FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

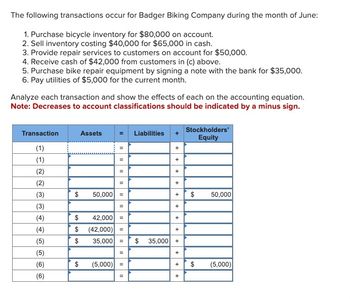

Transcribed Image Text:The following transactions occur for Badger Biking Company during the month of June:

1. Purchase bicycle inventory for $80,000 on account.

2. Sell inventory costing $40,000 for $65,000 in cash.

3. Provide repair services to customers on account for $50,000.

4. Receive cash of $42,000 from customers in (c) above.

5. Purchase bike repair equipment by signing a note with the bank for $35,000.

6. Pay utilities of $5,000 for the current month.

Analyze each transaction and show the effects of each on the accounting equation.

Note: Decreases to account classifications should be indicated by a minus sign.

Transaction

(1)

(1)

(2)

(2)

(3)

(3)

(4)

(4)

(5)

(5)

(6)

(6)

Assets

11

$

11

11

=

$ 50,000 =

=

42,000 =

$ (42,000) =

$

35,000 =

=

(5,000) =

=

II

Liabilities

$

35,000

+

+

+

+

+

+

+

+

+

+

+

Stockholders'

Equity

$ 50,000

$ (5,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue, Inc., sells playground equipment to schools and municipalities. It mails invoices at the end of each month for all goods shipped during that month; credit terms are net 30 days. Sales and accounts receivable data for 20X1, 20X2, and 20X3 follow: Years Ending December 31, 20X1 20X2 20X3 Sales $ 1,785,980 $ 1,839,559 $ 1,986,724 Accounts receivable at year-end 220,189 227,896 267,094 Required: Calculate the rates of increase in sales and in receivables during 20X2 and 20X3. (Do not round intermediate calculations. Round "Sales grew" answers to the nearest whole percent and "Receivables grew" answers to 1 decimal place.) Do your calculations indicate any potential problems with Blue’s receivables?arrow_forwardGrocery Outlet (*sings* Bargain Market….totally stuck in your head now) had cash sales of $598,000 during the month of August. Sales taxes of 6.5% were collected on the sales. Prepare a journal entry to record the sales revenue and sales tax for the month. Account name Debit Creditarrow_forwardRecord the following purchase transactions of Money Office Supplies. Aug. 3 Purchased 30 chairs on credit, at a cost of $60 per chair. Shipping charges are an extra $5 cash per chair and are not subject to discount. Terms of the purchase are 4/10, n/60, FOB Shipping Point, invoice dated August 3. Aug. 7 Purchased 22 chairs with cash, at a cost of $50 per chair. Shipping charges are an extra $3.50 cash per chair and are not subject to discount. Terms of the purchase are FOB Destination. Aug. 12 Money Office Supplies pays in full for their purchase on August 3. If an amount box does not require an entry, leave it blank. Assume the perpetual inventory system is used. Aug. 3 Purchase Merchandise Inventory Merchandise Inventory Accounts Payable Accounts Payable Aug. 3 Shipping charges Merchandise Inventory Merchandise Inventory Cash Cash Aug. 7 Purchase with cash Merchandise Inventory Merchandise Inventory Cash Cash Aug. 12…arrow_forward

- Please answer the question correctly. Thank you.arrow_forwardCollins Book Distributors distributes books to retail stores and extends credit terms of 2/10, n/30 to all its customers. During the month of June, the following merchandising transactions occurred: June Purchased 170 books on account for $6 each from Alpha Publishers, terms 3/10, n/30. 6 Received $60 credit for 10 books returned to Alpha Publishers. 6. Paid Alpha Publishers for balance due. 17 Sold 140 books on account to Cozy Bookstore for $11 each. 24 Received payment in full from Cozy Bookstore. 28 Sold 10 books on account to Ivy Bookstore for $11 each. 30 Granted Ivy Bookstore $22 credit for 2 books returned total cost was $12. Journalize the transactions for the month of June for Collins Book Distributors, using a perpetual inventory system. Assume the purchase cost of each book sold was $6.arrow_forwardShow the entry to be made by Cooley Grocery Store for the March 25 cash register reading showing sales of $10,000 and sales taxes of $600. Mar. 25 Cash Analyze, Journalize and Report Current Liabilities 10,600 Sales Revenue Sales Taxes Payable (To record daily sales and sales taxes) When the taxes are remitted to the state taxing agency the Sales Taxes Payable account is decreased (debited) and Cash is decreased (credited). Describe unearned entry when the prepayment is received (before revenue is earned) Describe entry when the revenue is earned. 10,000 600arrow_forward

