Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

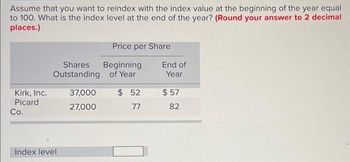

Transcribed Image Text:Assume that you want to reindex with the index value at the beginning of the year equal

to 100. What is the index level at the end of the year? (Round your answer to 2 decimal

places.)

Kirk, Inc.

Picard

Co.

Shares

Outstanding

Index level

37,000

27,000

Price per Share

Beginning

of Year

$ 52

77

End of

Year

$57

82

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- es Fegley, Incorporated, has an issue of preferred stock outstanding that pays a $6.10 dividend every year, in perpetuity. If this issue currently sells for $80.65 per share, what is the required return? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Required return %arrow_forwardExam What is the rate of return when 20 shares of Stock A, purchased for $15/share, are sold for $340? The commission on the sale is $6. Rate of Return [?] % Give your answer as a percent rounded to the nearest tenth. Enter s Corporation. All Rights Reserved.arrow_forwardComplete a pleasearrow_forward

- You purchased a stock at a price of $56.04. The stock paid a dividend of $2.31 per share and the stock price at the end of the year is $62.59. What is the capital gains yield? Multiple Choice 10.46% 15.81% 9.94% 4.12% 11.69%arrow_forwardYou have found the following stock quote for RJW Enterprises, Incorporated, in the financial pages of today's newspaper. 52-WEEK STOCK (DIV) YLD % PE VOLUME 100s CLOSE NET CHANGE HI LO 66.53 40.45 RJW 1.65 3.1 17 10 ?? -.51 a. What was the closing price for this stock that appeared in yesterday's paper? b. If the company currently has 23 million shares of stock outstanding, what was net income for the most recent four quarters?arrow_forwardYou are given the following information: Book value of stockholders' equity = $5 million; price/earnings ratio = 10; shares outstanding = 100,000; and the market/book ratio = .5. Calculate the market price of %3D a share of the company's stock. O $37.50 O $25.00 O $50.00 O $75.00 O $16.67arrow_forward

- Nonearrow_forwardXYZ's stock price and dividend history are as follows: Beginning-of-Year Price Year 2019 $ 110 2020 120 2021 100 2022 110 -1.34% -3.64% -2.58% -5.47% -0.37% Dividend Paid at Year- End $4 4 44 An investor buys three shares of XYZ at the beginning of 2019, buys another two shares at the beginning of 2020, sells one share at the beginning of 2021, and sells all four remaining shares at the beginning of 2022. What is the dollar-weighted rate of return? (Hint: Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2019, to January 1, 2022.arrow_forwardPlease no hand writing solutionarrow_forward

- Preferred Stock Rate of Return Nick's Enchiladas has preferred stock outstanding that pays a dividend of $3 at the end of each year. The preferred sells for $60 a share. What is the stock's required rate of return (assume the market is in equilibrium with the required return equal to the expected return)? Round the answer to two decimal places. %arrow_forwardXYZ stock price and dividend history are as follows: Beginning-of- $ 104 Year 2018 Year Price 2019 2020 2021 115 90 105 Dividend Paid at Year-End $ 2 2 2 2 An investor buys three shares of XYZ at the beginning of 2018, buys another one shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all three remaining shares at the beginning of 2021. Required: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Arithmetic time-weighted average returns Geometric time-weighted average returns % % b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. (Negative amounts should be indicated by a minus sign.) Date Cash Flow 01/01/2018 01/01/2019 01/01/2020 01/01/2021arrow_forwardacme Company has preferred stock outstanding. It pays an annual dividend of $20. If its current price is $70, what is the discount rate investors are using to value the stock? (Round answer to 2 decimal places, e.g. 52.75.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education