Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

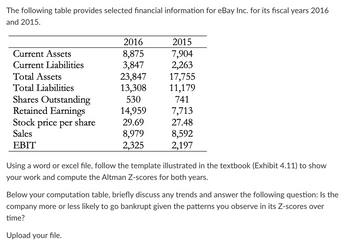

Transcribed Image Text:The following table provides selected financial information for eBay Inc. for its fiscal years 2016

and 2015.

Current Assets

Current Liabilities

Total Assets

Total Liabilities

Shares Outstanding

Retained Earnings

Stock price per share

Sales

EBIT

2016

8,875

3,847

23,847

13,308

530

14,959

29.69

8,979

2,325

2015

7,904

2,263

17,755

11,179

741

7,713

27.48

8,592

2,197

Using a word or excel file, follow the template illustrated in the textbook (Exhibit 4.11) to show

your work and compute the Altman Z-scores for both years.

Below your computation table, briefly discuss any trends and answer the following question: Is the

company more or less likely to go bankrupt given the patterns you observe in its Z-scores over

time?

Upload your file.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ratios Analyzing Firm Profitability The following information is available for Buhler Company: Annual Data 2013 2012 Net sales $8,700,000 $8,100,000 Gross profit on sales 3,053,000 2,736,000 Net income 667,600 588,000 Year-End Data Dec. 31, 2013 Dec. 31, 2012 Total assets $6,500,000 $6,100,000 Stockholders' equity 3,900,000 3,300,000 Calculate the following ratios for 2013: Note: Round answers to one decimal place, unless otherwise noted.a. Gross profit percentage Answer % b. Return on sales Answer % c. Asset turnover (Round answer to two decimal places.)Answer d. Return on assets Answer % e. Return on common stockholders' equity (Buhler Company has no preferred stock.) Answer %arrow_forwardHeedy Company had the following account balances in 2016 and 2017, respectively. Assuming dividends of $20,000 were paid in 2017, how much was net income? 2017 2016Capital Stock $ 42,000 $ 40,000Retained Earnings x 210,000Total Stockholders' Equity $ 314,000 $ 250,000arrow_forwardc, d, and earrow_forward

- The following information is available for Crest Company: Annual Data 2013 2012 Sales revenue $6,600,000 $6,000,000 Cost of goods sold 4,008,400 3,720,000 Net income 310,300 264,000 Year-End Data Dec. 31, 2013 Dec. 31, 2012 Total assets $2,750,000 $2,360,000 Common stockholders' equity 1,800,800 1,800,000 Calculate the following ratios for 2013: a. Gross profit percentage b. Return on salesarrow_forwardSuppose selected comparative statement data for the giant bookseller Barnes & Noble are as follows. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable Inventory Total assets Total common stockholders' equity 2022 $4,750.0 3.300.3 85.3 75.1 1,150.0 2,850.0 900.2 2021 $5,500.6 3,700.6 110.1 102.2 1.250.0 3,250.1 1.120.7arrow_forwardSubject: accountingarrow_forward

- Compute and Interpret Liquidity, Solvency and Coverage RatiosSelected balance sheet and income statement information for Nordstrom, Inc. for 2014 and 2013 follows. ($ millions) 2014 2013 Cash $ 1,194 $ 1,285 Accounts receivable 2,177 2,129 Current assets 5,228 5,081 Current liabilities 2,541 2,226 Long-term debt 3,113 3,131 Short-term debt 0 0 Total liabilities 6,494 6,176 Interest expense 161 160 Capital expenditures 803 513 Equity 2,080 1,913 Cash from operations 1,320 1,110 Earnings before interest and taxes 1,350 1,345 (a) Compute the following liquidity, solvency and coverage ratios for both years. (Round your answers to two decimal places.)2014 current ratio = Answer2013 current ratio = Answer2014 quick ratio = Answer2013 quick ratio = Answer2014 liabilities-to-equity = Answer2013 liabilities-to-equity = Answer2014 total debt-to-equity = Answer2013 total debt-to-equity = Answer2014 times interest earned = Answer2013 times interest earned =…arrow_forwardRefer to Apple’s balance sheet. What is the total of Apple’s 2017 accounts payable? What is the total of its schedule of accounts payable?arrow_forwardBruno Inc.'s Financial Statement for years 2014-2015. Compute for the Bruno Inc. Year 2015 Debt to Equity Ratio. (Answer Format: 12.23%, if computed answer is 12.343% answer should be 12.34%, if computed answer is 12.347% answer should be 12.35%) INCOME STATEMENTS 2014 2015 BALANCE SHEETS Assets Cash 2014 2015 Net sales $ 4,760 $ 5,000 S 60 50 COGS (excl. depr.) 3,560 3,800 ST Investments 40 . Depreciation 170 200 Accounts receivable 380 500 480 500 Inventories 820 1,000 Other operating expenses EBIT S 550 S 500 Total CA $ 1,300 $ 1,550 Interest expense 100 120 Net PP&E 1,700 2,000 Pre-tax earnings S 450 S 380 $ 3,000 $ 3,550 Taxes (40%) 180 152 NI before pref. div. $ 270 228 Preferred div. 8 8 S 190 $ 200 Net income $ 262 220 280 300 130 280 Other Data $ 600 S 780 Common dividends $48 $50 1,000 1,200 Addition to RE $214 $170 $ 1,600 $ 1,980 Tax rate 40% 40% 100 100 Shares of common stock 50 50 500 500 Earnings per share $5.24 $4.40 800 970 Dividends per share $0.96 $1.00 $ 1,300 S…arrow_forward

- Harrow_forwardSelected balance sheet and income statement information for Home Depot follows. $ millions Operating assets Jan. 31, 2016 Feb. 01, 2015 $40,333 $38,223 Nonoperating assets 2,216 1,723 Total assets 42,549 39,946 Operating liabilities 14,918 13,427 Nonoperating liabilities 21,315 17,197 Total liabilities 36,233 30,624 Total stockholders' equity 6.316 9.322 Sales 88,519 Net operating profit before tax (NOPBT) 11,774 Non-operating expense before tax 753 Tax expense 4,012 Net income 7,009 Compute the return on equity for the year ended January 31, 2016. You want your all-equity (no debt) firm to provide a return on equity of 13.5%. If total assets are $375,000, how much must be generated in net income to make this target? a. $41,234 b. $43,405 c. $45,689 d. $48,094 e. $50,625 For the FY 2016, Alpha Company had net sales of $950,000 and a net income of $65,000, paid income taxes of $30,000, and had before-tax interest expense of $15,000. Use this information to determine the: 1. Times…arrow_forwardCompute and Interpret Altman's Z-scores Following is selected financial information for Netflix, for 2018 and 2017. E4-28. $ thousands, except per share data 2018 2017 Current assets $ 9,694,135 $ 7,669,974 ... Current liabilities.. Total assets .. Total liabilities.. Shares outstanding. Retained earnings Stock price per share 6,487,320 25,974,400 5,466,312 19,012,742 ... . 20,735,635 436,598,597 15,430,786 433,392,686 2,942,359 1,731,117 267.66 191.96 Sales.... 15,794,341 1,605,226 11,692,713 Earnings before interest and taxes.. 838,679 Required a. Compute and compare the Altman Z-scores for both years. What explains the apparent trend? b. Is the company more likely to go bankrupt given the Z-score in 2018 compared to 2017? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education