Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Thanksu pls help me

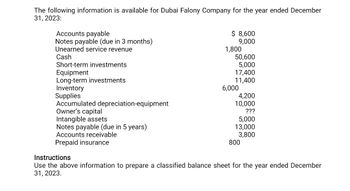

Transcribed Image Text:The following information is available for Dubai Falony Company for the year ended December

31, 2023:

Accounts payable

Notes payable (due in 3 months)

Unearned service revenue

Cash

$ 8,600

9,000

1,800

50,600

Short-term investments

5,000

Equipment

17,400

Long-term investments

11,400

Inventory

6,000

Supplies

4,200

Accumulated depreciation-equipment

10,000

Owner's capital

???

Notes payable (due in 5 years)

Intangible assets

Accounts receivable

Prepaid insurance

Instructions

Use the above information to prepare a classified balance sheet for the year ended December

31, 2023.

5,000

13,000

3,800

800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information was extracted from the records of SydMel Ltd for the year ended30 June 2021.SydMel LtdStatement of Financial Position (Extract)As at 30 June 2021AssetsAccounts receivables $26,000Allowance for doubtful debts 2,500 $23,500Equipment 150,000Accumulated depreciation – Equipment (20% per year) 30,000 120,000LiabilitiesInterest Payable 2,000 2,000Provision for employee benefits 5,000 5,000Additional information• The allowed deductible tax depreciation rate for Equipment is 25%.• None of the employee benefits has been paid. It is not deductible for tax purposes untilit is actually paid.• The tax rate is 30%.Requireda. Prepare a deferred tax worksheet to identify the temporary differences arising inrespect of the assets and liabilities in the statement of financial position, and tocalculate the balance of the deferred tax liability and deferred tax asset accounts at30 June 2021. Assume the opening balances of the deferred tax accounts were $3,000for Deferred Tax…arrow_forwardPlease SHOw your workarrow_forwardAssets Current assets Net fixed assets INCOME STATEMENT, 2022 (Figures in $ millions) Revenue Cost of goods sold Depreciation Interest expense 2021 $ 101 2022 $ 195 910 1,010 $ 2,005 1,085 405 251 Req A and B Req C and D BALANCE SHEET AT END OF YEAR (Figures in $ millions) Liabilities and Shareholders' Equity Current liabilities Long-term debt Req E Complete this question by entering your answers in the tabs below. a&b. What is shareholders' equity in 2021 and 2022? c&d. What is net working capital in 2021 and 2022? e. What are taxes paid in 2022? Assume the firm pays taxes equal to 21% of taxable income. f. What is cash provided by operations during 2022? g.Net fixed assets increased from $910 million to $1,010 million during 2022. What must have been South Sea's gross investment in fixed assets during 2022? Answer is complete but not entirely correct. h. If South Sea reduced its outstanding accounts payable by $46 million during the year, what must have happened to its other current…arrow_forward

- A company provides the following information for the year 2018: Description Description Mortgage payable (due 2021) $32,510 |Unearned revenue Amount Amount Cash $9,950| $17,500 Accounts payable $950 Temporary investments Inventory $16,750 |(to be sold within 3 $6,150 months) Accumulated depreciation Equipment Common shares Prepaid rent $97,500 $15,940 $9,500 $217,500 $50,000 Retained earnings $1,350 Salaries payable $23,750| |Long-term notes payable Accounts receivables $47,500 Compute the current liabilities for the company. a. $58,900 b. $42,960 c. $57,000 d. $57,950arrow_forwardThe current ratio including transaction c. is The debt ratio including transaction c is screenshots attached thank youarrow_forwardS Find online the annual 10 - K report for Costco Wholesale Corporation (COST) for September 28, 2023 f. Did the company have any contingent liabilities at the balance sheet date? Discuss the specific nature of these contingencies and how (or whether) they are expected to affect the firm's financial health h ASSEN s Ope TOTAL ASSETS CURRENT LIABILITIES LABILITIES AND EQUITY A Der Cap OTT L se org TOTAL LIATES COMMITMENTS AND CONTINGENCIES COUNTY 10 suhted this Consescanda Talk sil TOTAL LIABUTES AND EQUITY 2/12 3/18 2241 17667 Sa 24741 2/14 4 04.15 17482 s 52.545 2321 7301 топ 2337 2174 1.589 22 5611 TRE 3377 242 2482 2555 2.558 BUX 4351 = - 2 7.340 084 138931 21842 25194 21547 94111arrow_forward

