FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

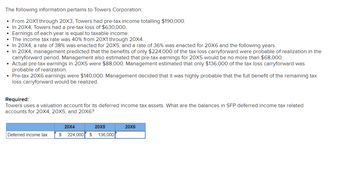

Transcribed Image Text:The following information pertains to Towers Corporation:

• From 20X1 through 20X3, Towers had pre-tax income totalling $190,000.

• In 20X4, Towers had a pre-tax loss of $630,000.

• Earnings of each year is equal to taxable income.

• The income tax rate was 40% from 20X1 through 20X4.

• In 20X4, a rate of 38% was enacted for 20X5, and a rate of 36% was enacted for 20X6 and the following years.

• In 20X4, management predicted that the benefits of only $224,000 of the tax loss carryforward were probable of realization in the

carryforward period. Management also estimated that pre-tax earnings for 20X5 would be no more than $68,000.

• Actual pre-tax earnings in 20X5 were $88,000. Management estimated that only $136,000 of the tax loss carryforward was

probable of realization.

• Pre-tax 20X6 earnings were $140,000. Management decided that it was highly probable that the full benefit of the remaining tax

loss carryforward would be realized.

Required:

Towers uses a valuation account for its deferred income tax assets. What are the balances in SFP deferred income tax related

accounts for 20X4, 20X5, and 20X6?

20X4

20X5

20X6

Deferred income tax

$ 224,000 $ 136,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The Costanza Corporation had the following transactions last year: Operating income $475,000 Interest received 37,000 Interest paid 75,000 Dividends received 44,000 Dividends paid 55,000 Assuming the state + federal tax rate of 25%, calculate Costanza's Taxable Income, Tax Liability and After-Tax Income.arrow_forwardI've tried everything I can and I still can't figure this out completely. Please help!arrow_forwardJohn Ulmus Corporation has $1,230,000 in taxable income for the year. A) Calculate the corporations tax liability for the yeararrow_forward

- The following information was taken from the accounting records of Lancer Inc, for the year ending 2020. Pretax accounting income $ 1,500,000 Interest Revenue on Municipal bonds 100,000 Litigation expense 2, 000,000 Excess Depreciation for tax purposes 1, 300,000 Deferred revenue 200,000 The tax rate for 2020 is 40% The total taxable income computed by Lancer for 2020 should be : A) $2,300,000 B) $4.900,000 C) $ 900,000 D) $3,700,000arrow_forwardA6arrow_forwardA corporation has the following taxable income in its first 5 years of operations: Tax year Taxable income Tax rate Income tax paid 20X1 150,000 35% 52,500 20X2 168,000 37% 62,160 20X3 192,000 35% 67,200 20X4 240,000 40% 96,000 20X5 (420,000 ) 38% Required: Prepare the journal entry to recognize the tax recovery in 20X5, assuming the company carries losses back to the earliest year allowed. (If no entry is required for a transaction/event, select "No journal entry required" in the first accounarrow_forward

- Please put all of the necessary information and computations for better understanding. Thanks ?arrow_forwardBluth, Inc. reported the following financial information: Taxable income for current year $200,000 Deferred tax liability, beginning of year 46,000 Deferred tax liability, end of year 57,000 Deferred tax asset, beginning of year 12,000 Deferred tax asset, end of year 18,000 Current and future years' tax rate 21% The current year's income tax expense is what amount?arrow_forwardLNS Corporation reports book income of $2,940,000. Included in the $2,940,000 is $17,500 of tax-exempt interest income. LNS reports $2,560,000 in ordinary and necessary business expenses. What is LNS Corporation's taxable income for the year? Answer is complete but not entirely correct. $ 640,000 Taxable incomearrow_forward

- Am.101.arrow_forwardSunshine Company has book income of $250,000. It also has tax depreciation in excess of book depreciation of $30,000 and $10,000 of interest on tax-exempt bonds. Without regard to tax expense, what is Sunshine's taxable income? $230,000. $210,000. $290,000. $270,000.arrow_forwardThornton, Inc., had taxable income of $129632 for the year. The company's marginal tax rate was 34 percent and its average tax rate was 24.7 percent. How much did the company have to pay in taxes for the year? a.30432 b.44075 c.30776 d.29074arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education