FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

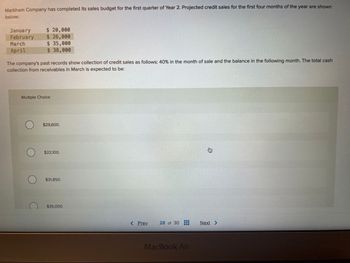

Transcribed Image Text:Markham Company has completed its sales budget for the first quarter of Year 2. Projected credit sales for the first four months of the year are shown

below:

January

February

March

April

$ 20,000

$ 26,000

$ 35,000

$ 38,000

The company's past records show collection of credit sales as follows: 40% in the month of sale and the balance in the following month. The total cash

collection from receivables in March is expected to be:

Multiple Choice

$29,600.

$22,100.

$31,850.

$35,000.

< Prev

28 of 30

MacBook Air

身

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following is the sales budget for Lemonis, Incorporated, for the first quarter of 2021: January February March Sales budget $198,000 $218,000 $241,000 Credit sales are collected as follows: 55 percent in the month of the sale. 30 percent in the month after the sale. 15 percent in the second month after the sale. The accounts receivable balance at the end of the previous quarter was $82,000 ($52,000 of which was uncollected December sales). a. Calculate the sales for November. (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Calculate the sales for December. (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Calculate the cash collections from sales for each month from January through March. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. November sales b. December sales c. January cash collections c. February cash collections c.…arrow_forwardGroup of answer choices $3,729,968 $3,781,600 $4,025,200 $4,408,000arrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts 523,000 $ Beginning cash balance Total cash available Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, Interest per month, paid at each month-end. The Interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. 408,500 476,000 Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Total cash payments Preliminary cash balance Loan activity Ending cash balance Cash payments $ 469,800…arrow_forward

- Emerald Service anticipates the following sales revenue over a five-month period Its collection history indicates that credit sales are collected as follows E (Click the icon to view the sales data ) The company's sales are 40% cash and 60% credit O (Click the icon to view the collections data) How much cash will be collected in January? In February? In March? For the quarter in total? Complete the cash budget to determine how much cash will be collected in January, February, March and for the quarter in total. (Round your answers to the nearest whole dollar) Emerald Service Cash Collections Budget For the Months of January through March January Cash sales 6,080 Collection of credit sales 25% Month of sale 2,280 50% Month after 15% Two months after Total cash collectionsarrow_forwardFoyert Corporation requires a minimum $6,300 cash balance. Loans taken to meet this requirement cost 2% interest per month (paid at the end of each month). Any preliminary cash balance above $6,300 is used to repay loans at month-end. The cash balance on October 1 is $6,300, and the company has an outstanding loan of $2,300. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. Cash receipts Cash payments October $ 22,300 24,450 November $ 16,300 15,300 December $ 20,300 15,700 Prepare a cash budget for October, November, and December. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) FOYERT CORPORATION es Beginning cash balance Add: Cash receipts Total cash available Add: Cash payments for Interest on loan Total cash payments Preliminary cash balance Loan activity Additional loan (loan repayment) Ending cash…arrow_forwardDineshbhaiarrow_forward

- A company requires a minimum $12,400 cash balance at each month-end. If necessary, a loan is taken to meet this requirement at a cost of 1% interest per month (paid at the end of each month). Any preliminary cash balance above $12,400 is used to repay loans at month-end. The cash balance on March 1 is $12,400, and the company has no outstanding loans. Budgeted cash receipts from sales are: March, $26,000; April, $32,400; and May, $41,000. Budgeted cash payments (excluding loan or interest payments) are: March, $30,000; April, $30,200; and May, $32,400. Required: Prepare a cash budget for March, April, and May. Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar. Beginning cash balance Add: Cash receipts from sales Total cash available Add: Cash receipts from sales Total cash payments Preliminary cash balance Loan activity Additional loan (loan repayment) Ending cash balance Loan balance,…arrow_forwardJulia's Candy Co. reports the following information from its sales account and sales budget: Sales Expected Sales: O $30,000 O $82,500 O $112,500 O $120,000 May June July O $202,500 August September Cash sales are normally 25% of total sales and all credit sales are expected to be collected in the month following the date of sale. Based on the information from Julia's, the total amount of cash expected to be received from customers in September is: -O+ 14 B % F6 D $105,000 93,000 F7 $90,000 6 110,000 120,000 F8 & F9arrow_forwardSpartan Industries has budgeted the following information for January Cash Receipts $ 43,400 Beginning Cash Balance $ 16,400 Cash Payments $ 61,400 Desired Ending Cash Balance $ 11,400 If there is not enough cash on hand to meet the desired ending balance, the company borrows money from the bank. All cash is borrowed at the beginning of the month in $1,700 increments. Interest is paid monthly on the first day of the following month. The interest rate is 1 percent per month. The company had no debt before January 1 The shortage or surplus of cash before considering cash borrowed or interest payments in January would be a: Multiple Choice $1,600 shortage $9,800 shortage.arrow_forward

- The following is the sales budget for Yellowhead Inc. for the first quarter of 2021: January February $212,000 $232,000 March $255,000 Sales Credit sales are collected as follows: 70% in the month of the sale, 15% In the month after the sale, and 15% in the second month after the sale. The accounts receivable balance at the end of the previous quarter was $96,000 ($66,000 of which was uncollected December sales), a. Calculate the sales for November. (Omit "$" sign in your response.) November sales $ b. Calculate the sales for December. (Round the final answer to 2 decimal places. Omit "$" sign in your response.) $ December sales c. Calculate the cash collections from sales for each month from January through March. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit "$" sign in your response.) January February March Cash collections $ $ $arrow_forwardPrince Charles Island Company has expected sales of $6,000 in September, $10,000 in October, $16,000 in November, and $12,000 in December. Cash sales are 20 percent and credit sales are 80 percent of total sales. Historically, 40 percent of receivables are collected in the month after the sale, and the remaining 60 percent collected two months after. Assume that the company's cash payments for November are $13,000, and December $6,000. The beginning cash balance in November is $5,000, which is the desired minimum balance. a. Prepare a cash receipts schedule for November and December. Sales Credit sales Cash sales Collections in the month after credit sales Collections two months after credit sales Total cash receipts Prince Charles Island Company Cash Receipts Schedule September S Cash receipts Cash payments Net cash flow Prince Charles Island Company Cash Budget November Beginning cash balance Cumulative cash balance. Monthly loan or (repayment). Cumulative loan balance. Ending cash…arrow_forwardMiller Corporation has the following sales budget for the third quarter of 2021: Month Sales July $400,000 August $320,000 September $500,000 Historically, the following trend has been established regarding cash collection of sales: 60 percent of sales are paid in month of sale 35 percent of sales are paid in month following the sale 5 percent of sales are uncollectible and are written off in the month following the sale The expected total cash receipts for the month of September is: A. $300,000. B. $25,000. C. $112,000. D. $412,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education