ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

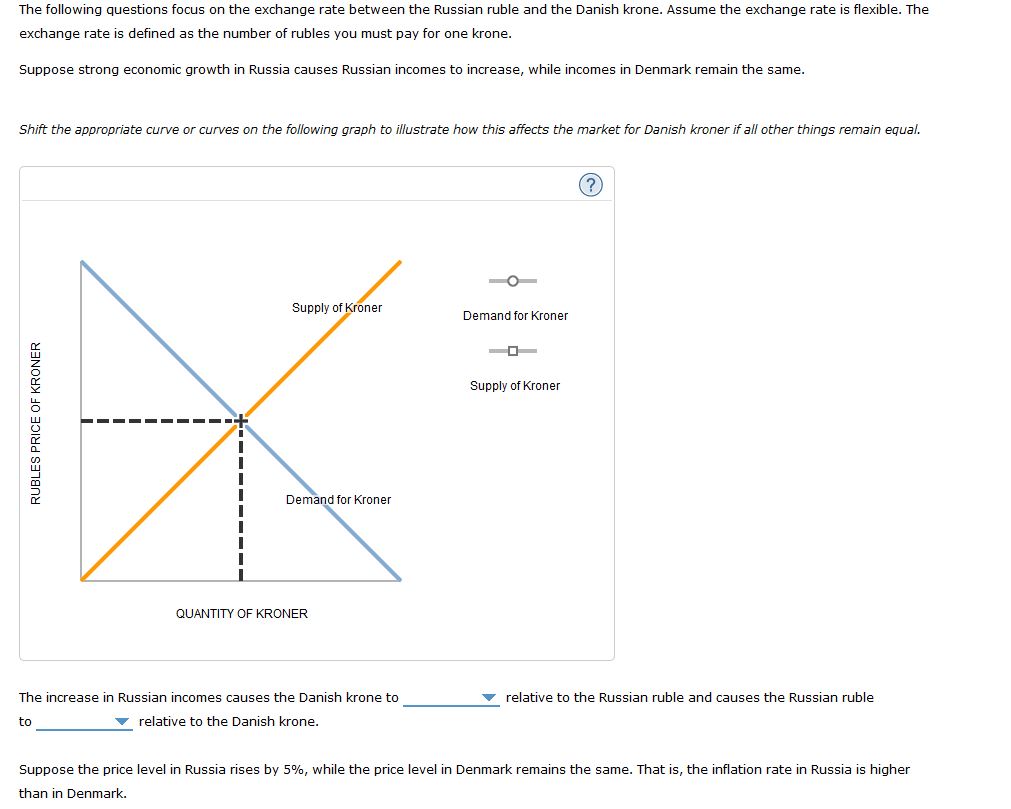

The following questions focus on the exchange rate between the Russian ruble and the Danish krone. Assume the exchange rate is flexible. The exchange rate is defined as the number of rubles you must pay for one krone

34.5

Transcribed Image Text:The following questions focus on the exchange rate between the Russian ruble and the Danish krone. Assume the exchange rate is flexible. The

exchange rate is defined as the number of rubles you must pay for one krone.

Suppose strong economic growth in Russia causes Russian incomes to increase, while incomes in Denmark remain the same.

Shift the appropriate curve or curves on the following graph to illustrate how this affects the market for Danish kroner if all other things remain equal.

(?)

Supply of Kroner

Demand for Kroner

Supply of Kroner

Demand for Kroner

QUANTITY OF KRONER

The increase in Russian incomes causes the Danish krone to

v relative to the Russian ruble and causes the Russian ruble

to

v relative to the Danish krone.

Suppose the price level in Russia rises by 5%, while the price level in Denmark remains the same. That is, the inflation rate in Russia is higher

than in Denmark.

