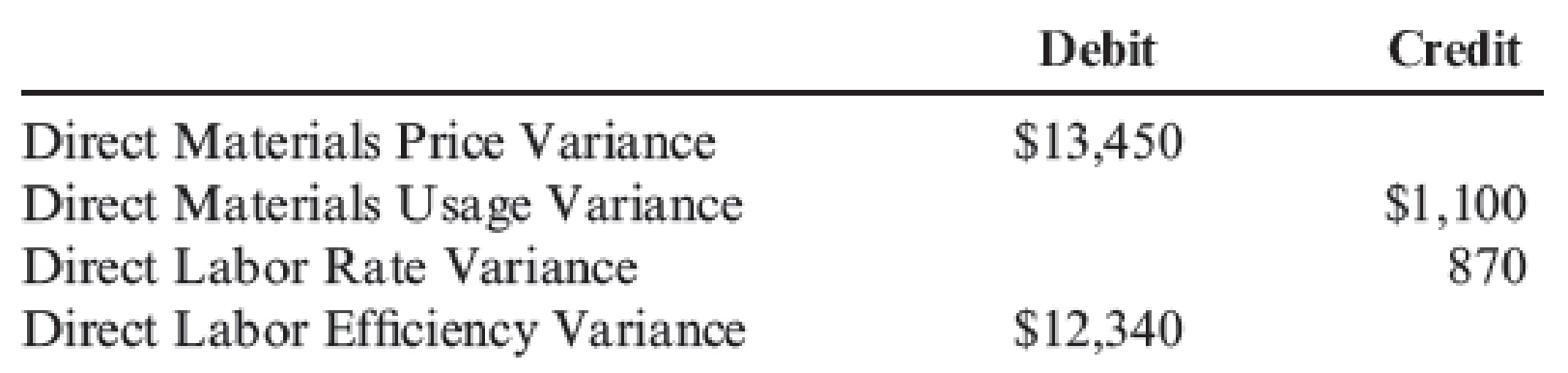

Yohan Company has the following balances in its direct materials and direct labor variance accounts at year-end:

Unadjusted Cost of Goods Sold equals $1,500,000, unadjusted Work in Process equals $236,000, and unadjusted Finished Goods equals $180,000.

Required:

- 1. Assume that the ending balances in the variance accounts are immaterial and prepare the

journal entries to close them to Cost of Goods Sold. What is the adjusted balance in Cost of Goods Sold after closing out the variances? - 2. What if any ending balance in a variance account that exceeds $10,000 is considered material? Close the immaterial variance accounts to Cost of Goods Sold and prorate the material variances among Cost of Goods Sold, Work in Process, and Finished Goods on the basis of prime costs in these accounts. The prime cost in Cost of Goods Sold is $1,050,000, the prime cost in Work in Process is $165,200, and the prime cost in Finished Goods is $126,000. What are the adjusted balances in Work in Process, Finished Goods, and Cost of Goods Sold after closing out all variances? (Round ratios to four significant digits. Round journal entries to the nearest dollar.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the effective rate of interest on these financial accounting question?

Provide solution step by step

Not use ai solution provided answer general Accounting

Chapter 9 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 9 - Discuss the difference between budgets and...Ch. 9 - What is the quantity decision? The pricing...Ch. 9 - Why is historical experience often a poor basis...Ch. 9 - Prob. 4DQCh. 9 - How does standard costing improve the control...Ch. 9 - The budget variance for variable production costs...Ch. 9 - Explain why the direct materials price variance is...Ch. 9 - The direct materials usage variance is always the...Ch. 9 - The direct labor rate variance is never...Ch. 9 - Prob. 10DQ

Ch. 9 - Prob. 11DQCh. 9 - What is the cause of an unfavorable volume...Ch. 9 - Prob. 13DQCh. 9 - Explain how the two-, three-, and four-variance...Ch. 9 - Prob. 15DQCh. 9 - Prob. 1CECh. 9 - Direct Materials Usage Variance Refer to...Ch. 9 - Refer to Cornerstone Exercise 9.1. Guillermos Oil...Ch. 9 - Kavallia Company set a standard cost for one item...Ch. 9 - Yohan Company has the following balances in its...Ch. 9 - Standish Company manufactures consumer products...Ch. 9 - Variances Refer to Cornerstone Exercise 9.6....Ch. 9 - Standish Company manufactures consumer products...Ch. 9 - Mangia Pizza Company makes frozen pizzas that are...Ch. 9 - Mangia Pizza Company makes frozen pizzas that are...Ch. 9 - Refer to Cornerstone Exercise 9.9. Required: 1....Ch. 9 - Quincy Farms is a producer of items made from farm...Ch. 9 - During the year, Dorner Company produced 280,000...Ch. 9 - Zoller Company produces a dark chocolate candy...Ch. 9 - Oerstman, Inc., uses a standard costing system and...Ch. 9 - Refer to the data in Exercise 9.15. Required: 1....Ch. 9 - Chypre, Inc., produces a cologne mist using a...Ch. 9 - Refer to Exercise 9.17. Chypre, Inc., purchased...Ch. 9 - Delano Company uses two types of direct labor for...Ch. 9 - Jameson Company produces paper towels. The company...Ch. 9 - Madison Company uses the following rule to...Ch. 9 - Laughlin, Inc., uses a standard costing system....Ch. 9 - Responsibility for the materials price variance...Ch. 9 - Which of the following is true concerning labor...Ch. 9 - A company uses a standard costing system. At the...Ch. 9 - Relevant information for direct labor is as...Ch. 9 - Which of the following is the most likely...Ch. 9 - Haversham Corporation produces dress shirts. The...Ch. 9 - Plimpton Company produces countertop ovens....Ch. 9 - Algers Company produces dry fertilizer. At the...Ch. 9 - Misterio Company uses a standard costing system....Ch. 9 - Petrillo Company produces engine parts for large...Ch. 9 - Business Specialty, Inc., manufactures two...Ch. 9 - Vet-Pro, Inc., produces a veterinary grade...Ch. 9 - Refer to the data in Problem 9.34. Vet-Pro, Inc.,...Ch. 9 - Energy Products Company produces a gasoline...Ch. 9 - Nuevo Company produces a single product. Nuevo...Ch. 9 - Ingles Company manufactures external hard drives....Ch. 9 - As part of its cost control program, Tracer...Ch. 9 - Aspen Medical Laboratory performs comprehensive...Ch. 9 - Leather Works is a family-owned maker of leather...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General accounting questionarrow_forward?arrow_forwardWW Office Solutions implemented a new supply requisition system. Departments must submit requests by Thursday for next week, maintain minimum 20% buffer stock, and obtain supervisor approval for urgent orders. From 85 total requisitions last month, 65 followed timeline, 72 maintained proper buffer, and 58 met both conditions. What is the compliance rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY