ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

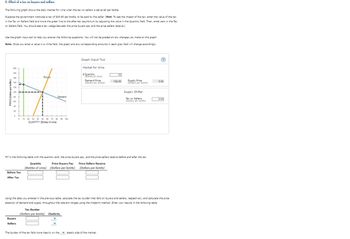

Transcribed Image Text:9. Effect of a tax on buyers and sellers

The following graph shows the daily market for wine when the tax on sellers is set at $0 per bottle.

Suppose the government institutes a tax of $40.60 per bottle, to be paid by the seller. (Hint: To see the impact of the tax, enter the value of the tax

in the Tax on Sellers field and move the green line to the after-tax equilibrium by adjusting the value in the Quantity field. Then, enter zero in the Tax

on Sellers field. You should see a tax wedge between the price buyers pay and the price sellers receive.)

Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

200

PRICE (Dollars per bottle)

160

Supply

140

120

100

14

80

Demand

60

40

20

0

10 20 30 40 50 60 70 80 90 100

QUANTITY (Bottles of wine)

180

0

Before Tax

After Tax

Graph Input Tool

Market for Wine

Buyers

Sellers

Quantity

(Bottles of wine)

Tax Burden

(Dollars per bottle) Elasticity

Demand Price

(Dollars per bottle)

10

Fill in the following table with the quantity sold, the price buyers pay, and the price sellers receive before and after the tax.

Quantity

Price Buyers Pay

(Bottles of wine) (Dollars per bottle)

Price Sellers Receive

(Dollars per bottle)

132.00

The burden of the tax falls more heavily on the elastic side of the market.

Supply Price

(Dollars per bottle)

Supply Shifter

Tax on Sellers

(Dollars per bottle)

?

Using the data you entered in the previous table, calculate the tax burden that falls on buyers and sellers, respectively, and calculate the price

elasticity of demand and supply throughout the relevant ranges using the midpoint method. Enter your results in the following table.

0.00

0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In the market for candy, researchers have estimated the following demand and supply curves. Demand: P= 8 - Q/100 Supply: P= (3Q)/700 If the government imposes an excise tax of $0.50 per unit. What is tax revenue out of this tax? (Remember that the tax does not change the demand and supply curves).arrow_forwardThe following graph shows the daily market for jeans when the tax on sellers is set at $0 per pair. Suppose the government institutes a tax of $40.60 per pair, to be paid by the seller. (Hint: To see the impact of the tax, enter the value of the tax in the Tax on Sellers field and move the green line to the after-tax equilibrium by adjusting the value in the Quantity field. Then, enter zero in the Tax on Sellers field. You should see a tax wedge between the price buyers pay and the price sellers receive.) Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. Graph Input Tool Market for Jeans 200 I Quantity (Pairs of jeans) 180 100 Supply 160 Demand Price (Dollars per pair) Supply Price (Dollars per pair) 132.00 0.00 140 120 Supply Shifter 100 Demand Tax on Sellers (Dollars per…arrow_forward@bulldogs.a.... 37,279 Q CENGAGE MINDTAP PRICE (Dollars per scooter) Homework (Ch 08) Consider the market for electric scooters. The following graph shows the demand and supply for electric scooters before the government imposes any taxes. 100 90 80 First, use the black point (plus symbol) to indicate the equilibrium price and quantity of electric scooters in the absence of a tax. Then use the green point (triangle symbol) to shade the area representing total consumer surplus (CS) at the equilibrium price. Next, use the purple point (diamond symbol) to shade the area representing total producer surplus (PS) at the equilibrium price. (?) 70 60 50 40 30 20 10 0 $ Grammarly was Successfully Installed | Gramma... 4 Demand M 0 160 320 480 640 800 960 1120 1280 1440 1600 R Supply MAX 1 an % Before Tax 5 ng.cengage.com T A 6 Y AL Alabama Black history stories you may not know.... MacBook Pro & 7 + Equilibrium tv NT A A Consumer Surplus U O Producer Surplus * C + O 8 4+ 9 amagan music zoom 0…arrow_forward

