FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

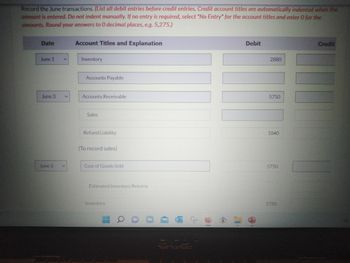

Transcribed Image Text:Record the June transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the

amounts. Round your answers to 0 decimal places, e.g. 5,275.)

Date

June 1

June 3

June 3

V

Account Titles and Explanation

Inventory

Accounts Payable

Accounts Receivable

Sales

Refund Liability

(To record sales)

Cost of Goods Sold

Estimated Inventory Returns

Inventory

HA

2

10

1

Debit

2880

5750

1840

5750

5750

Credit

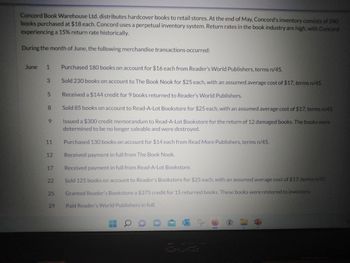

Transcribed Image Text:Concord Book Warehouse Ltd. distributes hardcover books to retail stores. At the end of May, Concord's inventory consists of 240

books purchased at $18 each. Concord uses a perpetual inventory system. Return rates in the book industry are high, with Concord

experiencing a 15% return rate historically.

During the month of June, the following merchandise transactions occurred:

June

1

3

5

8

9

11

12

17

22

25

29

Purchased 180 books on account for $16 each from Reader's World Publishers, terms n/45.

Sold 230 books on account to The Book Nook for $25 each, with an assumed average cost of $17, terms n/45.

Received a $144 credit for 9 books returned to Reader's World Publishers.

Sold 85 books on account to Read-A-Lot Bookstore for $25 each, with an assumed average cost of $17, terms n/45.

Issued a $300 credit memorandum to Read-A-Lot Bookstore for the return of 12 damaged books. The books were

determined to be no longer saleable and were destroyed.

Purchased 130 books on account for $14 each from Read More Publishers, terms n/45.

Received payment in full from The Book Nook.

Received payment in full from Read-A-Lot Bookstore.

Sold 125 books on account to Reader's Bookstore for $25 each, with an assumed average cost of $17, terms n/45.

Granted Reader's Bookstore a $375 credit for 15 returned books. These books were restored to inventory.

Paid Reader's World Publishers in full.

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane Enterprises uses a periodic inventory system for buckets it sells. It had a beginning inventory on April 1 of 72 units at a cost of $ 6 per unit. During April, the following purchases and sales were made. Purchases April 7 62 units at $ 7.00 13 124 units at $ 8.00 23 94 units at $ 9.00 29 52 units at $ 10.00 332 Sales April 5 124 units at $ 20 11 94 units at $ 20 20 84 units at $ 20 30 42 units at $ 20 344 Compute the April 30 ending inventory and April cost of goods sold under (a) average cost, (b) FIFO, and (c) LIFO. (Round cost per unit to 2 decimal places, e.g. 15.25 and final answer to 0 decimal places, e.g. 1,525.)arrow_forwardSwifty Distribution markets CDs of numerous performing artists. At the beginning of March, Swifty had in beginning inventory 3,900 CDs with a unit cost of $7. During March, Swifty made the following purchases of CDs. March 5 March 13 (1) 4,875 @ $8 6,825 @ $9 (2) During March 21,000 units were sold. Swifty uses a periodic inventory system. ✓ Which cost flow method results in (1) the highest inventory amount for the balance sheet and (2) the highest cost of goods sold for the income statement? FIFO LIFO March 21 Average-cost March 26 eTextbook and Media 7,850 $10 5,800 @ $11 produces the highest inventory amount for the balance sheet, $ produces the highest cost of goods sold on the income statement, $arrow_forwardConcord Book Warehouse Ltd. distributes hardcover books to retail stores. At the end of May, Concord's inventory consists of 240 books purchased at 18 each. Concord uses perpetual inventory system.Return rates in the book industry are high, with Concord experiencing a 15% return rate historically. During the month of June, the following merchandise transactions occured: B) Record the June transactions. To record sales To record cost of goods sold The part of this question must be completed in order. This part will be available when you completed in order. This part will be available when you complete the part above.arrow_forward

