FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

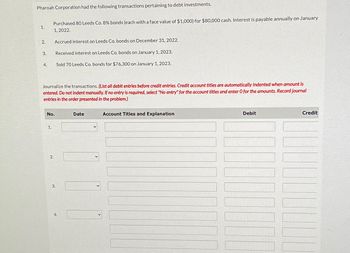

Transcribed Image Text:Pharoah Corporation had the following transactions pertaining to debt investments.

1.

Purchased 80 Leeds Co. 8% bonds (each with a face value of $1,000) for $80,000 cash. Interest is payable annually on January

1,2022.

2.

Accrued interest on Leeds Co. bonds on December 31, 2022.

3.

Received interest on Leeds Co. bonds on January 1, 2023.

4.

Sold 70 Leeds Co. bonds for $76,300 on January 1, 2023.

Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Record journal

entries in the order presented in the problem.)

No.

Date

1.

2.

3.

4.

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maxwell Manufacturing issued $480,000, 12-year, 8% bonds at 107, paying semiannual interest. What is the total amount of interest expense that will be recorded over the life of these bonds? A) $480,000 B) $513,600 C) $518,400 D) $427,200arrow_forwardThe following information relates to the debt investments of Concord Inc. during a recent year: 1. On February 1, the company purchased Gibbons Corp. 10% bonds with a face value of $372,000 at 100 plus accrued interest. Interest is payable on April 1 and October 1. 2. On April 1, semi-annual interest was received on the Gibbons bonds. 3. On June 15, Sampson Inc. 9% bonds were purchased. The $248,000 par-value bonds were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. 4. On August 31, Gibbons bonds with a par value of $74,400 purchased on February 1 were sold at 99 plus accrued interest. 5. On October 1, semi-annual interest was received on the remaining Gibbons bonds. 6. On December 1, semi-annual interest was received on the Sampson bonds. 7. On December 31, the fair values of the bonds purchased on February 1 and June 15 were 98.5 and 101, respectively. Assume the investments are accounted for under the recognition and measurement requirements of…arrow_forwardOn May 1, 2010, Kirmer Corp. purchased $450,000 of 12% bonds, interest payable on January 1 and July 1, for $422,800 plus accrued interest. The bonds mature on January 1, 2016. Amortization is recorded when interest is received by the straight-line method (by months and round to the nearest dollar). (Assume bonds are available for sale.) a) Prepare the entry for May 1, 2010. b) The bonds are sold on August 1, 2011, for $425,000 plus accrued interest. Prepare all entries required to properly record the sale.arrow_forward

- The following transactions relate to bond investments of Livermore Laboratories. The company's fiscal year ends on December 31. Livermore uses the straight-line method to determine interest. 2024 July 1 Purchased $22 million of Bracecourt Corporation 12% debentures, due in 20 years (June 30, 2044), for $21.1 million. Interest is payable on January 1 and July 1 of each year. October 1 Purchased $36 million of 14% Framm Pharmaceuticals debentures, due May 31, 2034, for $37,856,000 plus accrued interest. Interest is payable on June 1 and December 1 of each year. December 1 Received interest on the Framm bonds. December 31 Accrued interest. 2025 January 1 Received interest on the Bracecourt bonds. June 1 Received interest on the Framm bonds. July 1 Received interest on the Bracecourt bonds. September 1 Sold $18.0 million of the Framm bonds at 102 plus accrued interest. December 1 Received interest on the remaining Framm bonds. December 31 Accrued interest. 2026 January 1 Received interest…arrow_forwardSubject: accounting Carla Vista Enterprises issued 8%, 8-year, $2,950,000 par value bonds that pay interest annually on April 1. The bonds are dated April 1,2025, and are issued on that date. The discount rate of interest for such bonds on April 1, 2025, is 10%. What cash proceeds did Carla Vista receive from issuance of the bonds?arrow_forwardPharoah Company had the following transactions pertaining to debt securities held as an investment. Jan. 1 Dec. 31 Purchased 75, 6%, $1,000 Sheridan Company bonds for $75,000 cash. Interest is payable annually on January 1. Accrued $4,500 annual interest on Sheridan Company bonds. Journalize the purchase and the receipt of interest. Assume no interest has been accrued. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Jan. 1 Debt Investments Cash Dec. 31 Interest Receivable Interest Revenue Debit 75,000 4,500 Credit 75,000 4,500arrow_forward

- Ruben Company purchased $100,000 of Evans Company bonds at 100 plus $1,500 in accrued interest. The bond interest rate is 8% and interest is paid semiannually. The journal entry for the purchase would be. Oa. debit Investments-Evans Company Bonds, $100,000; credit Interest Revenue, $1,500, and Cash, $98,500 Ob. debit Investments-Evans Company Bonds, $100,000, and Interest Receivable $1,500; credit Cash, $101,500 Oc. debit Investments-Evans Company Bonds, $101,500; credit Cash, $101,500 Od. debit Investments-Evans Company Bonds, $100,000; credit Cash, $100,000arrow_forwardHerman Company received proceeds of $188,500 on 10-year, 8% bonds issued on January 1, 2018. The bonds had a face value of $200,000, pay semiannually on June 30 and December 31, and have a call price of 101. Herman uses the straight-line method of amortization. What is the carrying value of the bonds on January 1, 2020. $200,000 O $190, 800 O $189,650 O $197,700arrow_forwardKrause Corporation issued $2,300,000, 10-year, 6% bonds for $2,231,000 on January 1, 2022. Interest is paid semiannually on January 1 and July 1. The corporation uses the straight-line method of amortization. Krause's fiscal year ends on December 31. The amount of discount amortization on July 1, 2022, would be OA. $138,000. OB. $69,000. OC. $6,900. OD. $3,450.arrow_forward

- want answer for this questionarrow_forwardDavid corporation issued $100,000, 5- year bonds at 97 on January 1,2016. In December 31,2030 the bonds matured. The payment of the bonds at maturity would be s on the statement of cash flows as a cash outflow of -100,000 in the investing activities section -100,000 in the financing activities section -97,000 in the financing activities section -97,000 in the investing activities sectionarrow_forwardJSM Ltd. sold $6,010,000 of 8% bonds, which were dated March 1, 2023, on June 1, 2023. The bonds paid interest on September 1 and March 1 of each year. The bonds' maturity date was March 1, 2033, and the bonds were issued to yield 10%. JSM's fiscal year-end was February 28, and the company followed IFRS. On June 1, 2024, JSM bought back $2,010,000 worth of bonds for $1,910,000 plus accrued interest. (a) Your answer is partially correct. Using 1. a financial calculator, or 2. Excel function PV, calculate the issue price of the bonds and prepare the entry for the issuance of the bonds. Hint: Use the account Interest Expense in your entry). (Round answer to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Cash Debit Credit Interest…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education