FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

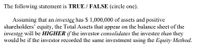

Transcribed Image Text:The following statement is TRUE / FALSE (circle one).

Assuming that an investee has $ 1,000,000 of assets and positive

shareholders' equity, the Total Assets that appear on the balance sheet of the

investor will be HIGHER if the investor consolidates the investee than they

would be if the investor recorded the same investment using the Equity Method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the formula for EVA. (WACC = Weighted-average cost of capital) After tax operating inc. Current liabilities Market value of debt Market value of equity Operating income Revenues Total assets WACC x ( )) = EVAarrow_forwardEmerson Electric is engaged in design, manufacture, and sale of a broad range of electrical, electromechanical, and electronic products and systems. The following shows Emerson's net income and net income before extraordinary items for the past 20 years (in millions): Net Year Income Y1 $201.0 Y2 237.7 Y3 273.3 Y4 300.1 Y5 302.9 Y6 349.2 Y7 401.1 Net Income before Extraordinary Items $201.0 237.7 273.3 300.1 302.9 349.2 401.1 Net Year Income Y8 $408.9 Y9 467.2 Y10 528.8 Y11 588.0 Y12 613.2 Y13 631.9 Y14 662.9 Net Income before Extraordinary Items $408.9 467.2 528.8 588.0 613.2 631.9 662.9 Emerson Electric Net Year Income Net Income before Extraordinary Items Y15 $708.1 Y16 Y17 Y18 1,018.5 Y19 1,121.9 Y20 1,228.6 1,228.6 788.5 907.7 $ 708.1 904.4 929.0 1,018.5 1,121.9 Emerson has achieved consistent earnings growth for more than 160 straight quarters (more than 40 years). PROBLEM 2-14 Earnings Management Strategiesarrow_forwardIn the following balance sheet, estimate the impact on the economic value of equity (EVE). If interest rates of assets fall by 1% and deposit rates increase by 1%. EVE=$()arrow_forward

- The right side of the balance sheet shows the firm’s liabilities and stockholders’ equity. Which of the following best describes shareholders’ equity? Equity is the difference between the company’s assets and retained earnings. Equity is the sum of shareholders’ capital provided by shareholders and retained earnings. NOW Inc. released its annual results and financial statements. Grace is reading the summary in the business pages of today’s paper. In its annual report this year, NOW Inc. reported a net income of $192 million. Last year, the company reported a retained earnings balance of $442 million, whereas this year it increased to $520 million. How much was paid out in dividends this year? $3 million $114 million $270 million $575 millionarrow_forwardGiven the financial data in the popup window, , for Disney (DIS) and McDonald's (MCD), compare these two companies using the following financial ratios: debt ratio, current ratio, total asset turnover, financial leverage component (equity miltiplier), profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The debt ratio for Disney is nothing. (Round to four decimal places.) Help Me Solve ThisView an Example Get More Help Clear All Check Answer Data Table Click on the following Icon in order to past this table's content into a spreadsheet. Disney McDonald's Sales $48,792 $28,023 EBIT $12,116 $8,123 Net Income $7,572 $5,507 Current Assets $15,187 $5,004 Total Assets $84,112 $36,637 Current Liabilities $13,105 $3,064…arrow_forwardRequired Indicate the effect of each of the following transactions on (1) the current ratio, (2) working capital, (3) stockholders' equity, (4) book value per share of common stock, and (5) retained earnings. Assume that the current ratio is greater than 1:1 (Indicate the effect of each transaction by selecting "+" for increase, "-"for decrease, and leave the cell blank if there is no effect.). a. Collected account receivable. b. Wrote off account receivable. c. Converted a short-term note payable to a long-term note payable. d. Purchased inventory on account. e. Declared cash dividend f. Sold merchandise on account at a profit. g. Issued stock dividend h. Paid account payable. i. Sold building at a loss. Retained Value Earnings Current Working Stockholders Book Ratio Capital Equityarrow_forward

- Janzen Company recorded employee salaries earned but not yet paid. Which of the following represents the effect of this transaction on the horizontal financial statements model? A. B. C. D. Assets + Balance Sheet Liabilities + + + Multiple Choice Option B Option A Option C Option D + Stockholders' Equity Income Statement Revenue + - Expense = + + + Net income + Statement of Cash Flows -Operating Activity -Investing Activityarrow_forwardIf a company receives $12,600 from a stockholder, the effect on the accounting equation would be: Multiple Choice Assets decrease $12,600 and equity decreases $12,600. Assets increase $12,600 and liabilities decrease $12,60. Assets increase $12,600 and liabilities increase $12,600, Liabilities increase $12,600 and equity decreases $12,600. Assets increase $12,600 and equity increases $12,600. Type here to searcharrow_forwardI need the retained earnings.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education