RUBLES PRICE OF KRONER

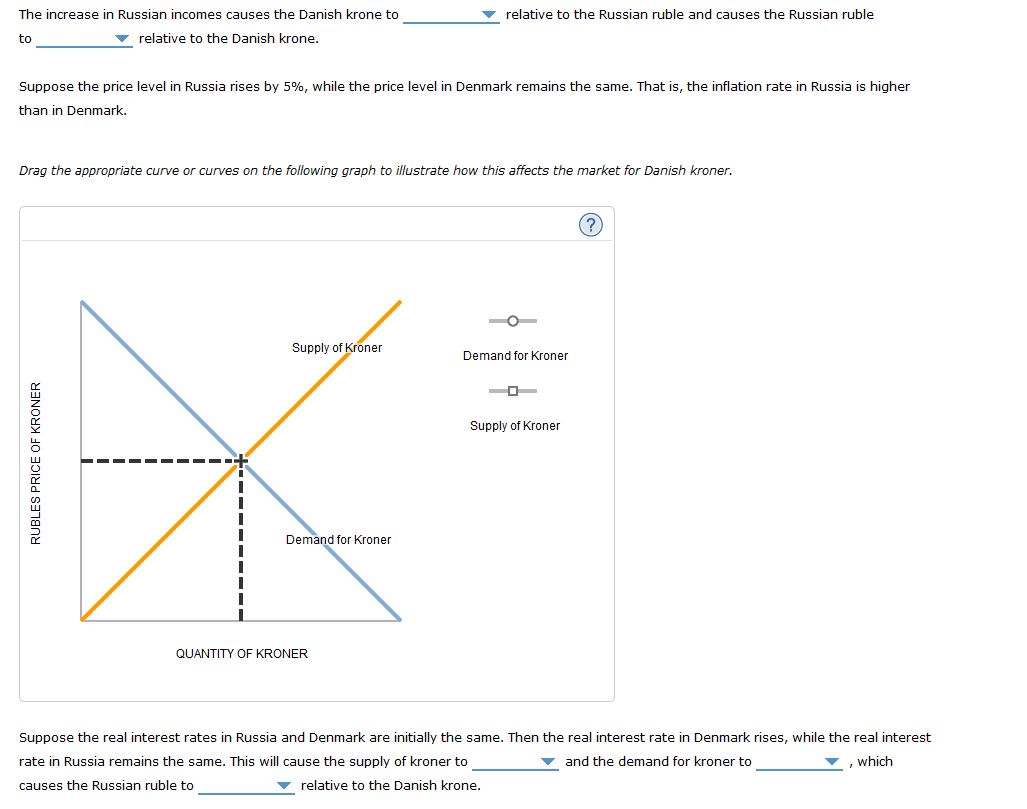

Transcribed Image Text:The increase in Russian incomes causes the Danish krone to

relative to the Russian ruble and causes the Russian ruble

to

relative to the Danish krone.

Suppose the price level in Russia rises by 5%, while the price level in Denmark remains the same. That is, the inflation rate in Russia is higher

than in Denmark.

Drag the appropriate curve or curves on the following graph to illustrate how this affects the market for Danish kroner.

(?)

Supply of Kroner

Demand for Kroner

Supply of Kroner

Demand for Kroner

QUANTITY OF KRONER

Suppose the real interest rates in Russia and Denmark are initially the same. Then the real interest rate in Denmark rises, while the real interest

rate in Russia remains the same. This will cause the supply of kroner to

v and the demand for kroner to

, which

causes the Russian ruble to

relative to the Danish krone.

RUBLES PRICE OF KRONER

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the nominal exchange rate e is foreign currency per dollar, the domestic price is P, and the foreign price is P*, what is the definition of the real exchange rate?arrow_forwardSuppose the foreign exchange market is characterized by the following equations: Qd = 12.5 – 1.25R Qs = 3.5 + 1.25R where Qd is the demand function for foreign exchange, Qs is supply function of foreign exchange, and R is exchange rate in units of domestic currency per unit of foreign currency (quantity is in million units of foreign currency). ===================== The foreign exchange market described above is Select one: stable unstable unpredictable none of the abovearrow_forwardIn the pound per euro market an increase in the demand for the euro is also: A) an increase in the supply of pounds B) a decrease in the demand for pounds C) an increase in the supply of euros D) the result of higher UK interest ratesarrow_forward

- You hold $12,000 in cash and the exchange rate of USD (American dollar) to Venezuelan bolivar is 10.15. Calculate how much your $12,000 are worth in Venezuelan bolivars (you will need this number for the calculations below). Now, suppose that you hold as much cash in bolivars, as you found above. But the exchange rate of USD to Venezuelan bolivar goes down to 9.85. How much would your cash amount in bolivars be worth in USD? Question 29 options: A) $120 B) $11,643 $12,000 D) $12,365arrow_forwardOolong tea is produced in China and sold in many countries. In the province of Fujian, per 100 grams of Oolong tea sells for 50 yuan. In Kuala Lumpur, per 100 grams of the same Oolong tea sells for RM20. Suppose that the exchange rate is RM0.45 1 yuan. Please do the following calculations based on the above information: 1. How much would it cost in Malaysian currency to buy the tea in Fujian? 2. How much would it cost in China currency to buy the tea in Kuala Lumpur?arrow_forwardIf the exchange rate between the US Dollar ($) and the Euro (E) goes from being $7/E to $6/E, we say that the US Dollar has __________ relative to the Euro. a) appreciated b) arbitraged c) stagnated d) depreciatedarrow_forward

- Suppose the exchange rate value of the dollar depreciates. Instructions: In order to receive full credit, you must make a selection for each option. For correct answer(s), click the option once to place a check mark. For incorrect answer(s), click the option twice to empty the box. Who are the winners? People who want to buy foreign assets Firms that export goods People who want to buy assets in this country People who travel abroad Firms that import goods People who travel to this countryarrow_forwardSuppose the implied exchange rate between euro and USD is $1.17 per euro based on PPP and the Hamburger standard. The actual exchange rate is $1.22. Therefore, euro is misvalued by ______%.arrow_forwardSuppose the nominal exchange rate between Russian rubles and US dollars is given as e=75 rubles. If the price level in Russia is 100 and the price level in the US is 150, what is the real exchange rate expressed in terms of a basket of Russian goods per basket of US goods? Round to two decimals.arrow_forward

- Relative inflation rates affect interest rates, exchange rates, the overall economic health of a country, and the operations and profitability of multinational companies. Consider the following statement: Countries with lower inflation rates will have lower interest rates. If companies borrow from countries with low interest rates, the potential gains from the interest savings will likely be (multiplied or offset) by the losses from currency appreciation.arrow_forwardThe spot exchange rate between the dollar and the Swiss franc is a floating, or flexible, rate. What are the effects of each of the following on this exchange rate? There is a large increase in Swiss demand for U.S. exports as U.S. culture becomes more popular in Switzerland. There is a large increase in Swiss demand for investments in U.S. dollar-denominated financial assets because of a Swiss belief that the U.S. economy and political situation are improving markedly. Political uncertainties in Europe lead U.S. investors to shift their financial investments out of Switzerland, back to the United States. U.S. demand for products imported from Switzerland falls significantly as bad press reports lead Americans to question the quality of Swiss products.arrow_forwardIf the exchange rate between the US Dollar ($) and the Euro (E) goes from being $5/E to $6/E, we say that the US Dollar has __________ relative to the Euro. a) depreciated b) stagnated c) appreciated d) arbitragedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education