FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

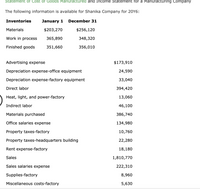

Transcribed Image Text:Statement of Cost of Goods Manufactured and Income Statement for a Manufacturing Company

The following information is available for Shanika Company for 20Y6:

Inventories

January 1

December 31

Materials

$203,270

$256,120

Work in process

365,890

348,320

Finished goods

351,660

356,010

Advertising expense

$173,910

Depreciation expense-office equipment

24,590

Depreciation expense-factory equipment

33,040

Direct labor

394,420

Heat, light, and power-factory

13,060

Indirect labor

46,100

Materials purchased

386,740

Office salaries expense

134,980

Property taxes-factory

10,760

Property taxes-headquarters building

22,280

Rent expense-factory

18,180

Sales

1,810,770

Sales salaries expense

222,310

Supplies-factory

8,960

Miscellaneous costs-factory

5,630

Transcribed Image Text:Shanika Company

Income Statement

For the Year Ended December 31, 20Y6

Cost of good sold:

Operating expenses:

Administrative expenses:

Selling expenses:

Total operating expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost data for Johnstone Manufacturing Company for th month ended March 31 are as follows: Inventories Materials Work in process Finished goods March 1 $199,500 131,670 101,750 Direct labor Materials purchased during March Factory overhead incurred during March: Indirect labor Machinery depreciation Heat, light, and power Supplies Property taxes Miscellaneous costs Direct materials: March 31 Factory overhead: $173,570 114,560 118,030 $359,100 383,040 a. Prepare a cost of goods manufactured statement fo March. Cost of goods manufactured Johnstone Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended March 31 38,300 23,140 Total factory overhead Total manufacturing costs incurred during March Total manufacturing costs 7,980 6,380 5,590 10,370 00 $ $ b. Determine the cost of goods sold for March.arrow_forwardThe accounting records of Bass SARL contain the following information: Raw Materials Used: $68,479 Direct Labor: $135,657 Manufacturing Overhead Incurred: $345,835 Work-in-Process inventory, Jan 1: $50,492 Work-in-Process inventory, Dec 31: $75,228 Finished Goods inventory, Jan 1: $172,181 Finished Goods inventory, Dec 31: $149,204 What is Cost of Goods Manufactured for the year?arrow_forwardNBGLIR982 Corp's reported data for the month: Inventories: Raw materials (All Direct Materials) Work in process Finished goods (ID#65926) Additional information for NBGLIR982: Raw materials purchases Direct labor cost Beginning $38,600 $20,200 $53,800 $69,700 $72,900 Ending $18,800 $16,800 $71,500 Manufacturing overhead cost actually incurred $49,200 Manufacturing overhead cost applied to Work in Process $47,100 (Baruch College Exam) Q) What is the adjusted cost of goods sold that appears on NBGLIR982's income statement for the month? A) $arrow_forward

- Statement of Cost of Goods Manufactured for a Manufacturing Company Cost data for Sandusky Manufacturing Company for the month ended January 31 are as follows: Inventories January 1 January 31 Materials $178,500 $155,300 Work in process 117,810 102,500 Finished goods 91,040 104,050 Direct labor $321,300 Materials purchased during January 342,720 Factory overhead incurred during January: Indirect labor 34,270 Machinery depreciation 20,710 Heat, light, and power 7,140 Supplies 5,710 Property taxes 5,000 Miscellaneous costs 9,280 a. Prepare a cost of goods manufactured statement for January. Sandusky Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended January 31arrow_forwardRaw Materials Used: $84,404 Direct Labor: $143,978 Manufacturing Overhead Incurred: $324,608 Work-in-Process inventory, Jan 1: $53,982 Work-in-Process inventory, Dec 31: $75,011 Finished Goods inventory, Jan 1: $181,914 Finished Goods inventory, Dec 31: $147,712 What is Cost of Goods Manufactured for the year?arrow_forwardA company compiled the following information for the current year. (Assume that all raw materials used were direct materials.) Raw materials inventory, January 1 Raw materials inventory, December 31 Work in process, January 1 Work in process, December 31 Finished goods, January 1 Finished goods, December 31 Raw materials purchases Direct labor Factory utilities Indirect labor Factory depreciation Operating expenses 000 $20000 40000 $4032000. $4048000. $4008000. $4046000. 18000 12000 40000 32000 1800000 760000 150000 50000 400000 If the cost of goods manufactured is $4040000, what is cost of goods sold for the period? 420000arrow_forward

