FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

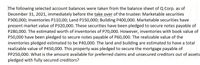

Transcribed Image Text:The following selected account balances were taken from the balance sheet of Q Corp. as of

December 31, 2021, immediately before the take over of the trustee: Marketable securities

P300,000; Inventories P110,00; Land P150,000; Building P400,000. Marketable securities have

present market value of P320,000. These securities have been pledged to secure notes payable of

P280,000. The estimated worth of inventories of P70,000. However, inventories with book value of

P50,000 have been pledged to secure notes payable of P60,000. The realizable value of the

inventories pledged estimated to be P40,000. The land and building are estimated to have a total

realizable value of P450,000. This property was pledged to secure the mortgage payable of

PP250,000. What is the amount available for preferred claims and unsecured creditors out of assets

pledged with fully secured creditors?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pharoah Corporation had the following transactions pertaining to debt investments. 1. Purchased 80 Leeds Co. 8% bonds (each with a face value of $1,000) for $80,000 cash. Interest is payable annually on January 1,2022. 2. Accrued interest on Leeds Co. bonds on December 31, 2022. 3. Received interest on Leeds Co. bonds on January 1, 2023. 4. Sold 70 Leeds Co. bonds for $76,300 on January 1, 2023. Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) No. Date 1. 2. 3. 4. Account Titles and Explanation Debit Creditarrow_forwardIn its first year of operations, Wildhorse Corporation purchased, available-for-sale debt securities costing $65.000 as a long-term investment. At December 31, 2022, the fair value of the securities is $60,500. Show the financial statement presentation of the securities and related accounts. Assume the securities are noncurrent. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45)) WILDHORSE CORPORATION Balance Sheet 4 $arrow_forwardCagney Company sold $248,000 of bonds on January 1, 2024. A portion of the amortization table follows. Period CashPayment(Credit) InterestExpense(Debit) Discounton BondsPayable(Credit) Discounton BondsPayableBalance CarryingValue At issue $8,000 $240,000 06/30/24 $12,000 $12,800 $800 7,200 240,800 12/31/24 12,000 12,800 800 6,400 241,600 06/30/25 ? ? ? ? ? Required: 1. Determine the stated interest rate on these bonds. Round your answer to the nearest whole number.fill in the blank 1 % 2. Calculate the interest expense and the discount amortization for the interest period ending on June 30, 2025. Interest expense $fill in the blank 2 Discount amortization $fill in the blank 3 3. Calculate the liability balance shown on a balance sheet after the interest payment is recorded on June 30, 2025.$fill in the blank 4arrow_forward

- Kiley Corporation had these transactions during 2025. Analyze the transactions and indicate whether each transaction is an operating activity, investing activity, financing activity, or noncash investing and financing activity. a. b. C d. e. f. bb Purchased a machine for $30,000, giving a long-term note in exchange. Issued $50,000 par value common stock for cash. Issued $200,000 par value common stock upon conversion of bonds having a face value of $200,000. Declared and paid a cash dividend of $13,000. Sold a long-term investment with a cost of $15,000 for $15,000 cash. Collected $16,000 from sale of goods. Paid $18,000 to suppliers. > <arrow_forwardOn July 1, Year 1, Hill Inc. bought and classified the following 10-year debt investments as trading securities. At December 31, Year 1, Hill prepares its financial statements for the end of the fiscal year. At December 31, Year 1, Hill determines the fair value of these securities: Security Cost Fair Value AX PH JB $100,000 40,000 82,000 $94,000 64,000 85,000 At what amount will Hill report these investments in its balance sheet at December 31, Year 1, and how will they be classified? Select one: a. $243,000; current assets Ob. $222,000; current assets о c. $222,000; long-term assets d. $140,000; current assetsarrow_forwardPlease help with problem. At the beginning of 2019, Ace Company had the following portfolio of investments in available-for-sale debt securities (all of which were acquired at par value): Security Cost 1/1/19 Fair Value A $25,000 $31,000 B 38,000 36,000 Totals $63,000 $67,000 During 2019, the following transactions occurred: Transactions: May 3 Purchased C debt securities at their par value for $50,000. July 1 Sold all of the A securities for $31,000 plus interest of $1,000. Dec. 31 Received interest of $1,000 on the B and C securities. Additionally the following information was available: Security 12/31/19 Fair Value B $42,000 C 53,000 Required: 1. Prepare journal entries to record the preceding information. 2. What is the balance in the Unrealized Holding Gain/Loss account on December 31, 2019? 3. Next Level What justification does the FASB give for its treatment of unrealized holding gains and losses…arrow_forward

- On the day Federer Ltd redeemed its $1,000,000 face value bonds at 98, their carrying value was $1,200,000. Prepare a residual analysis for the bond redemption. Prepare the journal entry for the bond redemption. If you recognise a gain or loss, state where in the Statement of Comprehensive Income the gain or loss should appeararrow_forwardAt December 31, 2024, Hull-Meyers Corporation had the following investments that were purchased during 2024, its first year of operations: Trading Securities: Amortized cost Fair Value Security A Totals Security B Securities Available-for-Sale: Security C Security D Totals Securities to Be Held-to-Maturity: Security E Security F Totals $ 960,000 165,000 $ 1,125,000 $760,000 960,000 $ 1,720,000 $ 550,000 675,000 $ 1,225,000 $ 975,000 159,400 $ 1,134,400 $ 834,000 977,400 $ 1,811,400 $ 561,200 669,800 $ 1,231,000 No investments were sold during 2024. All securities except Security D and Security F are considered short-term investments. None of the fair value changes is considered permanent. Required: Complete the following table. Note: Amounts to be deducted should be indicated with a minus sign. Trading Securities Security A Security B Securities Available-for-Sale Security C Security D Securities to be Held-to- Answer is not complete. Reported on Balance Sheet as: Unrealized gain…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education