FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

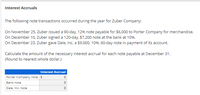

Transcribed Image Text:Interest Accruals

The following note transactions occurred during the year for Zuber Company:

On November 25, Zuber issued a 90-day. 12% note payable for $6,000 to Porter Company for merchandise.

On December 10, Zuber signed a 120-day, $7,200 note at the bank at 10%.

On December 23, Zuber gave Dale, Inc. a $9,000, 10%, 60-day note in payment of its account.

Calculate the amount of the necessary interest accrual for each note payable at December 31.

(Round to nearest whole dollar.)

Interest Accrual

Porter Company note $

Bank note

Dale, Inc. note

o o o

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selkirk Company obtained a $15,000 note receivable from a customer on January 1, 2021. The note, along with interest at 9%, is due on July 1, 2021. On February 28, 2021, Selkirk discounted the note at Unionville Bank. The bank’s discount rate is 12%. Required: Prepare the journal entries required on February 28, 2021, to accrue interest and to record the discounting for Selkirk. Assume that the discounting is accounted for as a sale.arrow_forwardOn January 1, MM Company borrows $360,000 cash from a bank and in return signs an 8% installment note for five annual payments of $90, 164 each. Analyze transactions involving issuance of the note and its first annual payment, by showing their effects on the accounting equation-specifically, identify the accounts and amounts (including + or -) for each transaction.arrow_forwardGeary Corporation had the following transactions: Apr. 15 - Issued a $6,000, 60-day, eight percent note payable in payment of an account with Marion Company. May 22 - Borrowed $50,000 from Sinclair Bank, signing a 60-day note at nine percent. June 14 - Paid Marion Company the principal and interest due on the April 15th note payable. July 13 - Purchased $15,000 of merchandise from Sharp Company; signed a 90-day note with eight percent interest. July 21 - Paid the May 22 note due to Sinclair Bank. Oct 02 - Borrowed $38,000 from Sinclair Bank, signing a 120-day note at twelve percent interest. Oct 11 - Paid the note payable and accrued interest to the Sharp Company (July 13). Record these transactions in general journal form. Record any adjusting entries for interest in general journal form. Geary Corporation has a December 31 year-end.arrow_forward

- Geary Corporation had the following transactions: · Apr. 15 - Received $6,000 from Marion Company and signed a 60-day, eight percent note payable. · May 22 - Borrowed $50,000 from Sinclair Bank, signing a 60-day note at nine percent. · June 14 - Paid Marion Company the principal and interest due on the April 15th note payable. July 13 - Purchased $15,000 of merchandise from Sharp Company; signed a 90-day note with eight percent interest. July 21 - Paid the May 22 note due to Sinclair Bank. · Oct 02 - Borowed $38,000 from Sinclair Bank, signing a 120-day note at twelve percent interest. · Oct 11 - Paid the note payable and accrued interest to the Sharp Company (July 13). Required: 1. Record these transactions in a general journal format. 2. Record any adjusting entries for interest in a general journal format. Geary Corporation has a December 31 year-end.arrow_forwardOn June 43, Trade Bank loaned a customer $30,000 on a 60-day, 10% note, temiting the face value less the interest to the customer. Which of the following journal entries would Trade Bank use to record the receipt of the note? a. Notes Receivable 30,000 Interest revenue 3,000 Cash 27,000 b. Notes receivable 30,000 Cash 30,000 c. Notes Receivable 29,500 Cash 29,500 d. Notes receivable 30,000 Interest revenue 500 Cash 29,500arrow_forwardOn May 10, 20X1, Washington Company received a 90-day, 8 percent, $8,400 interest-bearing note from Whitehead Company in settlement of Whitehead's past-due account. On June 30, Washington discounted this note at City Bank and Trust. The bank charged a discount rate of 13 percent. On August 8, Washington received a notice that Whitehead had paid the note and the interest on the due date. Required: Prepare the entries in general journal form to record these transactions. Analyze: If the company prepared a balance sheet on July 31, 20X1, how should Notes Receivable-Discounted be presented on the statement?arrow_forward

- . Determine the due date of the note. September 21 b. Determine the maturity value of the note. Assume 360 days in a year. Linstrum Company received a 60-day, 9% note for $56,000, dated July 23, from a customer on account. CHART OF ACCOUNTS Linstrum Company General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 129 Allowance for Doubtful Accounts 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Owner, Capital 311 Owner, Drawing 312 Income Summary REVENUE 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Merchandise Sold…arrow_forwardOn April 1, Year 1, Halo Co. issued a $5,000 face value discount note to the Capri Bank. The note had a 12 percent discount rate and a one-year term. 8. The amount of cash Halo received on April 1, Year 1, was a. $5,000. b. $4,250. c. $4,400. d. $5,500. 9. The total carrying value of Halo’s liabilities on December 31, Year 1, would be a. $5,600. b. $5,000. c. $5,450. d. $4,850. 10. If Halo Co. earned $2,000 of revenue in Year 1, the amount of net income would be a. $2,000. b. $1,550. c. $1,400. d. $1,850.arrow_forwardOn April 1, Year 1, Halo Co. issued a $5,000 face value discount note to the Capri Bank. The note had a 12 percent discount rate and a one-year term. The amount of cash Halo received on April 1, Year 1, was ০ $5,000 O $4,250 O $4,400 $5,500arrow_forward

- Selkirk Company obtained a $24,000 note receivable from a customer on January 1, 2021. The note, along with interest at 8%, is due on July 1, 2021. On February 28, 2021, Selkirk discounted the note at Unionville Bank. The bank's discount rate is 10%. Required: Prepare the journal entries required on February 28, 2021, to accrue interest and to record the discounting for Selkirk. Assume that the discounting is accounted for as a sale. (do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.). Tab 1) Record the accrued interest earned. Tab 2) Record the discounting of note receivable. Date General Journal Debit Credit February 28, 2021 ____________________________ ___________ ____________ _____________________________ ____________ ____________…arrow_forwardOn October 1, 2017, Chung, Inc. assigns $1,000,000 of its accounts receivable to Seneca National Bank as collateral for a $750,000 note. The bank assesses a finance charge of 2% of the receivables assigned and interest on the note of 9%. Prepare the October 1 journal entries for both Chung and Seneca.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education