FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

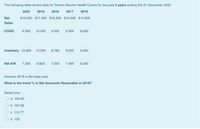

Transcribed Image Text:The following table shows data for Tommy Bourke Health Centre for the past 5 years ending the 31 December 2020

2020

2019

2018

2017

2016

Net

$19,500 $17,400 $18,200 $16,500 $14,900

Sales

COGS

9,500

10,300

9,500

8,900

8,000

Inventory 13,000

12,200

8,700

9,500

9,300

Net A/R

7,500

6,800

7,200

7,000

6,500

Assume 2016 is the base year.

What is the trend % in Net Accounts Receivable in 2018?

Select one:

a. 104.62

b. 107.69

c. 110.77

O d. 100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following table presents selected 2020 annual income statement items and balance sheet items for Toyota Motor and Apple. All figures are in millions. Use the information to answer the questions that follow. Toyota Apple Sales ¥29,931,992 $ 277,515 Cost of goods sold 24,582,364 172,559 Accounts receivable 8,715,065 19,120 Inventory 2 ,437,918 7,061 Accounts payable 2,441,380 45,296 Calculate the length of the operating cycle for Toyota and Apple. Calculate the length of the cash conversion cyclearrow_forward- Chapter 8 Saved Help Save Selected financial statement data from Western Colorado Stores is shown below. 2021 2020 Net sales Cost of goods sold Operating expenses Inventory $975, 000 780, 000 110,000 130, 000 $995, 000 800,000 90,000 110, 000 Required: 1. Compute the gross profit ratio for 2021. (Round your "Percentage" answer to two decimal places (i.e., 0.1234 should be entered as 12.34).) 2. Compute the inventory turnover ratio for 2021. (Round your answer to two decimal places.) 1Gross profit ratie- 2 Inventory tumover ratioarrow_forwardThe following information is taken from the financial statements of Down Home Deli for the last three years. The owner, John Walton is quite pleased to see that his sales are growing steadily. 2018 2017 2016 Sales $ 61,500 $ 50,400 $ 42,000 Cost of goods sold 27,670 21,170 16,800 Operating income 7,530 6,050 4,620 Net income 3,075 4,030 2,940 Instructions: (a) Calculate gross profit margin, profit margin, and profit margin using operating income. (b) Comment on whether the Deli is, in fact, doing better over the three years as John believes.arrow_forward

- vsarrow_forwardSuppose this information is available for PepsiCo, Inc. for 2020, 2021, and 2022. Calculate the gross profit rate for 2020, 2021, and 2022:arrow_forwardLinden Watch Company reported the following income statement data for a 2-year period 2019 2020 Sales $280,000 $320,000 Cost of goods sold Beginning inventory 32,000 44,000 Cost of goods purchased 193,000 225,000 Cost of goods available for sale 225,000 269,000 Ending inventory 44,000 52,000 Cost of goods sold 181,000 217,000 Gross profit $ 99,000 $103,000 Linden uses a periodic inventory system. The inventories on January 1, 2019, and December 31, 2020, are correct. However, the ending inventory on December 31, 2019, was overstated by $5,000.arrow_forward

- The following information is available for the past year for a retail store: Sales $121,000 Sales Returns $1,000 Markups $11,000 Markup cancellations $1,000 Markdowns $9,000 Purchases (at cost) $40,000 Purchases (at retail) $90,000 Beginning inventory (at cost) $30,000 Beginning inventory (at retail) $40,000 What is the cost-to-retail ratio to estimate the cost of ending inventory using the conventional retail method? (Round cost-to-retail ratios to four decimal places.) Group of answer choices 53.85% 75% 58.33% 50%arrow_forwardCAN SOMEONE HELP ME WITH THIS WORD PROBLEM? Selected account balances for Pharoah Company at January 1, 2020, are presented below. Accounts Payable $13,200 Accounts Receivable 22,600 Cash 16,400 Inventory 13,800 Pharoah’s sales journal for January shows a total of $110,000 in the selling-price column, and its one-column purchases journal for January shows a total of $77,700.The column totals in Pharoah’s cash receipts journal are Cash Dr. $60,900; Sales Discounts Dr. $2,500; Accounts Receivable Cr. $45,400; Sales Revenue Cr. $6,300; and Other Accounts Cr. $11,700.The column totals in Pharoah's cash payments journal for January are Cash Cr. $55,900; Inventory Cr. $1,800; Accounts Payable Dr. $46,700; and Other Accounts Dr. $11,000. Hulse’s total cost of goods sold for January is $63,900.Accounts Payable, Accounts Receivable, Cash, Inventory, and Sales Revenue are not involved in the Other Accounts column in either the cash receipts or cash payments…arrow_forwardPlease help mearrow_forward

- Excerpts from Hulkster Company's December 31, 2021 and 2020, financial statements are presented below: Accounts receivable Merchandise inventory Net sales Cost of goods sold Total assets Total shareholders' equity Net income Hulkster's 2021 average collection period is: Multiple Choice O 109 days. O 128 days. 2021 $ 40,000 $ 28,000 O 73 days. 190,000 114,000 425,000 240,000 32,500 2020 $ 36,000 35,000 186,000 108,000 405,000 225,000 28,000arrow_forwardA pharmacy manager determines that the pharmacy’s average inventory value is $228,050.00. The pharmacy’s annual purchase amount is $725,000.00. What is the pharmacy’s turnover rate? (round to the nearest hundredth) Group of answer choices 3.18 1.46 2.20 0.69arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education