FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer general accounting

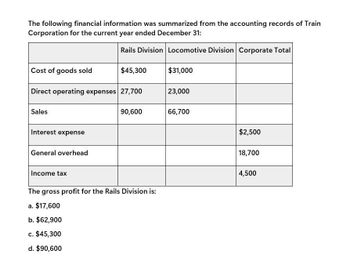

Transcribed Image Text:The following financial information was summarized from the accounting records of Train

Corporation for the current year ended December 31:

Rails Division Locomotive Division Corporate Total

Cost of goods sold

$45,300

$31,000

Direct operating expenses 27,700

23,000

Sales

90,600

66,700

Interest expense

$2,500

General overhead

18,700

Income tax

4,500

The gross profit for the Rails Division is:

a. $17,600

b. $62,900

c. $45,300

d. $90,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31: Locomotive Division Cost of goods sold Direct operating expenses Sales Interest expense General overhead. Income tax Rails Division $ 47,200 27,200 108,000 The income from operations for the Rails Division is O $21,150 Ob. $33,600 O $8,700 O d. $60,800 $30,720 20,040 78,000 Corporate Total $2,040 18,160 4,700arrow_forwardThe following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31: Rails Division Locomotive Division Corporate Total Cost of goods sold $45,200 $30,600 Direct operating expenses 27,000 22,300 Sales 95,800 69,400 Interest expense $2,000 General overhead 18,800 Income tax 4,500 The gross profit for the Locomotive Division isarrow_forwardAcarrow_forward

- Income Statement Format The following information from Buchanan Company’s current operations is available: Administrative expenses $73,000 Cost of goods sold 470,000 Sales revenue 772,000 Selling expenses 87,000 Interest expense 10,000 Loss from operations of discontinued segment 60,000 Gain on disposal of discontinued segment 40,000 Income taxes: Amount applicable to ordinary operations 40,000 Reduction applicable to loss from operations of discontinued segment 14,000 Amount applicable to gain on disposal of discontinued segment 8,000 Requireda. Prepare a multiple-step income statement. (Disregard earnings per share.)b. Prepare a single-step income statement. (Disregard earnings per share.)Note: Do not enter any answers as negative numbers unless it's indicated with an asterisk *. BUCHANAN COMPANYMultiple-Step Income StatementFor Year Ended Sales Revenue Answer Answer Answer Answer Answer Selling Expenses Answer…arrow_forwardIncome Statement Format The following information from Buchanan Company’s current operations is available: Administrative expenses $73,000 Cost of goods sold 470,000 Sales revenue 772,000 Selling expenses 87,000 Interest expense 10,000 Loss from operations of discontinued segment 60,000 Gain on disposal of discontinued segment 40,000 Income taxes: Amount applicable to ordinary operations 40,000 Reduction applicable to loss from operations of discontinued segment 14,000 Amount applicable to gain on disposal of discontinued segment 8,000 Requireda. Prepare a multiple-step income statement. (Disregard earnings per share.)b. Prepare a single-step income statement. (Disregard earnings per share.)Note: Do not enter any answers as negative numbers unless it's indicated with an asterisk *. BUCHANAN COMPANYMultiple-Step Income StatementFor Year Ended Sales Revenue Selling Expenses Administrative Expenses Operating Income…arrow_forwardSeaforce Manufacturing Inc. Income Statement Year Ended December 31, 20X5 Sale $ 340,000 Cost of goods sold $ 250,100 Gross Profit $ 89,900 Operating Expenses $ 55,000 Loss on Sale of equipment $ 2,500 $ 57,500 Profit from Operations $ 32,400 Other expenses Interest Expense $ 3,500 Profit before Income Tax $ 28,900 Income Tax Expense $ 12,000 Profit $ 16,900 Additional Information: Operating expenses include depreciation expense of $10,000 Accounts Payable related to the purchase of inventory Equipment that cost $12,500 was sold at a loss of $2,500 New equipment was purchased during the year for $8,500 Dividends declared and paid in 20X5 totaled $3,000 Common shares were sold for $12,000 cash Interest payable in 20X5 was $800 greater than interest payable in 20X4 The company uses IFRS and do not treat dividends as part of operations Seaforce Manufacturing Inc. comparative balance sheet at December 31 20X5…arrow_forward

- The comparative statements of Waterway Company are presented here. Waterway CompanyIncome StatementsFor the Years Ended December 3120222021Net sales$1,813,300 $1,753,100 Cost of goods sold1,008,900 983,000 Gross profit804,400 770,100 Selling and administrative expenses516,800 477,800 Income from operations287,600 292,300 Other expenses and losses Interest expense18,900 14,800 Income before income taxes268,700 277,500 Income tax expense78,224 77,700 Net income$ 190,476 $ 199,800 Waterway CompanyBalance SheetsDecember 31Assets20222021Current assets Cash$60,200 $64,500 Debt investments (short-term)70,600 49,200 Accounts receivable (net)117,800 102,700 Inventory123,600 114,700 Total current assets372,200 331,100 Plant assets (net)602,200 517,900 Total…arrow_forwardThe comparative statements of Waterway Company are presented here. Waterway CompanyIncome StatementsFor the Years Ended December 3120222021Net sales$1,813,300 $1,753,100 Cost of goods sold1,008,900 983,000 Gross profit804,400 770,100 Selling and administrative expenses516,800 477,800 Income from operations287,600 292,300 Other expenses and losses Interest expense18,900 14,800 Income before income taxes268,700 277,500 Income tax expense78,224 77,700 Net income$ 190,476 $ 199,800 Waterway CompanyBalance SheetsDecember 31Assets20222021Current assets Cash$60,200 $64,500 Debt investments (short-term)70,600 49,200 Accounts receivable (net)117,800 102,700 Inventory123,600 114,700 Total current assets372,200 331,100 Plant assets (net)602,200 517,900 Total…arrow_forwardDundee Co. reported the following for the current year: net sales of $80,000; cost of goods sold of $60,000; beginning balance of total assets of $115,000; and ending balance of total assets of $85,000. Compute total asset turnover. Round to one decimal.arrow_forward

- Grandy productions reported the following items for the current year sales 15,250,000; cost of goods 8750,000; depreciation expense 335,000; taxes925,000 administrative expenses; 275,000 interest, expenses; 97,500 and marketing expenses 385,000. What is grandes operating income?arrow_forwardK George Company had the following data for the current year. What is the income from continuing operations for the year? Net Sales $169,000 16,000 Discontinued Operations Gain (after tax) Cost of Goods Sold Income Tax rate 82,000 40% 14,000 Operating Expenses Other Income and (Expenses): Gain on Sale of Equipment Loss on Disposal of Equipment A. $73,000 OB. $45,000 OC. $60,000 OD. $75,000 8,000 (6,000) 27.arrow_forwardCorycorn Corp. and its divisions (each is an operating segment) are engaged solely in manufacturing operations. The following data (consistent with prior years' data) pertain to the operations conducted for the yaer ended December 31, year 1: (Industry Operating Segment) Total revenue Operating profit Identifiable assets at 12/31/Y1 A P10,000,000 P1,750,000 P20,000,000 B 8,000,000 1,400,000 17,500,000 C 6,000,000 1,200,000 12,500,000 D 3,000,000 550,000 7,500,000 E 4,250,000 675,000 7,000,000 F…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education