- Balance Sheet as at As at 30/9/16 As at 30/9/15 $ $ Assets Current assets- Cash 8,200 9,400 Accounts Receivable 107,000 103,500 Inventory 82,700 71,300 Non-current assets less accumulated depreciation 242,600 245,700 Total assets 440,500 429,900 Liabilities and Owners' equity Current liabilities 117,000 120,000 Loan (repayable in 2019) 152,000 150,000 Total liabilities 269,000 270,000 Owners' equity 171,500 159,900 Total Liabilities and Owners' equity 440,500 429,900 Summarised Income Statement of Bishan Enterprise for the year ended 30 September 2016 $ Sales 990,000 Cost of goods sold 580,000 Gross profit 410,000 Operating expenses 350,000 Net profit 60,000 · Note - The owner withdrew $48,400 during 2016. Required: Calculate…arrow_forwardA partial amortization schedule for a 5-year note payable that Mabry Company issued on January 1, 2018, is shown as follows. AccountingPeriod PrincipalBalance January 1 CashPayment Applied toInterest Applied toPrincipal 2018 $ 123,000 $ 31,622 $ 11,070 $ 20,552 2019 102,448 31,622 9,220 22,402 2020 80,046 31,622 7,204 24,418 What is the amount of interest expense on this loan for 2021?arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forward

- Solar Electric Inc. Balance Sheet 32 Marks ACB As at December 31, 2023 Account Title Debit Credit Assets Current Assets Cash 100,649 Accounts Receivable 35,860 Interest Rceivable 9,113 Prepaid Insurance 7,370 Short-Term Investment- Citi Inc 237,000 Short-Term Investment- Bonds 135,000 Inventory 90,640 Valuation Allowance for Fair Value Adjustment 50,700 Total Current Assets 666,332 Non-current Assets Investment in HSBC Inc. Common Shares 503,840 Long-Term Investment- Bond 145,000 Property, Plant & Equipment 280,000 Accumulated Depreciation 86,000 Total Non-Current Assets 842,840 Total Assets 1,509,172 Liabilities Current Liabilities Accounts Payable 212,400 Interest Payable 31,167 Unearned Revenue 21,000 Total Current Liabilities 264,567 Long-Term Liabilities Bonds Payable 340,000 Discount on Bonds Payable 15,741 Bank Loan 225,000 Total-Long Term Liabilities 549,259 Total Liabilities 813,826 Shareholders Equity Common Shares 362,000 Preferred Shares 80,000 Retained Earnings 348,385…arrow_forwardThe 2025 Annual Report of Indigo International contains the following information: (in millions) Total assets Total liabilities Net sales Net income (a) (b) (c) June 29, 2025 $1,456 1,130 2,485 Save for Inte 129 June 27, 2024 $1,436 Compute the following ratios for Indigo International for 2025: 1,157 2,663 137 Asset turnover ratio. (Round answer to 3 decimal places, e.g. 0.851 times.) Rate of return on assets. (Round answer to 2 decimal places, e.g. 4.87.) Profit margin on sales. (Round answer to 2 decimal places, e.g. 4.87 times %arrow_forwardCullumber Company has these comparative balance sheet data: CULLUMBER COMPANYBalance SheetsDecember 31 2022 2021 Cash $ 16,350 $ 32,700 Accounts receivable (net) 76,300 65,400 Inventory 65,400 54,500 Plant assets (net) 218,000 196,200 $376,050 $348,800 Accounts payable $ 54,500 $ 65,400 Mortgage payable (15%) 109,000 109,000 Common stock, $10 par 152,600 130,800 Retained earnings 59,950 43,600 $376,050 $348,800 Additional information for 2022: 1. Net income was $34,000. 2. Sales on account were $383,300. Sales returns and allowances amounted to $26,600. 3. Cost of goods sold was $200,600. 4. Net cash provided by operating activities was $59,000. 5. Capital expenditures were $26,400, and cash dividends were $16,500. Compute the following ratios at December 31, 2022. (Round current ratio and inventory turnover to 2 decimal…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning