FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

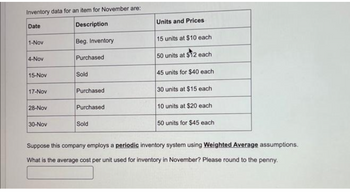

Transcribed Image Text:Inventory data for an item for November are:

Date

Description

1-Nov

4-Nov

15-Nov

17-Nov

28-Nov

30-Nov

Beg. Inventory

Purchased

Sold

Purchased

Purchased

Sold

Units and Prices

15 units at $10 each

50 units at $12 each

45 units for $40 each

30 units at $15 each

10 units at $20 each

50 units for $45 each

Suppose this company employs a periodic inventory system using Weighted Average assumptions.

What is the average cost per unit used for inventory in November? Please round to the penny.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- April 1 Beginning Inventory 100 units @ $4 April 2 Sales 50 units April 3 Purchases 300 units @ $6 April 10 Sales 250 units April 21 Purchases 400 units @ $8 April 28 Sales 200 units Assuming a periodic inventory system is used, what is cost of goods sold under FIFO? Select one: a. $2,400 b. $2,100 c. $3,000 d. $3,300arrow_forwardInventory Valuation Methods Inventory Data – June 1-30 June 1 Inventory 10 units @ $4.00 June 6 Purchase 10 units @ $6.00 June 13 Sale 12 units @ selling price of $10.00 June 20 Purchase 2 units @ $7.50 June 25 Sale 5 units @ selling price of $11.00 Required: Calculate ending inventory, cost of goods sold and gross profit for each inventory method below (assuming a perpetual inventory system): FIFO LIFO Which inventory method provides the highest profit? Which method provides the best income statement matching? Which method provides the better balance sheet valuation? Is a LIFO liquidation occurring?arrow_forwardsavitaarrow_forward

- X CengageNOWv2 | Online teachin X + com/ilm/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator assign... eBook Show Me How Weighted average cost flow method under perpetual inventory system The following units of a particular item were available for sale during the calendar year: Jan. 1 Inventory 9,000 units at $50.00 Mar. 18 Sale 7,000 units May 2 Purchase 8,000 units at $56.50 Aug. 9 Sale 8,000 units Oct. 20 Purchase A✩ 中 4,000 units at $60.00 The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in Exhibit 5. Round your "Unit Cost" answers to two decimal places. Weighted Average Cost Flow Method Goods Sold Cost ofarrow_forwardQuestion 16 Purchased Beginning Inventory May June July Units Available for Sale Units on Hand Units Sold in August $1,865 $1,805 $2,105 Beginning Inventory and Purchases Unit Cost $2,045 Units 115 125 65 20 325 165 160 $11 $12 $13 $15 Ending Inventory O Mark this question Total Cost Compute the correct Cost of Goods Sold in August using the FIFO method, based on the information above. $1,265 $1,500 $845 $300 $3,910 Cost of Units on Hand $ Cost of Goods Sold $arrow_forwardPerpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Copper are as follows: Mar. 1 Inventory 450 units at $7 6. Sale 390 units 13 Purchase 410 units at $8 25 Sale 340 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on March 25 and (b) the inventory on March 31. a. Cost of merchandise sold on March 25 5,450 X b. Inventory on March 31 1,040 V Feedback Check My Work a. When the FIFO method is used, costs are included in cost of merchandise sold in the order in which they were purchased. Think of your inventory in terms of "layers." Determine how much inventory remains from each layer after each sale. b. The ending inventory is made up of the most recent purchases. 12:59 AM 10/24/2020 ort sc delete T UD backspace TUY Vock T home H. enter pause M ctriarrow_forward

- nku.3arrow_forward1 ) Cost of goods sold 2 ) Ending inventory Follow FIFOarrow_forwardBeginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 24 units @ $10 5 Sale 17 units 17 Purchase 10 units @ $15 30 Sale 8 units Assuming a perpetual inventory system and the last-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale.$fill in the blank 1arrow_forward

- Date January 1 April 7 July 16 October 6 Transaction Beginning inventory Purchase Purchase Purchase Req 1a and b Number of Units 52 132 202 112 498 For the entire year, the company sells 432 units of inventory for $62 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are rising. Req 2a and b Req 1c and d Unit Cost Complete this question by entering your answers in the tabs below. $44 46 49 50 Req 3a and b Req 2c and d Using FIFO, calculate ending inventory and cost of goods sold. Cost of Goods Available for…arrow_forward7arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education