FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

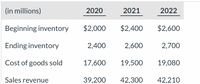

Suppose this information is available for PepsiCo, Inc. for 2020, 2021, and 2022.

Calculate the gross profit rate for 2020, 2021, and 2022:

Transcribed Image Text:(in millions)

2020

2021

2022

Beginning inventory

$2,000

$2,400

$2,600

Ending inventory

2,400

2,600

2,700

Cost of goods sold

17,600

19,500

19,080

Sales revenue

39,200

42,300

42,210

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Shamal Plastics Industries Sohar, is one of the leading plastic sheets manufacturing companies in Sultanate of Oman. While preparing the financial statement for the year 2020, some of the earnings reported in the year 2021 has been shifted to 2020. This denotes that Shamal Plastics Industries management might have followed O a. The political cost hypothesis Ob. The debt covenant hypothesis or political cost hypothesis. Oc The bonus plan hypothesis or political cost hypothesis. Od The bonus plan hypothesis or debt covenant hypothesis.arrow_forwardHere are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2019 Sales $ 5,000 Cost 3,900 Net income $ 1,100 BALANCE SHEET, YEAR-END 2018 2019 2018 2019 Assets $ 7,500 $ 12,100 Debt $ 833 $ 1,000 Equity 6,667 11,100 Total $ 7,500 $ 12,100 Total $ 7,500 $ 12,100 a. If sales increase by 10% in 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? b. What will be the value of this balancing item?arrow_forwardToby’s forecasted 2021 financial statements follow, along with some industry average ratios. Calculate Toby’s 2021 forecasted ratios and fill in the above table. Calculate the EPS and DPS. The company has a 40% payout ratio. Please provide the solutions for the EPS, DPS, Days Sales Outstanding, Fixed Asset Turnover, Total Asset Turnover, Return on Assets, Return on Equity, Total Debt Ratio, Profit Margin on Sales, P/E Ratio.arrow_forward

- Here are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2022 Sales $ 5,000 Cost 3,900 Net income $ 1,100 BALANCE SHEET, YEAR-END 2021 2022 2021 2022 Assets $ 7,500 $ 12,100 Debt $ 833 $ 1,000 Equity 6,667 11,100 Total $ 7,500 $ 12,100 Total $ 7,500 $ 12,100 If sales increase by 10% in 2023 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? What will be the value of this balancing item?arrow_forwardForecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardWHY THE FORECAST INCOME HSVE DEACLINE IN THE 2022 AND 2023 OF APPLE COMPANYarrow_forward

- How do i find the industry ratios for Walmart and Target 2022, comparing both retailers, Gross Margin Ratio, Profit Margin Ratio and Return on Asset to the industry.arrow_forwardOn the attached page prepare a well-formatted multi-section income statement for the Fiona Company for the fiscal year ending December 31, 2020 from the data below. Use the entire figures as shown on your income statement.Note: For items in section 2 (Other Items) and section 4 (Below-the-line Items) use brackets if an item will have a negative impact on earnings. In section 1 individual items are not generally shown in brackets except for calculated margins or totals if negative. Cost of Goods Sold amounted to $20,000. Sale of equipment that had a historical cost of $1,400 had accumulated depreciation of $910 and was sold for $890. The tax rate related to such a transaction is 25%. Non-taxable interest income on municipal bonds of $300 Sales revenue totaled $35,000. Interest expense totaled $500 for the period. Selling and Administrative Expenses amounted to $6,000 The company discontinued operations during the year that will result in total losses before taxes of $2,000. This…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education