- macro question 6arrow_forwardThe following graph depicts a market where a tax has been imposed. Pe was the equilibrium price before the tax was imposed, and Qe was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers. What is the amount of the tax, as measured along the y axis? PC + PS Pe – PS PC – PS PC – P* Pe + PSarrow_forwardDoyle and Samphantharak (2008) find that when a 5% gas tax is implemented, prices consumers pay for gas increase by about 4%. What role does demand elasticity play in determining the size of this price change? That is, under what demand elasticity cases would the price change be closer to 5%, or closer to 0%? Illustrate and explain using supply-and-demand graph(s)..arrow_forward

- o Suppose the Canadian government has decided to place an excise tax of $20 per tire on producers of automobile tires. Excise taxes are also called sales or commodity taxes. Previously, there was no excise tax on automobile tires. As a result of the excise tax, producers of tires, such as Bridgestone and Michelin, are going to alter their tire prices. The graph illustrates the demand and supply curves for automobile tires before the excise tax. Please shift the appropriate curve or curves on the graph to demonstrate the impact of the new tax. What is the price consumers pay for a tire post tax? Round to the nearest 10. price paid by consumers: $ What is the price producers receive for a tire net of taxes? Round to the nearest 10. Price 150 140 130 120 110 100 90 80 70 60 50 O 1 2 3 01 4 5 Quantity 6 Supply Demad 7 8 9 10arrow_forwardSuppose that the local government of Santa Fe decides to institute a tax on seltzer producers. Before the tax, 15 million packs of seltzer were sold every month at a price of $11 per pack. After the tax, 9 million packs of seltzer are sold every month; consumers pay $14 per pack, and producers receive $7 per pack (after paying the tax). The amount of the tax on a pack of seltzer is $ burden that falls on producers is $ O True per pack. True or False: The effect of the tax on the quantity sold would have been the same as if the tax had been levied on consumers. O False per pack. Of this amount, the burden that falls on consumers is $ per pack, and thearrow_forward7arrow_forward

- Government-imposed taxes cause reductions in the activity that is being taxed, which has important implications for revenue collections. To understand the effect of such a tax, consider the monthly market for champagne, which is shown on the following graph. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. PRICE (Dollars per case) 50 45 40 35 30 25 20 15 10 5 0 0 Supply Demand 8 16 24 32 40 48 56 64 72 80 QUANTITY (Cases) Graph Input Tool Suppose the government imposes a $10-per-case tax on suppliers. At this tax amount, the equilibrium quantity of champagne is Market for Champagne Quantity (Cases) Demand Price (Dollars per case) Tax (Dollars per case) 32 30.00 10.00 Supply Price (Dollars per case) cases, and the government collects $ 20.00 in tax revenue.arrow_forwardYou are an economist in the Internal Revenue System and just heard of a plan to increase the sales tax on a certain widget by $.06. Last year customers purchased about 10 million widgets. The demand curve in the last year was such that a $.01 increasein price decreases sales by 100,000. A study showed that a $.01 increase in price resulted in producers willing to provide 50,000 more widgets to the market. Congress stated that this$.06 tax will increase government revenues by $600,000 and raise the price of each widget by $.06. Is this correct? If so, explain why this is the case and, if not, what is the increase in prices and revenues?arrow_forwardSuppose the government imposes an excise tax on mountain bikes. The black line on the following graph shows the tax wedge created by a tax of $40 per bike. First, use the tan quadrilateral (dash symbols) to shade the area representing tax revenue. Next, use the green point (triangle symbol) to shade the area representing total consumer surplus after the tax. Then, use the purple point (diamond symbol) to shade the area representing total producer surplus after the tax, Finally, use the black point (plus symbol) to shade the area representing deadweight loss. After Tax 200 100 160 Tax Revenue Demand 140 120 Consumer Surplus 100 Tax Wedge Supply Producer Surplus 40 Deadweight Loss 20 60 100 150 200 210 300 0 400 40 s00 QUANTITY (Ues) ( ad a soearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education