FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

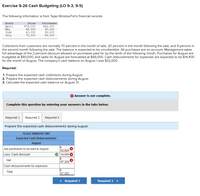

Transcribed Image Text:Exercise 9-26 Cash Budgeting (LO 9-3, 9-5)

The following information is from Tejas WindowTint's financial records.

Month

Sales

Purchases

April

May

June

July

$72,000

66,000

60,000

78,000

$42,000

48,000

36,000

54,000

Collections from customers are normally 70 percent in the month of sale, 20 percent in the month following the sale, and 9 percent in

the second month following the sale. The balance is expected to be uncollectible. All purchases are on account. Management takes

full advantage of the 2 percent discount allowed on purchases paid for by the tenth of the following month. Purchases for August are

budgeted at $60,000, and sales for August are forecasted at $66,000. Cash disbursements for expenses are expected to be $14,400

for the month of August. The company's cash balance on August 1 was $22,000.

Required:

1. Prepare the expected cash collections during August.

2. Prepare the expected cash disbursements during August.

3. Calculate the expected cash balance on August 31.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3

Prepare the expected cash disbursements during August.

TEJAS WINDOW TINT

Expected Cash Disbursements

August

July purchases to be paid in August

Less: Cash discount

52,920

14,400 O

Net

67,320

Cash disbursements for expenses

Total

67,320

< Required 1

Required 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Juneau limited purchases all of its inventory on credit and always pays suppliers in the month following the purchase in order to receive a 9% discount. The purchases in April were $56,383. What was the cash paid to suppliers in May?arrow_forwardConcord Book Warehouse Ltd. distributes hardcover books to retail stores. At the end of May, Concord's inventory consists of 240 books purchased at 18 each. Concord uses perpetual inventory system.Return rates in the book industry are high, with Concord experiencing a 15% return rate historically. During the month of June, the following merchandise transactions occured: B) Record the June transactions. To record sales To record cost of goods sold The part of this question must be completed in order. This part will be available when you completed in order. This part will be available when you complete the part above.arrow_forwardPrepare journal entries for the following credit card sales transactions (the company uses the perpetual inventory system). Sold $24,000 of merchandise, which cost $18,200, on Mastercard credit cards. Mastercard charges a 5% fee. Sold $5,400 of merchandise, which cost $3,200, on an assortment of bank credit cards. These cards charge a 4% fee.Please use the numbers in my question and place correct solution on journal sheet as rrequested in the assignment please.arrow_forward

- The records of Carla's Boutique report the following data for the month of April. Sales revenue $95,600 Purchases (at cost) $47,200 Sales returns 1,800 Purchases (at sales price) 85,800 Markups 9,500 Purchase returns (at cost) 1,800 Markup cancellations 1,400 Purchase returns (at sales price) 2,800 Markdowns 8,600 Beginning inventory (at cost) 36,103 Markdown cancellations 2,700 Beginning inventory (at sales price) 50,600 Freight on purchases 2,100 Compute the ending inventory by the conventional retail inventory method. (Round ratios for computational purposes to O decimal places, eg 78% and final answer to O decimal places, eg. 28,987.) Ending inventory using conventional retail inventory method 2$arrow_forwardAt the beginning of July, CD City has a balance in inventory of $3,400. The following transactions occur during the month of July.July 3 Purchase CDs on account from Wholesale Music for $2,300, terms 1/10, n/30.July 4 Pay cash for freight charges related to the July 3 purchase from Wholesale Music, $110.July 9 Return incorrectly ordered CDs to Wholesale Music and receive credit, $200.July 11 Pay Wholesale Music in full.July 12 Sell CDs to customers on account, $5,800, that had a cost of $3,000.July 15 Receive full payment from customers related to the sale on July 12.July 18 Purchase CDs on account from Music Supply for $3,100, terms 1/10, n/30.July 22 Sell CDs to customers for cash, $4,200, that had a cost of $2,500.July 28 Return CDs to Music Supply and receive credit of $300.July 30 Pay Music Supply in full.Required:1. Assuming that CD City uses a perpetual inventory system, record the transactions.2. Prepare the top section of the multiple-step income statement through gross profit…arrow_forwardDigital World is a retail store that sells cameras and photography supplies. The firm’s credit purchases and purchases returns and allowances transactions for June 20X1 appear below, along with the general ledger accounts used to record these transactions. The balance shown in Accounts Payable is for the beginning of June. June 1 Purchased instant cameras for $1,850 plus a freight charge of $130 from Pro Photo Equipment, Invoice 4241, dated May 27; the terms are 60 days net. 8 Purchased film for $1,374 from Photo Supplies, Invoice 1102, dated June 3, net payable in 45 days. 12 Purchased lenses for $896 from Nano Glass, Invoice 7282, dated June 9; the terms are 1/10, n/60. 18 Received Credit Memorandum 110 for $300 from Pro Photo Equipment for defective cameras that were returned; they were originally purchased on Invoice 4241, dated May 27. 20 Purchased color film for $1,000 plus freight of $55 from Photo Supplies, Invoice 1148, dated June 15, net…arrow_forward

