ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

![The Canadian government decides to impose trade restrictions on barley imports by setting a quota of 20 million bushels of barley. With the quota, the price of barley in Canada will be $_____ per bushel.

The Canadian government explains that it is necessary to impose trade restrictions on barley to protect workers in the domestic barley industry. Assume that the Canadian government would like to generate government revenue through its protectionist policies.

Which of the following would provide the Canadian government with revenue? *Check all that apply.*

- [ ] A quota on barley in which the import licenses are distributed via lottery

- [ ] A tariff on U.S. barley

- [ ] A quota on barley in which import licenses are auctioned off to U.S. barley producers

- [ ] A quota on barley in which import licenses are given to the U.S. government for free distribution to U.S. barley producers](https://content.bartleby.com/qna-images/question/c19a2b88-1c0e-4a6a-a3c8-ae203e8204b7/9b02143c-9b84-4ea5-82f7-43f805652949/e2ho93_thumbnail.png)

Transcribed Image Text:The Canadian government decides to impose trade restrictions on barley imports by setting a quota of 20 million bushels of barley. With the quota, the price of barley in Canada will be $_____ per bushel.

The Canadian government explains that it is necessary to impose trade restrictions on barley to protect workers in the domestic barley industry. Assume that the Canadian government would like to generate government revenue through its protectionist policies.

Which of the following would provide the Canadian government with revenue? *Check all that apply.*

- [ ] A quota on barley in which the import licenses are distributed via lottery

- [ ] A tariff on U.S. barley

- [ ] A quota on barley in which import licenses are auctioned off to U.S. barley producers

- [ ] A quota on barley in which import licenses are given to the U.S. government for free distribution to U.S. barley producers

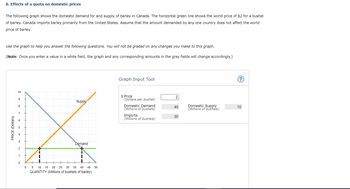

Transcribed Image Text:# Effects of a Quota on Domestic Prices

The following graph illustrates the domestic demand and supply of barley in Canada. The horizontal green line highlights the world price of $2 per bushel of barley. Canada primarily imports barley from the United States. It is assumed that the demand from any single country does not influence the world price of barley.

**Instructions:**

Use the graph to assist in answering the questions below. Changes made to the graph will not be graded.

**Note:** Once a value is entered in a white field, the graph and any related amounts in the grey fields will update accordingly.

## Graph Explanation

### Graph Input Tool

- **Price (Dollars per bushel):** \(2\)

- **Domestic Demand (Millions of bushels):** \(40\)

- **Domestic Supply (Millions of bushels):** \(10\)

- **Imports (Millions of bushels):** \(30\)

### Graph Details

- **X-axis (Quantity):** Represents millions of bushels of barley.

- **Y-axis (Price):** Represents the price in dollars per bushel.

- **Supply Curve (Orange Line):** Shows the domestic supply of barley.

- **Demand Curve (Blue Line):** Shows the domestic demand for barley.

- **World Price Line (Green Line):** Fixed at $2, indicating the world market price.

The intersection of the supply and demand curves indicates market equilibrium, while the horizontal world price line represents the point where imports fill the gap between domestic supply and demand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- I need help with my economics homework.arrow_forwardBefore the North American Free Trade Agreement (NAFTA) gradually eliminated import tariffs on goods, the autarky price of tomatoes in Mexico was below the world price and in the United States was above the world price. Similarly, the autarky price of poultry in Mexico was above the world price and in the United States was below the world price. Draw diagrams with domestic supply and demand curves for each country and each of the two goods. As a result of NAFTA, the United States now imports tomatoes from Mexico and the United States now exports poultry to Mexico. How would you expect the following groups to be affected? a. Mexican and U.S. consumers of tomatoes. Illustrate the effect on consumer surplus in your diagram. b. Mexican and U.S. producers of tomatoes. Illustrate the effect on producer surplus in your diagram. c. Mexican and U.S. tomato workers. d. Mexican and U.S. consumers of poultry. Illustrate the effect on consumer surplus in your diagram. e. Mexican and U.S.…arrow_forwardEconomic Use the graph below and the following information to answer the next question. The world price of soybeans is five dollars per bushel and the importing country is small enough to not affect the real price. Suppose the government puts a tariff of one dollars per bushel on soybean imports how much revenue will the government raise from a one dollar per bushel tariff on soybean imports.arrow_forward

- e Price -Q₁ Quantity Which of the following scenarios is BEST represented in the graph? A number of sellers increase B decrease in government taxes C resource costs increase D technology improvesarrow_forwardIf the United States is currently importing 14 million barrels per day at a world price of $4.00 per unit (the entire amount consumed), what is the effect on imports of a tax equal to $4.00 per unit? 1.) Using the line drawing tool, help determine the quantity of U.S. crude oil imports after the $4.00 per-unit tax by drawing a horizontal line at the price paid by U.S. consumers. Label this line + Tax'. 2.) Using the point drawing tool, determine quantity demanded at the price paid by U.S. consumers after the imposition of the import tax. Label this line 'Pop'. 3.) Using the point drawing tool, determine quantity supplied at the price paid by U.S. consumers after the imposition of the import tax. Label this line "Pas". Carefully follow the instructions above and only draw the required objects. The amount of imports after the $4.00 per-unit tax is million barrels per day. Before the tax, domestic producers supplied 0 barrels of crude oil. They now supply million barrels Price per barrel…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Small engines are the main components of office and house appliances like printers, hand dryers, microwave ovens, food processors, etc. The graph depicts the market for small engines in the United States. Suppose that the government imposes a $15 tariff on each imported engine in an effort to bring manufacturing jobs back to the United States. Place the Waste shape to describe the waste of resources that would result from the trade restriction. Price (3) Incorrect 50 45 40 35 30 25 20 15 10 5 0 0 total cost: What is the total cost of the tariff? 337.5 Domestic supply Domestic demand 15 30 45 60 75 90 105 120 135 150 Quantity (millions of engines) Incorrect World supply Waste millions of dollarsarrow_forwardGovernment-imposed taxes cause reductions in the activity that is being taxed, which has important implications for revenue collections. To understand the effect of such a tax, consider the monthly market for cigarettes, which is shown on the following graph. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. PRICE (Dollars per pack) 10 9 8 6 2 1 0 0 # Supply Demand 10 20 30 40 50 60 70 80 90 100 QUANTITY (Packs) Graph Input Tool Market for Cigarettes 31- Quantity (Packs) Demand Price (Dollars per pack) (Dollars per pack) Suppose the government imposes a $2-per-pack tax on suppliers. At this tax amount, the equilibrium quantity of cigarettes is Tax 40 6.00 2.00 Supply Price (Dollars per pack) packs, and the government collects $ ? 4.00 in tax revenue.arrow_forwardQuestion 2: Suppose you have the following information about the demand and supply of cotton in the U.S.: Price 9 15 25 35 U.S. Supply 4 12 17 U.S. Demand 40 36 30 20 10 (a) Determine the equations of the supply and demand curves. Assume that the two equations are linear. (b) Determine the market equilibrium price and quantity. (c) Now suppose that the US can import an arbitrary quantity of cotton at a price of 15 Dollars. How many units will the U.S. import?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education