FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:6

00:50:46

ipped

Book

8

Hint

Print

erences

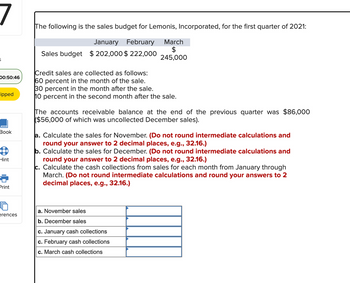

The following is the sales budget for Lemonis, Incorporated, for the first quarter of 2021:

January February

Sales budget $ 202,000 $ 222,000

March

$

245,000

Credit sales are collected as follows:

60 percent in the month of the sale.

30 percent in the month after the sale.

10 percent in the second month after the sale.

The accounts receivable balance at the end of the previous quarter was $86,000

($56,000 of which was uncollected December sales).

a. Calculate the sales for November. (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

b. Calculate the sales for December. (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

c. Calculate the cash collections from sales for each month from January through

March. (Do not round intermediate calculations and round your answers to 2

decimal places, e.g., 32.16.)

a. November sales

b. December sales

c. January cash collections

c. February cash collections

c. March cash collections

Transcribed Image Text:0:51:07

ped

ok

nt

nt

7

ences

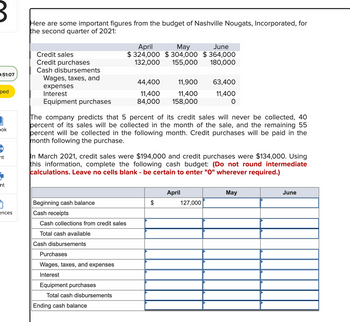

Here are some important figures from the budget of Nashville Nougats, Incorporated, for

the second quarter of 2021:

Credit sales

Credit purchases

Cash disbursements

Wages, taxes, and

expenses

Interest

Equipment purchases

Beginning cash balance

Cash receipts

Cash collections from credit sales

Total cash available

Cash disbursements

The company predicts that 5 percent of its credit sales will never be collected, 40

percent of its sales will be collected in the month of the sale, and the remaining 55

percent will be collected in the following month. Credit purchases will be paid in the

month following the purchase.

Purchases

Wages, taxes, and expenses

Interest

April

May

June

$324,000 $304,000 $364,000

132,000

155,000 180,000

In March 2021, credit sales were $194,000 and credit purchases were $134,000. Using

this information, complete the following cash budget: (Do not round intermediate

calculations. Leave no cells blank - be certain to enter "0" wherever required.)

Equipment purchases

Total cash disbursements

44,400

11,400

84,000

Ending cash balance

11,900

11,400

158,000

63,400

11,400

O

April

127,000

May

June

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts Cash payments $ 519,000 $ 468,000 404,000 452,000 353,000 521,000 Kayak requires a minimum cash balance of $40,000 at each month end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1 Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)arrow_forwardIn 2021 the company “AROFAH” will prepare a cash budget. The cash receipts and disbursements plan for the first six months (January to June) are as follows: Admission Plan: Sales Receipts: Sales are made in cash as much as 50% and 50% credit of sales. Of credit sales, 60% is received one month after the month of sale and the remaining is received 2 months after the month of sale. The total receipts of receivables in January and February are IDR 200,000 and IDR 300,000, respectively. The acceptance plans are: A. The amount of sales are: B. Other receipts are: January IDR 1,400,000 January IDR 200,000 February IDR 1,500,000 February IDR 300,000 March IDR 1,500,000 March IDR 100,000 April IDR 1,600,000 April IDR 200,000 May IDR 1,700,000 May IDR 400,000 June IDR 1,650,000 June IDR 500,000 2. Expediture Plan : A. Purchase of raw materials: B. Purchase of…arrow_forwardMarkham Company has completed its sales budget for the first quarter of Year 2. Projected credit sales for the first four months of the year are shown below: January February March April $ 20,000 $ 26,000 $ 35,000 $ 38,000 The company's past records show collection of credit sales as follows: 40% in the month of sale and the balance in the following month. The total cash collection from receivables in March is expected to be: Multiple Choice $29,600. $22,100. $31,850. $35,000.arrow_forward

- The following information was taken from Bonita Industries's cash budget for the month of July: Beginning cash balance $440000 Cash receipts 404000 Cash disbursements 558000 If the company's policy is to maintain a minimum end of the month cash balance of $430000, the amount the company would have to borrow in July is $286000. $144000. $10000. $26000.arrow_forwardHunt Company's sales, based on past experience, are 30% cash and 70% credit. Credit sales are typically collected as follows: 40% in the month of sale, 50% in the month after the sale, and 10% in the second month following month of sale. On December 31, the accounts receivable balance is $69,000, of which $24,000 is from November sales. Total sales for January and February are budgeted to be $110,000 and $130,000, respectively. What are Hunt Company's budgeted cash receipts for January? Multiple Choice $79,500. $92,500. $95,800. $112,500. $125,300.arrow_forwardNuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business September, October, and November are $239,000, $309,000, and $419,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. The cash collections expected in October from accounts receivable are estimated to be a. $173,040 b. $206,500 c. $139,580 d. $247,800arrow_forward

- Dove Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business are $245,000, $302,000, and $402,000, respectively, for September, October, and November. The company expects to sell 25% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month of the sale and 30% in the month following the The cash collections expected in October are O & $267,120 O & $218120 Oc $278,520 O d. $289.175arrow_forwardOld Antique Store prepared the following budget information for the month of May: Sales are budgeted at $303,000. All sales are on account and a provision for bad debts is made for each month at three percent of sales for the month. Inventory was $91,000 on April 30; an inventory increase of $17,000 is planned for May 31. All inventory is marked to sell at cost plus 50 percent. Estimated cash disbursements for selling and administrative expenses for the month are $55,000. Depreciation for May is projected at $6,700. Old Antique's budgeted cost of inventory purchases for May is:Multiple Choice $101,000. $151,500. $203,200. $219,000. $202,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education