FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

the company uses straight like

only typed solution

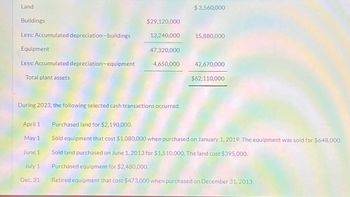

Transcribed Image Text:Land

Buildings

Less: Accumulated depreciation-buildings

Equipment

Less: Accumulated depreciation-equipment

Total plant assets

April 1

May 1

June 1

July 1

$29,120,000

During 2023, the following selected cash transactions occurred.

Dec. 31

13,240,000

47,320,000

4,650,000

$3,560,000

15,880,000

42,670,000

$62,110,000

Purchased land for $2,190,000.

Sold equipment that cost $1,080,000 when purchased on January 1, 2019. The equipment was sold for $648,000.

Sold land purchased on June 1, 2013 for $1,510,000. The land cost $395,000.

Purchased equipment for $2,480,000.

Retired equipment that cost $473,000 when purchased on December 31, 2013.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please complete using the same formart. Thank you :)arrow_forwardAt December 31, 2025, Martinez Corporation reported the following plant assets. Land Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total plant assets Apr. 1 Purchased land for $2,774.200. May June 1 July 1 Dec. 31 $26,590,000 11.965,500 1 50,440,000 During 2026, the following selected cash transactions occurred. 6,305,000 $ 3,783,000 14,624,500 44,135.000 $62,542,500 Sold equipment that cost $756,600 when purchased on January 1, 2019. The equipment was sold for $214,370. Sold land for $2,017,600. The land cost $1.261.000. Purchased equipment for $1,387,100. Retired equipment that cost $882.700 when purchased on December 31, 2016. No salvage value was received.arrow_forwardanswer quicklyarrow_forward

- The Home Depot financial statements appear in Appendix A at the end of this textbook. Use thesestatements to answer the following questions and indicate where in the financial statements youfound the information. a. What depreciation method does Home Depot use for buildings, furniture, fixtures, and equip-ment? What are the useful lives over which these assets are depreciated? b. From the notes to Home Depot ’s financial statements, what can you learn about the company’spolicy regarding impairment of plant assets?c. Locate Home Depot ’s balance sheet and find the section entitled “Property and Equipment, atcost.” As of January 31, 2010, determine the amount of the company’s investment in propertyand equipment and the amount of depreciation taken to date on those assets. Are these assets,taken as a whole, near the beginning or end of their estimated useful lives? Explain your answer.arrow_forwardBefore you begin this assignment, review the Tying It All Together feature in the chapter iHeartMedia , Inc. in their annual report for the year ending December 31, 2015, state that the plant assets reported on its balance sheet includes the following: Depreciation is computed using the straight-line method. Requirements 1. Suppose iHeartMedia, Inc. purchases a new advertising structure for $100,000 on August 1. The residual value of the structure is $4,000 and the useful life is 10 years. How would iHeartMedia record the depreciation expense on December 31 in the first year of use? What about the second year of use? 2. What would be the book value of the structure at the end of the first year? What would be the book value of the structure at the end of the second year? 3. What would be the impact on iHeartMedia, Inc. financial statements if they failed to record the adjusting entry related to the structure?arrow_forwardAnswer the following questions: Required: a-1. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbell's. Use data from the Campbell Soup Company annual report O Straight-line method O Double declining method O Written down value method a-2. Why the particular method is used for the purpose described. Straight-line depreciation is used for financial reporting purposes because depreciation expense will be lower than under any of the accelerated depreciation methods. O Straight-line depreciation is used for financial reporting purposes because depreciation expense will be higher than under any of the accelerated depreciation methods. a-3. What method do you think the company uses for income tax purposes? O Accelerated depreciation using the MACRS rates is probably used for tax purposes to minimize taxes payable. O Straight line Method using the MACRS rates is probably used for tax purposes to minimize taxes payable. Written down value Method using…arrow_forward

- KHS&R's Construction bought a truck on 1/1/ at a cost of $31,000, an estimated salvage (residual) value of $3,000, and an estimated useful life of 4 years. The truck is being depreciated on a straight-line basis. At the end of year 3, what amount will be reported for accumulated depreciation? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 ASUS f4 f5 f6 X f7 f8 f9 f10 f11 4. 5 C R Y 60 08 图arrow_forwardCan you show me step by step this one too? 13. ABC Inc. purchased a truck on January 1, 2018 for $40,000. The truck had an estimated life of six years and anestimated salvage value of $4,000. ABC uses the straight-line method to depreciate the asset. On July 1, 2020, the truck was sold for $14,000 cash. A. Determine the effect on the accounting equation upon recording the depreciation for 2018. Assets = Liabilities + Stockholders’ Equity Revenues – Expenses =Net Income B. Calculate the gain or loss on the sale of the asset.arrow_forwardDescribe the purchase of an item of Property, Plant and Equipment so that your peers can determine depreciation for that first year using both the Straight-Line Method and the Units of Activity Method. Then describe the sale of that item at the end of it's life so that your peers can determine if there was a gain or loss on disposal. Note please see below as I have included some examples. The information and amounts can be made up but it needs to follow the guidelines above.arrow_forward

- A machine (a Section 1231 asset that is also a Section 1245 asset) was acquired on February 5, Year 1 for $180,000. It is five-year MACRS property and cost recovery (accumulated depreciation) totals $110,880 when it is sold. The property was sold for $120,000 on July 31, Year 3. You will need to type your calculation and answer in the box. For example, type in "20,000 - 5,000 = 15,000" to calculate the adjusted basis of an asset that cost 20,000 and had accumulated depreciation of 5,000 when sold. Some items do not need a calculation so for those items just type in the answer. What will follow will be 5 questions related to this asset sale. Provide an answer for every question even if the amount is 0. 1. What is the amount realized?arrow_forwardWith direct write off, one writes off amounts from sales in the past are determined to be uncollectible. An estimate writes off estimated amounts of current sales that are expected to be uncollectible. Does that help you determine the accounting principle used for estimates? And a fixed asset question: when an asset is fully depreciated (think Kate's Cards after four years when the equipment with cost of $4,800 has accumulated depreciation of $4,800), should a company keep it on the books? Why or why not?arrow_forwardJojo Ltd. purchased a machinery on January 1, 2020. . Cost = $15,000 • Expected salvage value = $1,000 • Estimated useful life in years = 10 years • Estimated useful life in machine hours = 7,000 hours Question: Compute end of year book value for the first two years using the following methods. You must prepare a depreciation schedule for each method. a. Straight Line b. Declining Balance C. Units of Activity* *For the units of activity method, actual machine hours of use in 2020 and 2021 were 300 hours and 1000 hours respectively.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education