FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

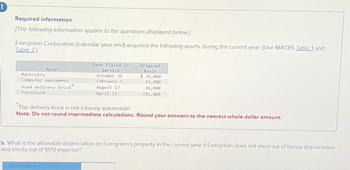

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.)

Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and

Table 2)

Machinery

Asset

Computer equipment

Used delivery truck

Furniture

Date Placed in

Service

October 25

February 3

Original

Basis

$ 74,000

13,000

August 17

April 22

26,000

155,000

The delivery truck is not a luxury automobile.

Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.

b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation

and elects out of §179 expense?

Depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In recent years, Blue Spruce Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant was in charge of selecting the depreciation method for each bus, and various methods have been used. Information concerning the buses is summarized in the table below. Salvage Useful Life Depreciation Bus Acquired Cost Value in Years Method 1 Jan. 1, 2020 $ 95,600 $ 8,000 4 Straight-line 2 Jan. 1, 2020 119,000 12,000 Declining-balance 3 Jan. 1, 2021 91,300 8,000 Units-of-activity For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 119,000. Actual miles of use in the first 3 years were 2021, 28,000; 2022, 35,000; and 2023, 31,000. (a1) For Bus #3, calculate depreciation expense per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. O.50.) Depreciation expense per mile %24arrow_forwardNonearrow_forwardAs the accountant of a manufacturing company, you have been asked to recommend a depreciation method that will be used in measuring and reporting all fixed assets of the company. With your vast knowledge in accounting principles and in compliances with generally accepted accounting standards, you came up with the following proposed methods for the approval of the management; Method I: Straight Line Method Method II: Written Down Value Method at 59% The company bought a machine for OMR 175,000 on January 1, 2019. The machine is expected to be useful for 4 years and has an estimated salvage value of OMR 5,000. Using method I Straight Line Method, compute the annual depreciation. 2. Complete the following table if straight line method is used; Year Depreciation Expense Accumulated Depreciation Book Value…arrow_forward

- Confused on how to get book valuearrow_forwardPlease dont provide solution in an image based thanksarrow_forwardEvergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Asset Date Placed in Service Original Basis Machinery October 25 $ 70,000 Computer equipment February 3 10,000 Used delivery truck* August 17 23,000 Furniture April 22 150,000 *The delivery truck is not a luxury automobile. a. What is the allowable depreciation on Evergreen's property in the current year, assuming Evergreen does not elect §179 expense and elects out of bonus depreciation?arrow_forward

- Antique corporation is contemplating the replacement of an existing acid using the operation of its business. The original cost of this asset was $34,000; since date of acquisition, the company has taken a total of $26,000 of depreciation expense on this asset.arrow_forwardCheyenne Corp. owns equipment that cost $63,100 when purchased on January 1, 2017. It has been depreciated using the straight-line method based on an estimated salvage value of $4,900 and an estimated useful life of 5 years.Prepare Cheyenne Corp.’s journal entries to record the sale of the equipment in these four independent situations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g.125. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) Sold for $29,920 on January 1, 2020. (b) Sold for $29,920 on May 1, 2020. (c) Sold for $10,100 on January 1, 2020. (d) Sold for $10,100 on October 1, 2020. No. Account Titles and Explanation Debit Credit (a) enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an…arrow_forwardPlease help me with all answersarrow_forward

- Francis Company purchased a machine for $24, 000; the seller is holding the note. Francis Company paid $5, 400 for improvements to extend the life of the machine. Francis Company has deducted depreciation on the machine for 3 years totaling $12,000. Francis Company owes $10,000 to the seller. What is Francis Company's adjusted basis in the machine? Group of answer choicesarrow_forwardDo not give answer in imagearrow_forwardHot Stone Creamery sold ice cream equipment for $17,600. Hot Stone originally purchased the equipment for $94,000, and depreciation through the date of sale totaled $73,000. Record the gain or loss on the sale of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education