FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

The following is a summary of transactions for January 20xx, gathered by the Sample Cafe bookkeeper and Use the preceding transaction information to create a Cash-Based Income Statement for January using the following template.

Transcribed Image Text:Item

Notes

8,700 medium cups of coffee sold at

$3.00 each

Includes 600 medium cups medium cups sold to the college and delivered to a reception that has been

invoiced, but not yet paid.

3,900 large cups of coffee sold at $4.00

each

Espresso maker purchased last year for

$12,600

5-year life

$600 premium for business insurance

Premium for full year

$3,300 for rent

Includes $2,100 in rent deposits.

$2,500 for coffee beans

Includes coffee discarded valued at $100

$1,600 for coffee cups

O cups in inventory at the beginning of January. $700 worth of cups still in inventory at the end of month.

$15,300 to employees for payroll

$2,200 owed in payroll taxes

$200 of interest on loan

Paid mid-month

$1,000 for electricity and water

Includes $500 in utility deposits

$10,800 in advertising

$2,700 per week billed monthly

Use the preceding transaction information to create a Cash-Based Income Statement for January using the following template.

Account

Balance

Revenues

$ 0

Expenses

Coffee and Cups

$ 0

Salaries and Wages

$ 0

Rent and Utilities

$ 0

Advertising

$ 0

Insurance

$ 0

Equipment

$ 0

Interest

$ 0

Other Expenses

$ 0

Total Expenses

$ 0

Net Income

$ 0

O O O O O O O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

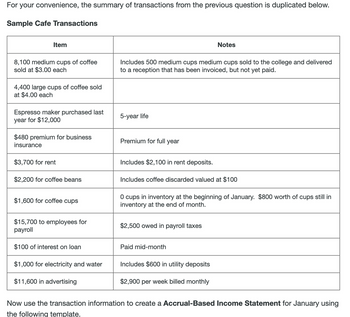

Transcribed Image Text:For your convenience, the summary of transactions from the previous question is duplicated below.

Sample Cafe Transactions

Item

8,100 medium cups of coffee

sold at $3.00 each

4,400 large cups of coffee sold

at $4.00 each

Espresso maker purchased last

year for $12,000

$480 premium for business

insurance

$3,700 for rent

$2,200 for coffee beans

$1,600 for coffee cups

$15,700 to employees for

payroll

$100 of interest on loan

$1,000 for electricity and water

$11,600 in advertising

Includes 500 medium cups medium cups sold to the college and delivered

to a reception that has been invoiced, but not yet paid.

5-year life

Premium for full year

Includes $2,100 in rent deposits.

Includes coffee discarded valued at $100

Notes

0 cups in inventory at the beginning of January. $800 worth of cups still in

inventory at the end of month.

$2,500 owed in payroll taxes

Paid mid-month

Includes $600 in utility deposits

$2,900 per week billed monthly

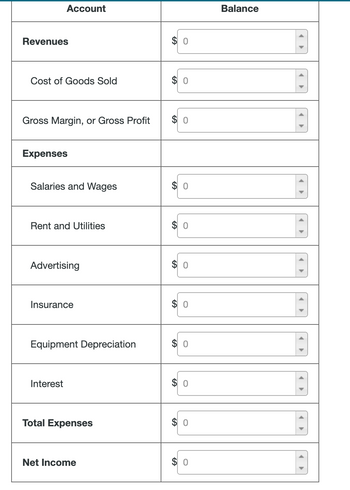

Now use the transaction information to create a Accrual-Based Income Statement for January using

the following template.

Transcribed Image Text:Account

Revenues

Cost of Goods Sold

Gross Margin, or Gross Profit

Expenses

Salaries and Wages

Rent and Utilities

Advertising

Insurance

Equipment Depreciation

Interest

Total Expenses

Net Income

$0

$0

$0

GA

GA

0

0

GA

O

0

$0

$0

0

$0

Balance

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

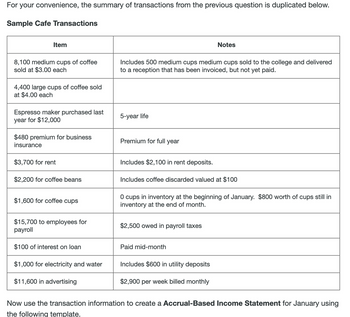

Transcribed Image Text:For your convenience, the summary of transactions from the previous question is duplicated below.

Sample Cafe Transactions

Item

8,100 medium cups of coffee

sold at $3.00 each

4,400 large cups of coffee sold

at $4.00 each

Espresso maker purchased last

year for $12,000

$480 premium for business

insurance

$3,700 for rent

$2,200 for coffee beans

$1,600 for coffee cups

$15,700 to employees for

payroll

$100 of interest on loan

$1,000 for electricity and water

$11,600 in advertising

Includes 500 medium cups medium cups sold to the college and delivered

to a reception that has been invoiced, but not yet paid.

5-year life

Premium for full year

Includes $2,100 in rent deposits.

