FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

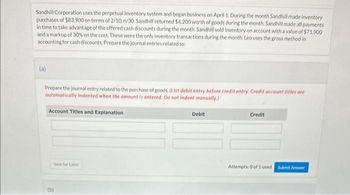

Transcribed Image Text:Sandhill Corporation uses the perpetual inventory system and began business on April 1. During the month Sandhill made inventory

purchases of $83,900 on terms of 2/10, n/30. Sandhill returned $4,200 worth of goods during the month. Sandhill made all payments

in time to take advantage of the offered cash discounts during the month. Sandhill sold inventory on account with a value of $71,900

and a markup of 30% on the cost. These were the only inventory transactions during the month. Leo uses the gross method in

accounting for cash discounts. Prepare the journal entries related to:

(a)

Prepare the journal entry related to the purchase of goods. (List debit entry before credit entry. Credit account titles are

automatically indented when the amount is entered. Do not indent manually.)

Account Titles and Explanation

Save for Later

(b)

Debit

Credit

Attempts: 0 of 1 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardJordache Corp. uses a perpetual inventory system and sells merchandise on account to Polo Limited for $2.000 on February 2, terms n/10. Management expects returns of 10%. The goods cost Jordache $800. On February 5, Polo returns merchandise worth $500 to Jordache. This merchandise costs $300 and is still in saleable condition; therefore, it was put back into inventory. On February 9, Jordache receives payment from Polo for the balance due. Identify the journal entry that Jordache needs to record for the sale of the merchandise on February 2. Accounts Receivable Sales Refund Liability Cash Accounts Receivable Accounts Receivable Sales Accounts Receivable Sales 2,000 1,800 1.800 2,000 1,800 200 1,800 1,800 2,000arrow_forwardAt the beginning of the year, Culver Shipping Ltd., a company that has a perpetual inventory system, had $49,500 of inventory. During the year, inventory costing $198,000 was purchased. Of this, $23,300 was returned to the supplier and a 5% discount was taken on the remainder. Freight costs incurred by the company for inventory purchases amounted to $2,410. The cost of goods sold during the year was $196,400. (a) Determine the balance in the Inventory account at the end of the year. Balance in the inventory account $ eTextbook and Media List of Accounts GA Save for Later Attempts: 0 of 3 used Submit Answerarrow_forward

- Jillet Corporation began the year with inventory of 24,000 units of its only product. The units cost $8 each. The company uses a perpetual inventory system and the FIFO cost method. The following transactions occurred during the year: Purchased 120,000 additional units at a cost of $10 per unit. Terms of the purchases were 210/210 , n30/�30 . The company uses the gross method to record purchase discounts. The inventory was purchased f.o.b. shipping point and additional freight costs of $0.50 per unit were charged to Jillet. 2,400 units purchased during the year were returned to suppliers for credit. Jillet was also given credit for the freight charges of $0.50 per unit on the original purchase. The units were defective and were returned two days after they were received. The remaining inventory was paid within the discount period. (Hint: The discount applies only to inventory and not the freight.) Sales for the year totaled 115,000 units at $18 per unit. (Hint: The cost of the…arrow_forwardJillet Corporation began the year with inventory of 12,000 units of its only product. The units cost $8 each. The company uses a perpetual inventory system and the FIFO cost method. The following transactions occurred during the year: a. Purchased 60,000 additional units at a cost of $10 per unit. Terms of the purchases were 2/10. "/30. The company uses the gross method to record purchase discounts. The inventory was purchased f.o.b. shipping point and additional freight costs of $0.50 per unit were charged to Jillet. b. 1,200 units purchased during the year were returned to suppliers for credit. Jillet was also given credit for the freight charges of $0.50 per unit on the original purchase. The units were defective and were returned two days after they were received. The remaining inventory was paid within the discount period. (Hint: The discount applies only to inventory and not the freight.) c. Sales for the year totaled 55,000 units at $18 per unit. (Hint: The cost of the inventory…arrow_forwardMarigold Corporation uses a perpetual inventory system and had inventory worth $73,500 at the beginning of the year. Purchases were made during the year for $323,000; however, 10% of these goods were returned to the supplier, and a 3% discount was taken on the remaining balance owing. Marigold paid $2,500 cash for freight to ship the inventory to its location during the year. Marigold reported cost of goods sold for the year of $245,000. Marigold has a calendar year end. What is the balance in the inventory account at the end of the year? Balance $arrow_forward

- John's Specialty Store uses a perpetual inventory system. The following are some inventory transactions for the month of May: 1. John's purchased merchandise on account for $5,500. Freight charges of $550 were paid in cash. 2. John's returned some of the merchandise purchased in (1). The cost of the merchandise was $850 and John's account was credited by the supplier. 3. Merchandise costing $3,050 was sold for $5,700 in cash. Required: Prepare the necessary journal entries to record these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 2 3 4 5 Record the merchandise purchased on account for $5,500. Note: Enter debits before credits. Transaction General Journal Debit Credit 1a Record entry Clear entry View general journal 1b Record the payment of freight charges for $55o. 2. Record the return of merchandise purchased on account costing $850. 3a. Record the sale of merchandise for…arrow_forwardFreedman Company estimates that sales this year of $12,000 will be returned next year and customers will be granted a full refund. Which of the following journal entries would Freedman Company record as part of its year-end adjustments assuming it uses the perpetual inventory system? a.Debit Estimated Returns Inventory for $12,000 and credit Income Summary for $12,000 b.Debit Sales Returns and Allowances for $12,000 and credit Cost of Goods Sold for $12,000 c.Debit Inventory Short and Over for $12,000 and credit Merchandise Inventory for $12,000 d.Debit Sales Returns and Allowances for $12,000 and credit Customer Refunds Payable for $12,000arrow_forwardCamino Jet Engines, Inc. Is a supplier of jet engine parts. The company began the most reecent Fiscal Year with inventory of 75 units. The units cost 8,500 each. The company uses a perpetual inventory system to account for inventory. The following transactions occurred during the year. a. Purchases 50 additional units at a cost of $8,900 per unit. Terms of the purchases were 2/10, n/30, and payments was made within 10-days discount period. The company uses the gross method to record purchase discounts. The merchandise was purchased f.o.b shipping point. The company paid freight charges of $500 per unit b. 6 of the units purchased during the year were returned to the manufacturer for credit. The company were also given credit for the freight charges of $500 per unit it had paid on the original purchase. The units were defective and were returned two days after they were received c. Sales for the year totaled…arrow_forward

- Longmire & Sons made sales on credit to Alderman Sports totaling $500,000 on April 18. The cost of the goods sold is $400,000. Longmire estimates 3% of its sales to Alderman may be returned. On May 22, $9,000 worth of goods (with a cost of $7,200) are returned by Alderman. Longmire uses a periodic inventory system.arrow_forwardIρngmire & Sons made sales On credit to Alderman Sports totaling $500,000 On April 18. The cost of the goods sold is $400,000. Longmire estimates 3% of its sales to Alderman may be returned. On May 22, $9 ,000 worth of goods (with a cost of $7,200) are returned by Alderman. Iρngmire uses a periodic inventory system. Prepare the related journal entries for Longmire & Sons.arrow_forward10) The company recorded cash sales for an additional 12) 20 pairs of shoes for $65 each on the 24th of the month. 11) On the last day of the month, the company estimated sales returns for their sales. They estimate that 2% of sales will be returned. (Hint: use total sales from above) Prepare the appropriate journal entries for each transaction under a perpetual inventory system.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education