ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

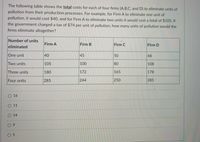

Transcribed Image Text:The following table shows the total costs for each of four firms (A,B,C, and D) to eliminate units of

pollution from their production processes. For example, for Firm A to eliminate one unit of

pollution, it would cost $40, and for Firm A to eliminate two units it would cost a total of $105. If

the government charged a tax of $74 per unit of pollution, how many units of pollution would the

firms eliminate altogether?

Number of units

Firm A

Firm B

Firm C

Firm D

eliminated

One unit

40

45

50

48

Two units

105

100

80

108

Three units

180

172

165

178

Four units

285

244

250

285

O 16

O 11

O 14

0 9

O 5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Exercise 1.23: Challenging Question. The Mondevil Corporation operates a chemical plant, which is located on the banks of the Sacramento river. Downstream from the chemical plant is a group of fisheries. The Mondevil plant emits by- products that pollute the river, causing harm to the fisheries. The profit Mondevil obtains from operating the chemical plant is $II > 0. The harm inflicted on the fisheries due to water pollution is equal to $L > 0 of lost profit [without pollution the fisheries' profit is $A, while with pollution it is $(A - L)]. Suppose that the fisheries collectively sue the Mondevil Corporation. It is easily verified in court that Mondevil's plant pollutes the river. However, the values of II and L cannot be verified by the court, although they are commonly known to the litigants. Suppose that the court requires the Mondevil attorney (player 1) and the fisheries' attorney (player 2) to play the following litigation game. Player 1 is asked to announce a number x≥0,…arrow_forwardUse a graph to illustrate the quantity of pollution that would be emitted (a) after a corrective tax has been imposed and (b) after tradable pollution permits have been imposed. Could these two quantities ever be equivalent?arrow_forwardQuestion 3 Professor Paudel shows the graph for the case of negative externalities in the class. He wants the class to think about positive externalities as well. This got him thinking a lot about potential market failure due to positive production externality in the oil exploration market. Specifically, in his research, he found that expenditures on oil exploration by any company can have a positive externality because they offer more profitable opportunities for other companies. Professor Paudel wants you to enlighten him on the following issues: a) Graphically show private and social marginal cost functions and the demand curve. b) Under positive externalities as mentioned above, is the social marginal cost below than the private marginal cost? Explain and support your answers with the help of a clearly labeled graph. c) Under positive externalities as mentioned above, what's the relationship between social optimum quantity and the competitive market equilibrium quantity? Is there…arrow_forward

- Can you explain why the following statement is false? The efficient level of a pollution-emitting activity (e.g., production of a good) is that at which the marginal external cost of pollution is equal to zero.arrow_forwardA city currently emits 16 million gallons (MG) of raw sewage into a lake that is beside the city. The table below shows the total costs (TC) in thousands of dollars of cleaning up the sewage to different levels, together with the total benefits (TB) of doing so. Benefits include environmental, recreational, health, and industrial benefits. Emissions Total Cost Marginal Cost Total Benefit Marginal Benefit 16 MG Current N/A Current N/A 12 MG 50 800 8 MG 150 1300 4 MG 500 1650 0 MG 1200 1950 Complete the table. What is the optimal level of sewage for this city? How can you tell?arrow_forwardNonearrow_forward

- yn iru Suppose the government wants to reduce the total pollution emitted by three local firms. Currently, each firm is creating 4 units of pollution in the area, for a total of 12 pollution units. If the government wants to reduce total pollution in the area to 6 units, it can choose between the following two methods: Available Methods to Reduce Pollution 1. The government sets pollution standards using regulation. 2. The government allocates tradable pollution permits. Each firm faces different costs, so reducing pollution is more difficult for some firms than others. The following table shows the cost each firm faces to eliminate each unit of pollution. For each firm, assume that the cost of reducing pollution to zero (that is, eliminating all 4 units of pollution) is prohibitively expensive. Cost of Eliminating the... Second Unit of Pollution First Unit of Pollution Firm (Dollars) (Dollars) Third Unit of Pollution (Dollars) 150 1,050 Firm X 80 100 800 450 Firm Y 200 Firm Z 120 95…arrow_forwardThere are three industrial firms in a town Firm Initial Pollution Level Cost of Reducing Pollution by 1 Unit A 30 units $20 40 units 20 units B с $30 $10 The government wants to reduce pollution to 60 units, so it gives each firm 20 tradable pollution permits. 1. Who sells permits and how many do they sell? Who buys permits and how many do they buy? Briefly explain why the sellers and buyers are each willing to do so. What is the total cost of pollution reduction in this situation? 2. How much higher would the costs of pollution reduction be if the permits could not be traded?arrow_forwardThe primary source of air pollution in the small town of Smokey, Nevada is a nearby steel mill. The local environmental agency has decided that the mill needs to reduce its emissions because the town's population is located directly downwind from it. Currently the agency is considering three different approaches to reducing pollution from the mill: a technology standard, an emission standard and an emission tax. Why might the owner of the mill prefer an emission standard to a technology standard that would produce the same level of emissions? a Because with emission standards the polluter is more flexible in selecting the technology that will minimize her abatement cost Ob. Because polluters usually try to stick to their existing technology O C. Because it has been proven to be easier to implement O d. Because polluters, as all producers are suspicious about new technologiesarrow_forward

- Im confused on this question.arrow_forwardSuppose the the government has set the trading price of a permit at $126 per permit. Complete the following table with the action each firm will take at this permit price, the amount of pollution each firm will eliminate, and the amount it costs each firm to reduce pollution to the necessary level. If a firm is willing to buy two permits, assume that it buys one permit from each of the other firms. (Hint: Do not include the prices paid for permits in the cost of reducing pollution.) Firm Firm A Firm B Firm C Initial Pollution Permit Allocation (Units of pollution) 2 2 2 Regulation Versus Tradable Permits Action Proposed Method Regulation Tradable Permits Final Amount of Pollution Eliminated (Units of pollution) Cost of Pollution Reduction (Dollars) Determine the total cost of eliminating six units of pollution using both methods, and enter the amounts in the following table. (Hint: You might need to get information from previous tasks to complete this table.) Total Cost of Eliminating…arrow_forwardSuppose the government wants to reduce the total pollution emitted by three local firms. Currently, each firm is creating 4 units of pollution in the area, for a total of 12 pollution units. If the government wants to reduce total pollution in the area to 6 units, it can choose between the following two methods: Available Methods to Reduce Pollution 1. The government sets pollution standards using regulation. 2. The government allocates tradable pollution permits. Each firm faces different costs, so reducing pollution is more difficult for some firms than others. The following table shows the cost each firm faces to eliminate each unit of pollution. For each firm, assume that the cost of reducing pollution to zero (that is, eliminating all 4 units of pollution) is prohibitively expensive. Firm Cost of Eliminating the... First Unit of Pollution Second Unit of Pollution Third Unit of Pollution (Dollars) (Dollars) (Dollars) Firm X 90 125 180…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education