- D. The following selected account balances were taken from the records of J. Gucela Company, for the month of January 20B. (VAT of 12% is billed separately). Purchases P100,000 10,000 5,000 80,000 6,000 7,000 Purchase Returns & Allowances Purchase Discounts Sales Sales Returns and Allowances Sales Discounts 3 - Required: 1. Compute the Input Tax 2. Compute the Output Tax 3. Compute the Prepaid Tax 4. Entry to close the Output Tax to Input Tax 5. Where do we show the Prepaid Tax in the Financial Statements?arrow_forwardThe Comet Company, Inc. uses the perpetual inventory system. Their credit terms are 2/10, n/30. They sell one product at a price of $500 and it costs Comet $300. Requirement: Prepare journal entries for the Comet Company, Inc. for the transactions listed below. On May 1, Comet sold 10 items of merchandise inventory to J. Miller on account. On May 2, Comet collected $23,520 cash from customer sales on credit in the prior month, all within the discount period. On May 3, Comet sold 5 items of merchandise to S. Wendell on account. On May 9, Comet receives payment from S. Wendell on the May 3 sale. On May 12, Comet receives payment from J. Miller on the May 1 sale. On May 14, S. Wendell returns one of the items purchased on May 3 for a cash refund because it was defective.arrow_forwardThe records of Ellen’s Boutique report the following data for the month of April. Sales revenue $99,000 Purchases (at cost) $48,000 Sales returns 2,000 Purchases (at sales price) 88,000 Markups 10,000 Purchase returns (at cost) 2,000 Markup cancellations 1,500 Purchase returns (at sales price) 3,000 Markdowns 9,300 Beginning inventory (at cost) 30,000 Markdown cancellations 2,800 Beginning inventory (at sales price) 46,500 Freight on purchases 2,400 Instructions Compute the ending inventory by the conventional retail inventory method. The records of Ellen’s Boutique report the following data for the month of April. Sales revenue $99,000 Purchases (at cost) $48,000 Sales returns 2,000 Purchases (at sales price) 88,000 Markups 10,000 Purchase returns (at cost) 2,000 Markup cancellations 1,500 Purchase returns (at sales price) 3,000 Markdowns 9,300…arrow_forward

- Concord Book Warehouse Ltd. distributes hardcover books to retail stores. At the end of May, Concord's inventory consists of 240 books purchased at $18 each. Concord uses a perpetual inventory system. Return rates in the book industry are high, with Concord experiencing a 15% return rate historically. During the month of June, the following merchandise transactions occurred: June 1 3 5 8 9 11 12 17 22 25 29 Purchased 180 books on account for $16 each from Reader's World Publishers, terms n/45. Sold 230 books on account to The Book Nook for $25 each, with an assumed average cost of $17, terms n/45. Received a $144 credit for 9 books returned to Reader's World Publishers. Sold 85 books on account to Read-A-Lot Bookstore for $25 each, with an assumed average cost of $17, terms n/45. Issued a $300 credit memorandum to Read-A-Lot Bookstore for the return of 12 damaged books. The books were determined to be no longer saleable and were destroyed. Purchased 130 books on account for $14 each…arrow_forwardJournalize the following entries for purchases, sales, and returns. Friends Hardware store made the following transactions during the month of March: DATE: MARCH TRANSACTIONS 2 12,000 in inventory was purchased on credit with a 2/13 n/30 term and FOB shipping point. 4 Merchandise for $400 of the purchase made on March 2 was returned because it was defective. 6 Paid shipping for the inventory purchased on March 2. 11 Sold inventory on credit to a customer for $5,000 with a sales term of 2/10 n/30. 12 Paid the purchase due for the March 2 purchase. 15 An allowance was offered to the customer on the March 11 purchase. 20 The customer who made the purchase on March 11 paid in full with the appropriate discounts.arrow_forwardok nces Bryant Company sells a wide range of inventories, which are initially purchased on account. Occasionally, short-term notes payable are used to obtain cash for current use. The following transactions were selected from those occurring during the year. a. On January 10, purchased merchandise on credit for $21,000. The company uses a perpetual inventory system. b. On March 1, borrowed $46,000 cash from City Bank and signed a promissory note with a face amount of $46,000, due at the end of six months, accruing interest at an annual rate of 6.50 percent, payable at maturity, Required: 1. For each of the transactions, indicate the accounts, amounts, and effects on the accounting equation 2. What amount of cast, is paid on the maturity date of the note? 3. Indicate the impact of each transaction (increase, decrease, and no effect) on the debt-to-assets ratio. Assume Bryant Company had $360,000 in total liabilities and $560,000 in total assets, yielding a debt-to-assets ratio of 0.64,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education