ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

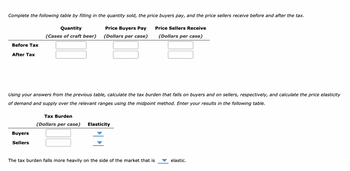

Transcribed Image Text:Complete the following table by filling in the quantity sold, the price buyers pay, and the price sellers receive before and after the tax.

Price Buyers Pay Price Sellers Receive

(Dollars per case) (Dollars per case)

Before Tax

After Tax

Quantity

(Cases of craft beer)

Using your answers from the previous table, calculate the tax burden that falls on buyers and on sellers, respectively, and calculate the price elasticity

of demand and supply over the relevant ranges using the midpoint method. Enter your results in the following table.

Buyers

Sellers

Tax Burden

(Dollars per case)

Elasticity

The tax burden falls more heavily on the side of the market that is

elastic.

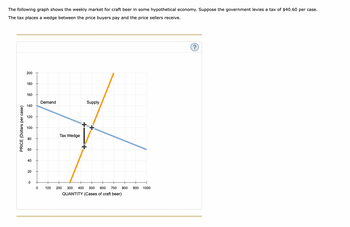

Transcribed Image Text:The following graph shows the weekly market for craft beer in some hypothetical economy. Suppose the government levies a tax of $40.60 per case.

The tax places a wedge between the price buyers pay and the price sellers receive.

Demand

Supply

140

120

K

100

Tax Wedge

80

PRICE (Dollars per case)

200

180

160

60

40

20

0

0

400 500 600 700 800

QUANTITY (Cases of craft beer)

100 200 300

900 1000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The price elasticity of demand for beer among young adults (age 18 to 24) is about 1.30, and the number of highway deaths is roughly proportional to the group’s beer consumption. If a state imposes a beer tax that increases the price of beer by 20%, by how much will the number of highway deaths among young adults decrease?arrow_forwardEconomists in Champaign have been studying the local market for pizza. The market is described in the graph below: What is the price elasticity of demand(in absolute value) when the price changes from $7 to $5?(Round your answer to include 2 decimal places.)arrow_forwardTo encourage people to stop smoking the government of a country introduces an indirect tax of 20% on the price of cigarettes(Currently 10$ per packet). The price elasticity of demand for cigarettes in the country is estimated to be 0.6. Describe the likely impact the tax will have on a, the demand for cigarettes b, government revenuearrow_forward

- Correctly illustrate the market (supply and demand curve). Make sure to correctly shade the area of the tax. a) Washington state has a salmon market which sells salmon at a price of P. At that price, Q lbs. of salmon will be consumed in one week. Elasticity of supply: relatively elastic Elasticity of demand: relatively inelastic In addition, suppose Washington state were to levy an excise tax collected by producers.arrow_forwardThe figure below represents the market for Gasoline, where initially the equilibrium price was $5.60. The picture shows the effect of a $1.50 tax on gasoline. Using the information from the figure, what is the price elasticity of supply(Using the Midpoint method) when moving from equilibrium to the new supply after the tax?(round your answer to 2 decimal places)arrow_forwardPlease help with the following questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education