FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

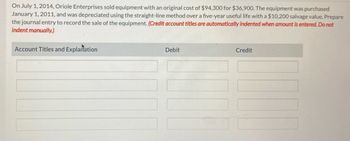

Transcribed Image Text:On July 1, 2014, Oriole Enterprises sold equipment with an original cost of $94,300 for $36,900. The equipment was purchased

January 1, 2011, and was depreciated using the straight-line method over a five-year useful life with a $10,200 salvage value. Prepare

the journal entry to record the sale of the equipment. (Credit account titles are automatically indented when amount is entered. Do not

indent manually.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- don't forget to Select the explanation on the last line of the journal entry table.arrow_forwardHot Stone Creamery sold ice cream equipment for $17,600. Hot Stone originally purchased the equipment for $94,000, and depreciation through the date of sale totaled $73,000. Record the gain or loss on the sale of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardOn July 1, 2020, Bridgeport Corporation purchased Johnson Company by paying $189,700 cash and issuing a $64,500 note payable to Steve Johnson. At July 1, 2020, the balance sheet of Johnson Company was as follows. Cash $38,100 Accounts payable $160,000 Accounts Receivable 67,500 Stockholders' equity 165,800 Inventory 75,800 $325,800 Land 29,400 Buildings (net) 55,200 Equipment (net) 52,200 Copyrights 7,600 $325,800 The recorded amounts all approximate current fair values except for land (worth $45,400), inventory (worth $94,900), and copyrights (worth $11,300).arrow_forward

- On January 1, 2014, Santo Company purchased a computer system for $30,500. The system had an estimated useful life of 5 years and no salvage value. On January 1, 2016, the company revised the remaining useful life to four years. Required: What amount of depreciation will be recorded for 2016?arrow_forwardMarigold Industries presents you with the following information. Complete the table for the year ended December 31, 2027. The company depreciates all assets using the half-year convention. (Round answers to O decimal places, e.g. 45,892.) Description Machine A Machine B Machine C Machine D Date Purchased 2/12/25 8/15/24 7/21/23 Cost $148,200 89,600 227,760 (c) Salvage Value $16,640 21,840 25,000 71,760 Life in Years 10 5 8 5 Depreciation Method SL DDB SYD (a) Accumulated Depreciation to 12/31/26 $34,684 30,160 72,800 (e) Depreciation for 2027 (b) (d) (f) (h)arrow_forwardA company purchased factory equipment on June 1, 2017, for $101800. It is estimated that the equipment will have a $13000 salvage value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31, 2017, is $5180. $4440. $3700. $8880.arrow_forward

- Do not give answer in imagearrow_forwardMarin Inc. purchased a commercial grade soft-serve ice cream machine on September 30, 2017. Marin traded in its existing machine and paid cash in the transaction. The details of the transaction are as follows: ● List price of new freezer $25,730 ● Cash paid 17,112 ● Cost of old machine (4-year life, $1,860 salvage value) 21,700 ● Accumulated depreciation—old machine (straight-line) 9,920 ● Secondhand fair value of old machine 8,308 Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial substance, and (b) lacks commercial substance.arrow_forwardPlease help me find the accumulated depreciation . I got 150 but it's wrong apparently.arrow_forward

- On July 1, 2014, Sunland Enterprises sold equipment with an original cost of $80,700 for $31,300. The equipment was purchased January 1, 2011, and was depreciated using the straight-line method over a five-year useful life with a $8,600 salvage value. Prepare the journal entry to record the sale of the equipment. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit IIIarrow_forwardWhispering Company owns equipment that cost $100,000 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on an estimated salvage value of $10,000 and an estimated useful life of 5 years. Depreciation expense adjustments are recognized annually. Instructions: Prepare Whispering Company's journal entries to record the sale of the equipment in these four independent situations. Update depreciation on assets disposed of at time of sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) (c) (d) (e) (f) (a) Sold for $59,000 on January 1, 2022. Sold for $59,000 on April 1, 2022. SR. Account Titles and Explanation (b) Sold for $21,000 on January 1, 2022. Sold for $21,000 on September 1, 2022. Repeat (a), assuming Whispering uses double-declining…arrow_forwardThe following are the transactions of Morrell Corporation: Morrell Corporation disposed of two computers at the end of their useful lives. The computers had cost $4,640 and their Accumulated Depreciation was $4,640. No residual value was received. Assume the same information as (a), except that Accumulated Depreciation, updated to the date of disposal, was $3,280. Prepare journal entries to record above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education