Concept explainers

Provide general discussion on predetermined variable

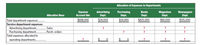

The following is a partially completed lower section of a departmental expense allocation for Cozy Bookstore. It reports the total amounts of direct and indirect expenses allocated to its five (5) departments. Allocate the expenses of the two service departments (advertising and purchasing) to the three operating departments and provide the complete income statement.

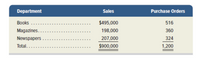

Advertising and purchasing department expenses are allocated to operating departments on the basis of dollar sales and purchase orders, respectively. Information about the allocation bases for the three operating departments follows.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. Marley's ManufacturingIncome StatementMonth Ending August 31, 2018 Dept. A Dept. B Sales $23,000 $50,000 Cost of goods sold 11,270 25,500 Gross profit $11,730 $24,500 Expenses: Utility expenses $1,380 $3,000 Wages expense 5,520 10,000 Costs allocated from corporate 2,070 14,000 Total expenses $8,970 $27,000 Operating income/(loss) in dollars $fill in the blank 1 $fill in the blank 2 Operating income/(loss) in percentage fill in the blank 3 % fill in the blank 4 %arrow_forwardWhich one of the following is not a step in allocating the support department cost to the production department? Select one: a. Trace all the overhead cost b. Divide the departments in to support and producing departments c. Undertake a breakeven analysis d. Divide the company in departmentsarrow_forwardHi-Tek Manufacturing, Incorporated, makes two industrial component parts-B300 and T500. An absorption costing income statement for the most recent period is shown below: Hi-Tek Manufacturing, Incorporated Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss Hi-Tek produced and sold 60,400 units of B300 at a price of $21 per unit and 12,800 units of T500 at a price of $39 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold $ 1,767,600 1,212,922 554,678 610,000 $ (55,322) 8300 T500 $ 400,300 $ 162,400 $ 120,100. $ 42,400 Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other…arrow_forward

- Part 1: Allocate the costs of the 3 service departments using the direct method. Part 2: Allocate the costs of the 3 service departments using the step method, with the order determined by the greater percentage usage. Part 3: Allocate the costs of the 3 service departments using the reciprical method. Part 4:What is one strength and one drawback of each of the methods?arrow_forwardActivity-based costing can be beneficial in allocating selling and administrative expenses to various products for managerial decision making. Which of the following would be the best allocation base for help desk costs? a. number of sales employees Ob. number of products sold c. number of calls Od. square footage of the help desk officearrow_forwardAssume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. Marley's ManufacturingIncome StatementMonth Ending August 31, 2018 Dept. A Dept. B Sales $21,000 $52,000 Cost of goods sold 9,870 27,040 Gross profit $11,130 $24,960 Expenses: Utility expenses $840 $3,120 Wages expense 5,040 10,920 Costs allocated from corporate 2,100 14,560 Total expenses $7,980 $28,600 Operating income/(loss) in dollars $fill in the blank 1 $fill in the blank 2 Operating income/(loss) in percentage fill in the blank 3 % fill in the blank 4 % Department B had…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education