- The records of Carla's Boutique report the following data for the month of April. Sales revenue $95,600 Purchases (at cost) $47,200 Sales returns 1,800 Purchases (at sales price) 85,800 Markups 9,500 Purchase returns (at cost) 1,800 Markup cancellations 1,400 Purchase returns (at sales price) 2,800 Markdowns 8,600 Beginning inventory (at cost) 36,103 Markdown cancellations 2,700 Beginning inventory (at sales price) 50,600 Freight on purchases 2,100 Compute the ending inventory by the conventional retail inventory method. (Round ratios for computational purposes to O decimal places, eg 78% and final answer to O decimal places, eg. 28,987.) Ending inventory using conventional retail inventory method 2$arrow_forwardConcord Distribution markets CDs of numerous performing artists. At the beginning of March, Concord had in beginning inventory 2,390 CDs with a unit cost of $7. During March, Concord made the following purchases of CDs. March 5 2,030 @ $8 March 21 5,060 @ $10 March 13 3,260 @ $9 March 26 1,800 @ $11 During March 11,470 units were sold. Concord uses a periodic inventory system. Determine the cost of goods available for sale. The cost of goods available for sale $4 Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). (For calculation purposes, round average cost to 3 decimal places, e.g. 5.275. Round answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST The ending inventory %24 $4 24 The cost of goods sold $4 2$ 24 Which cost flow method results in (1) the highest inventory amount for the balance sheet and (2) the highest cost of goods sold for the income statement? (1) produces the highest…arrow_forwardOn May 1, Blossom Company had 380 units of inventory on hand, at a cost of $4.00 each. The company uses a perpetual inventory system. All purchases and sales are on account. A record of inventory transactions for the month May for the company is as follows: May 4 (a) 14 29 Purchases 1,400 @ $4.00 740 @ 400 @ $4.64 $4.30 Cost of goods sold Ending inventory $ May 3 $ 16 18 Sales Calculate the cost of goods sold and ending inventory using FIFO. FIFO $7.00 1,000 @ $7.00 260 @ 520 @ $7.50arrow_forward

- The records of Ellen’s Boutique report the following data for the month of April. Sales revenue $99,000 Purchases (at cost) $48,000 Sales returns 2,000 Purchases (at sales price) 88,000 Markups 10,000 Purchase returns (at cost) 2,000 Markup cancellations 1,500 Purchase returns (at sales price) 3,000 Markdowns 9,300 Beginning inventory (at cost) 30,000 Markdown cancellations 2,800 Beginning inventory (at sales price) 46,500 Freight on purchases 2,400 Instructions Compute the ending inventory by the conventional retail inventory method. The records of Ellen’s Boutique report the following data for the month of April. Sales revenue $99,000 Purchases (at cost) $48,000 Sales returns 2,000 Purchases (at sales price) 88,000 Markups 10,000 Purchase returns (at cost) 2,000 Markup cancellations 1,500 Purchase returns (at sales price) 3,000 Markdowns 9,300…arrow_forwardAt the beginning of November, Yoshi Inc.’s inventory consists of 64 units with a cost per unit of $96. The following transactions occur during the month of November. November 2 Purchase 80 units of inventory on account from Toad Inc. for $100 per unit, terms 1/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $320. November 9 Return 16 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Inc. in full. November 16 Sell 100 units of inventory to customers on account, $12,600. [Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $5 per unit for freight less $1 per unit for the purchase discount, or $104 per unit.] November 20 Receive full payment from customers related to the sale on November 16. November 21 Purchase 56 units of inventory from Toad Inc. for $106 per unit, terms 3/10, n/30. November 24 Sell 70 units of inventory to…arrow_forwardZ-Mart uses the perpetual inventory system and has its own credit card. Z-Mart charges a per-month interest fee for any unpaid balance on its store credit card at each month-end. Apr. 30 -Mart sold merchandise for \$1,001 (that had cost $650) and accepted the customer'a -store credit card. May 31 -Mart recorded $4 of interest earned from its store credit card ap of this month-end.arrow_forward

- Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug.1 Inventory on hand—2,200 units; cost $6.30 each. 8 Purchased 11,000 units for $5.70 each. 14 Sold 8,800 units for $12.20 each. 18 Purchased 6,600 units for $5.20 each. 25 Sold 7,800 units for $11.20 each. 28 Purchased 4,200 units for $5.80 each. 31 Inventory on hand—7,400 units. 2. Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 31, 2021, balance sheet and the cost of goods sold it would report in its August 2021 income statement using the Average cost method. (Round "Average Cost per Unit" to 2 decimal places.)arrow_forwardTravel Warehouse Ltd. distributes suitcases to retail stores. At the end of June, Travel Warehouse's inventory consisted of 60 suitcases purchased at $50 each. Travel Warehouse uses a perpetual inventory system. During the month of July, the following merchandising transactions occurred: July 2. July 3. July 6. July 7. July 9. July 11. July 13. July 16. July 17. July 20. July 27. Purchased 75 suitcases on account for $60 each from Trunk Manufacturers Ltd., terms 2/10, n/30. Received a $240 credit from Trunk Manufacturers after returning four suitcases because they were damaged. Sold 55 suitcases on account to Satchel World Inc. for $90 each, with an average cost of $50, terms 2/15, n/45. Issued a $270 credit for three suitcases returned by Satchel World because they were the wrong model. The suitcases were returned to inventory. Sold three suitcases this time the right model number on account to Satchel World Inc. for $100 each, with an average cost of $60, terms 2/15, n/45. Paid Trunk…arrow_forwardThornton Books buys books and magazines directly from publishers and distributes them to grocery stores. The wholesaler expects to purchase the following inventory: April May June Required purchases (on account) $ 113,000 $ 133,000 $ 145,000 Thornton Books’s accountant prepared the following schedule of cash payments for inventory purchases. Thornton Books’s suppliers require that 90 percent of purchases on account be paid in the month of purchase; the remaining 10 percent are paid in the month following the month of purchase. Required Complete the schedule of cash payments for inventory purchases by filling in the missing amounts. Determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education