- Statement of Cost of Goods Manufactured for a Manufacturing Company Cost data for Sandusky Manufacturing Company for the month ended January 31 are as follows: Inventories January 1 January 31 Materials $151,500 $128,780 Work in process 101,510 86,280 Finished goods 77,270 86,280 Direct labor $272,700 Materials purchased during January 290,880 Factory overhead incurred during January: Indirect labor 29,090 Machinery depreciation 17,570 Heat, light, and power 6,060 Supplies 4,850 Property taxes 4,240 Miscellaneous costs 7,880 a. Prepare a cost of goods manufactured statement for January. Sandusky Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended January 31 $fill in the blank 9dc536060f91fdb_2 Direct materials: $fill in the blank 9dc536060f91fdb_4 fill in the blank 9dc536060f91fdb_6 $fill in the blank 9dc536060f91fdb_8 fill in the blank…arrow_forwardgjknjhvhkarrow_forwardThe following information is available for Robstown Corporation for 20Y8: Inventories January 1 December 31 Materials $78,750 $94,450 Work in process 108,600 96,800 Finished goods 113,750 109,100 December 31 Advertising expense $ 69,000 Depreciation expense-office equipment 22,750 Depreciation expense-factory equipment 14,860 Direct labor 184,350 Heat, light, and power-factory 5,950 Indirect labor 24,600 Materials purchased 122,200 Office salaries expense 77,750 Property taxes-factory 4,170 Property taxes-office building 13,200 Rent expense-factory 6,675 Sales 862,000 Sales salaries expense 138,500 Supplies-factory 5,000 Miscellaneous costs-factory 5,280 Required: a. Prepare the 20Y8 statement of cost of goods manufactured. For those boxes in which you must enter subtracted or negative numbers use a minus sign.* b. Prepare the 20Y8 income statement. *Refer to the Amount Descriptions list…arrow_forward

- The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Garcon Company Pepper Company Finished goods inventory, beginning $ 13,000 $ 16,600 Work in process inventory, beginning 18,500 23,400 Raw materials inventory, beginning 11,600 9,750 Rental cost on factory equipment 32,000 26,350 Direct labor 22,000 44,600 Finished goods inventory, ending 20,900 15,500 Work in process inventory, ending 24,700 16,600 Raw materials inventory, ending 6,400 7,400 Factory utilities 10,050 13,000 General and administrative expenses 34,500 55,000 Indirect labor 13,900 14,480 Repairs—Factory equipment 7,100 1,950 Raw materials purchases 46,000 58,000 Selling expenses 52,000 59,500 Sales 290,490 380,970 Cash 21,000 16,200 Accounts receivable, net 13,600 21,450 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31.2. Complete the…arrow_forwardQuestion: The accounting records of Dolphin Company revealed the following information: Total manufacturing costs $780,000 Work-in-process inventory, Jan. 1 81,000 Work-in-process inventory, Dec. 31 103,000 Finished goods inventory, Jan. 1 171,000 148,000 Finished goods inventory, Dec. 31 What is Dolphin's cost of goods sold?arrow_forwardces The following transactions occurred during April: (a) Purchased materials on account at a cost of $232,870. (b) Requisitioned materials at a cost of $111,500, of which $15,700 was for general factory use. (c) Recorded factory labor of $224,300, of which $42,775 was indirect. (d) Incurred other costs: Selling expense Factory utilities Administrative expenses Factory rent Factory depreciation $35,900 24,600 50,750 11,700 20,600 (e) Applied overhead at a rate equal to 144 percent of direct labor cost. (f) Completed jobs costing $262,350. (g) Sold jobs costing $324,070. (h) Recorded sales revenue of $513,000. Required: 1. & 2. Post the April transactions to the T-accounts and compute the balance in the accounts at the end of April. (Post each transaction (d) cost separately. Round your answers to 2 decimal places.) 3-a. Compute over- or underapplied manufacturing overhead. (Round your answer to 2 decimal places.) 3-b. If the balance in the Manufacturing Overhead account is closed…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education