- Based on the scenario below complete: (i) any five journal entries, & (ii) draw up T- accounts and post the entries appropriately. A. July 1: Your friend has started a bike parts business by depositing Tk. 45 lac in Prime Bank. B. Aug 14: The company buys parts worth Tk. 12 lacs 50% on credit and 50% by cash. C. Sep 6: The company sells merchandise worth Tk. 330,000 on credit. D. Oct 5: The company receives Tk. 299,000 from customers. E. Oct 31: The company recognizes it has to pay Tk. 13,500 to DESCO in the following month for electricity consumed during October. F. Nov 1: The company paid two months' rent in advance, Tk. 50,000, by giving a cheque on Prime Bank.arrow_forwardA business maintains a petty cash book with an imprest of $50, which is restored on the first day of each month. On 31 March, there was $13.40 in the petty cash box and vouchers totalling $36.60. How much did the petty cashier receive from the chief cashier on 1 April? A $13.40 B $23.20 C $36.60 D $50arrow_forwardBranch purchased 160,000 worth of merchandise for 50% cash and balance on account.Delivery charge of 3,000 paid by the branch. Requirements:a. Prepare the journal entries for both the Home Office and Branch books based on theabove transactions.arrow_forward

- The following transactions were selected from among those completed by Bennett Retallers in November and December: November 20 November 25 Sold 20 items of merchandise to Customer 8 at an invoice price of $6,400 (total); terms 2/10, n/30. Sold two items of merchandise to Customer C, who charged the $700 (total) sales price on her Visa credit card. Visa charges Bennett Retailers a 1 percent credit card fee. Sold 10 identical items of merchandise to Customer D at an invoice price of $9,600 (total); terms 2/10, n/38. Customer D returned one of the items purchased on the 28th; the item was defective and credit was given to the customer. December 6 Customer D paid the account balance in full. December 20 Customer 8 paid in full for the invoice of November 20. November 28 November 29 Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31. Note: Do not round your…arrow_forward16. Joseph Howard owns a bicycle parts business called Quality Bike Products. The following transactions took place during July the current year. July 5 Purchased merchandise on account from Wheeler Warehouse, $3,300. 8 Paid freight charge on merchandise purchased, $330. 12 Sold merchandise on account to Big Time Spoiler, $4,500. The merchandise cost $2,500. 15 Received a credit memo from Wheeler Warehouse for merchandise, $470. Required: 1. Journalize the above transactions in a general journal using the periodic inventory method. 2. Journalize the above transactions in a general journal using the perpetual inventory method. GENERAL JOURNAL (Periodic Inventory Method) Page 1 Post Date Description Ref. Debit Creditarrow_forwardLim Auto Parts, a family-owned auto parts store, began January with $10,000 cash. Management fo that collections from credit customers will be $11,600 in January and $15,300 in February. The stor scheduled to receive $8,500 cash on a business note receivable in January. Projected cash payme include inventory purchases ($16,700 in January and $13,300 in February) and selling and adminis expenses ($2,900 each month). (Click the icon to view additional information about Lim Auto Parts.) Read the requirements. More info Lim Auto Parts' bank requires a $10,000 minimum balance in the store's checking account. At the end of any month when the account balance falls below $10,000, the bank automatically extends credit to the store in multiples of $1,000. Lim Auto Parts borrows as little as possible and pays back loans in quarterly installments of $2,000, plus 3% APR interest on the entire unpaid principal. The first payment occurs three months after the loan. Requirements 4 1. Prepare Lim Auto…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education