Includes coffee discarded valued at $100

Notes

0 cups in inventory at the beginning of January. $800 worth of cups still in

inventory at the end of month.

$2,500 owed in payroll taxes

Paid mid-month

Includes $600 in utility deposits

$2,900 per week billed monthly

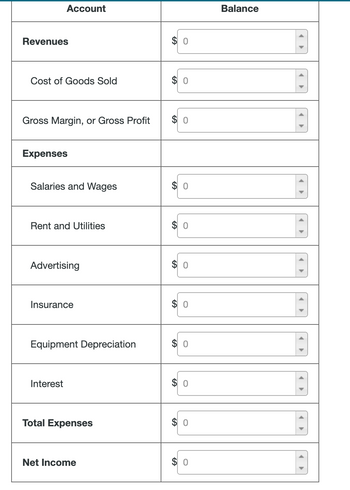

Now use the transaction information to create a Accrual-Based Income Statement for January using

the following template.

Transcribed Image Text:Account

Revenues

Cost of Goods Sold

Gross Margin, or Gross Profit

Expenses

Salaries and Wages

Rent and Utilities

Advertising

Insurance

Equipment Depreciation

Interest

Total Expenses

Net Income

$0

$0

$0

GA

GA

0

0

GA

O

0

$0

$0

0

$0

Balance

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can I get some help on this table, thank you!arrow_forwardA company's Cash account shows a balance of $3,460 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as bank service fees ($50), an NSF check from a customer ($370), a customer's note receivable collected by the bank ($1,600), and interest earned ($130). Required: Record the necessary entry(ies) to adjust the company's balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the items that increase cash. 2 Note: Enter debits before credits. Transaction Record entry General Journal Clear entry Debit Credit View general Journalarrow_forwardSunrise Coffee Shop, in an effort to streamline its accounting system, has decided to utilize a cash receipts journal. Record the following transactions for the first two weeks in March, total the columns, and include the posting references. A partial chart of accounts is given below. After recording the transactions, indicate if there are any additional columns you would add to this journal. March 1 Cash received for beverages, $375. Cash received for food, $250. Cash received for customer sales of Sunrise's signature coffee mugs, $130. Cash received for beverages, $480. Cash received for food, $325. Cash received for customer sales of Sunrise's signature coffee mugs, $115. 10 Cash received on account from Central.com, $900. Chart of Accounts (Partial) 10 Cash 41 Beverage Revenue 12 Accounts Receivable 42 Food Revenue 15 Retail Items 43 Retail Revenue MacBook Air DII 80 F10 F11 F12 esc F6 F7 F8 F9 F1 F2 F3 F4 F5 23 & 3 4 5 8 тarrow_forward

- The following is information related to Blossom Company for its first month of operations. Jan, 7- 15 23 Credit Sales Austin Co. Diaz Co. Noble Co. $11,800 7,300 11,100 Balance of Accounts Receivable Jan. 17 24 Austin Co. 29 Cash Collections Austin Co. Diaz Co. Noble Co. $7,900 4,900 Identify the balances that appear in the accounts receivable subsidiary ledger and the accounts receivable balance that appears in the general ledger at the end of January. 11.100 Subsidary Ledger Diaz Co, $ Noble Co. General Ledarrow_forwardPrepare journal entries for the following transactions, using the accounts in the order listed: PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the transactions. On June 1, Kellie Company had decided to initiate a petty cash fund in the amount of $1,200. DR CR On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. DR DR DR DR DR DR or CR? CR On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $80. DR DR DR DR DR DR or CR?…arrow_forward1.Journalize and post transactions on account to the cash payments j ournal 2.Complete the petty cash report by classifying each expense to compute the actual cash on hand. 3.Print the cash paymentsjournal and petty cash report. The cash paymentsjournal and a petty cash report for Electronic Source are given in the Worlting Papers. Instructions: Use page 9 of a cash payments journa l tojourna lize the following transactions completed during September of the cun-ent year.Source documents are abbreviated as follows check,C;purchase invoice,P.Save your work to complete Problem 9-S. Transactions: Sept 2.Paid cash for advertising, $125.00.C388. 5.Paid cash on account to Henson Audio, $2,489.00, covering P346,less 2% discount. C389. 8.Paid cash for heating bill, $240.00.C390 . 10.Paid cash on account to Peterson Electronics,$3,484.00 covering P349,less 2% discount.C391. 12.Paid cash for office supplies,$43.00.C392$. 15.Paid cash to KLP Mfg.for merchandise with a list…arrow_forward

- Please step by step answer.arrow_forwardThe cash register tape for Marin Industries reported sales of $10,307.20. Record the journal entry that would be necessary for each of the following situations. a) Sales per cash register tape exceeds cash on hand by $76.12. b) Cash on hand exceeds cash reported by cash register tape by $42.47.arrow_forwardGiorgio is in the Sales by Customer Detail report. He wants to see the line items for Jones Company's transactions for the previous month in date order. How should Giorgio proceed? Select an answer: Go to Sort and then select Num. Go to Display columns by and then select Month. Go to Sort and then select Trans.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education